By KPEC Legal Team, King’s Private Equity Club

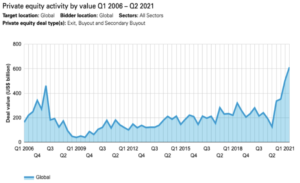

Private equity (‘PE’) funds comprise the capital that is to be invested in companies with the goal of highly profitable rates of return. PE deals in 2021 have witnessed an almost 90% increase than the earlier quarter.

Private equity activity by value Q1 2006 – Q2 2021

Source: White & Case

However, establishing and operating of PE funds come with several legal, regulatory and compliance issues. The risks have substantially increased mainly due to the following factors:

- Covid-19 Pandemic

- Brexit

- Proliferation of cryptocurrencies in the financial markets

- New US administration

- New UK foreign investment rules

Legal and Regulatory Risks

Recent developments, as mentioned above, in the market space have led to increased risks for the funds and fund’s managers alike. Below is a list of legal and regulatory risks which should be assessed by the PE funds before making investments in public and private companies.

i. Higher scrutiny for Special purpose acquisition companies (‘SPACs’)-SPACs are a means for early-stage companies to go public without the regulatory scrutiny of a traditional IPO. Owing to this gap in regulations, there have been multiple reports for SPACs failing to account for warrants given to investors, wrongful corporate filings and sharing misleading profit-earning projections leading to the SEC tightening their scrutiny, almost at the same level of a traditional IPO deal. SPACs grew increasingly popular in the US, with funds raised amounting to about US$ 83.4 billion. Although the UK has not yet seen an uptake in SPACs equivalent to the US. Financial conduct authority (’FCA’) estimated that there are just 33 SPACs listed in the UK and EY reported that there were just four UK SPAC IPOs in 2020, it is possible that SPACs will become more popular, especially if regulatory changes are made. The main purpose behind a SPAC is to make a company public without going through the hurdles of a traditional IPO. A number of PE-backed companies have been acquired by SPACs and in case the SPAC gets under scrutiny about the acquisition, the fund managers and sponsors are also at risk of being dragged into litigation.

ii. Blockchain-based investments- The volatility of cryptocurrencies remains to be a ground for disputes. SEC Chairman Gensler has alternated between censure and praise, referring to cryptocurrencies and blockchain both as an “innovative irritant” and as a “catalyst for change” while noting that crypto markets have been “rife with scams, fraud, hacks and manipulation”. It is still not clear if these digital assets are subject to the SEC regulations as securities. The regulators continue 3 with the cases of anti-fraud violations resulting from cryptocurrencies. Investment choices should be carefully considered by the fund managers and they should expect several levels of scrutiny while teaming up with cryptocurrencies.

iii. Data Privacy- Funds before making an investment would rely on as much information/ data as possible about the investee. Sometimes, the funds may turn to non-traditional and non-standard ways of collecting this information/ data. These may include using geo-location to extract data from phones, securing data stored in credit cards or other forms of monetary transactions, and searching the web (deep web). The practices fall within the ambit of data privacy and security laws, and this could cause the funds to disrupt. The regulators may view the methods of collecting material non-public information about companies as deceptive. To avoid the fall, funds should undertake internal diligence towards compliance and regulatory activities. SEC’s division cyