By Victor Henry, Research Analyst at King’s Private Equity Club

- Published as part of our ‘Deep Dive’ Section, promoting in-depth pieces which analyse underrepresented issues and challenge conventional narratives.

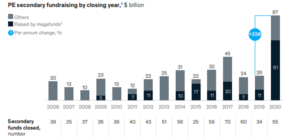

Private equity needs no introduction these days. From the front page of The Financial Times to the Pitchbook daily newsletter, the private equity industry has gotten much publicity over the years. Despite a drop of 22.5% in deal volume during the Covid 19 crisis, the industry has shown signs of resilience and recovery as limited partners slowly moved to alternative investments in the secondary market. Indeed, secondaries hit a record high in the financial year of 2021 with secondaries transactions reaching $143.3 billion. This surge in volume corresponds to a 132% increase over the previous year ($61.8 billion in 2020). More notably, it was the first time the secondary market deal size surpassed the $100 billion benchmark. It goes without saying that fundraising activities have also skyrocketed over the last 15 years. Indeed, private equity secondaries raised roughly $87 billion in 2020, nearly tripling 2019 totals.

Source: Mc Kinsey&Company, 2021

These stylised facts underline the growing popularity of secondary deals in private markets. But, what are the reasons for this surge?

This article aims to answer this question by explaining the factors underlying the growth in the secondary markets. Firstly, it is crucial to understand the differences are between a primary and secondary fund.

Primary fund vs secondary fund?

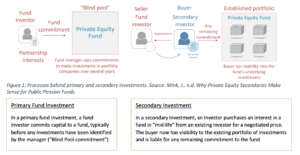

There are two way investors can gain access to private equity, through primary and secondary investment. Primary fund investing refers to investment made by an investor in funds at their inception during the initial or subsequent closings (i.e. when capital commitments are requested). Primary investing allows the investor to participate in the fund from its creation and gives the opportunity to realise the full benefit of distributions as the portfolio investment are conducted. Moreover, it gives the investor the opportunity to negotiate the terms and conditions of the fund with the developer, as the fund is being established.

On the other hand, secondary fund investing refers to purchasing existing limited partner private equity interests available on the secondary market. The process is the following. The fund raises capital from institutional investors such as pensions, sovereign wealth funds, endowments, and high-net-worth individuals. Once established, the fund will enter secondary transactions by purchasing existing portfolios composed of underlying assets. Therefore, the capital raised is invested in specific private equity portfolios detained by other private equity firms.

Source: Mink, J., n.d. Why Private Equity Secondaries Make Sense for Public Pension Funds |

To summarise, secondary transactions involve the sale and transfer of an existing limited partnership interest in a private equity fund, or a portfolio of funds, from one investor to another. The seller receives liquidity for their stake in the investment and is free from any unfunded capital commitment. Instead, the buyer becomes liable for future funding obligations in exchange for capital distributions once the investments are realised.

Why do investors buy on the secondary market?

Secondary transactions have several advantages over primary transactions. Below is an overview of some benefits that can explain secondaries’ popularity in the last decade.

Blind pool risk mitigation

The first advantage of secondary funds is the reduction of blind pool risk. Unlike primary funds in which investors commit capital to a “to-be-assembled portfolio”, secondary funds allow to cherry-pick pre-identified portfolios of underlying assets and therefore acquire the ones that fit the fund’s strategy. The acquired portfolios are typically 50+% funded meaning that half of the committed capital has been called. Furthermore, the acquisition typically occurs 3 to 5 years into the investment period. As a result, it allows the buyer to establish a comprehensive analysis of past performance of the underlying companies and evaluate their future value potential. Thus, the portfolio risk is easily identifiable and can be taken into account when pricing the transaction.

J curve mitigation

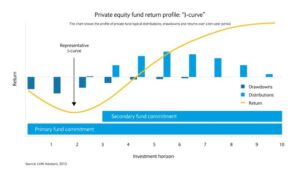

The J curve relates to the rate of return of a fund across the investment lifecycle. When a primary fund is ready to invest, it calls for capital from an investor to acquire companies and finance the development of the assets. During this initial phase of the fund lifecycle (usually 4 years), the investor’s contributions (drawdowns) exceed the capital gain distributions. In other words, during this period, the fund uses the investor’s liquidity for new investments, management fees, expenses which exceed the cash inflow or valuation gain from the immature companies of the fund. The fund experiences negative cumulative cash flow.

Figure 2: J Curve mitigation. Source: Moser, G., 2022

Secondary funds do not take possession of their investor’s funds until they’ve identified profitable investments. They fast forward through the uncertainty of early portfolio construction and acquire developed portfolios towards the end of their construction phase. Thus, the relative maturity of underlying holdings suggests that secondary funds tend to distribute capital gains to Limited Partners earlier making the return on investment is more certain than for primary fund investment.

Diversification

In practice, Secondary funds usually acquire multiple portfolios each made of hundreds of underlying companies. Therefore, the exposure of a single secondary fund will typically span a range of vintage years, geographies, investment strategies, industries… This wide level of diversification helps smooth the return volatility associated with primary investing. This multi-dimensional diversification makes secondaries a good entry point for investors looking to enter the private equity space for the first time.

Accelerated and predictable cashflows

As seen prior, capital gain distributions tend to be accelerated in secondary funds compared to primary funds. Indeed, the historical returns of the portfolio can be analysed to predict future cashflows. The cashflow risk is reduced and returns are enhanced allowing rapid distributions to the investor. The quick distribution of capital gains helps investors close the liquidity gap between their current and new commitments. Furthermore, the cash inflow from the distributions can be used as a funding source for other capital calls in the same portfolio. This is referred to as a self-funding portfolio. Accelerated and predictable cashflows may appeal to investors looking to meet allocation targets quickly.

The complexity of secondary transactions has evolved in the last decade. Secondary market experiences a shift from LP-led transactions to GP-led transactions.

LP vs GP led Transaction

Initially, secondary transactions were mainly led by LP sales meaning that a fund investor (limited partner) would sell its fund interest to a secondary fund. The primary condition is that the Seller General Partner (which manages the fund) must approve the transfer of the LP interest to the buyer. Once the transaction has been completed, the Buyer (secondary fund) now owns the LP interest in the fund, and is responsible for all future capital calls, and will receive all future distributions.

Today secondaries are seeing a growth in popularity of GP driven transactions. Indeed, GP-led secondaries comprised one-third or more of total secondaries deal volume in each year over 2018–20. This type of transaction refers to the sale of one or more assets from a mature fund managed by the GP to a new fund. The mature portfolio of underlying assets is purchased by the secondary fund hence providing extra time and/or capital to further maximise the value of the portfolio.

The popularity of GP-led transactions is growing since it provides both the GP and the LP with several benefits. It allows struggling fund managers with solutions to extend the lifetime of the assets to extract additional value, recapitalise funds and accelerate realised gains for both GPs and LPs. On the LP side, it can lead to more attractive management fees and strategies with more substantial alignment to their commitments. The recapitalisation of holdings aims to create additional value and makes the LP better off during capital distributions (Thoughts on Private Equity, 2022). Additionally, LPs have the option to partially or fully sell their interests in the portfolio.

GP-led transactions typically occur when private equity funds are approaching, or have exceeded, the end of the fund’s life but still did not manage to exit the assets.

Conclusion

The arguments illustrated above help explain why private equity secondaries market has thrived in recent years. Investors seek sources of potential outperformance, risk reduction, diversification, and portfolio flexibility. Secondaries allow to make the best of a difficult environment and still provide investors with higher returns than more traditional asset classes.

The rapid market growth and strong operation tend to attract new participants, and several large GPs have been reported to be considering raising their own secondaries funds.

Finally, the share of positions that transact in the secondary market has risen as the practice has gained popularity among LPs and GPs. Many investors now view secondaries as a portfolio management tool, while GPs’ reluctance to allow LPs to exit positions has dropped over time.

Figure 1: Processes behind primary and secondary investments.

Figure 1: Processes behind primary and secondary investments.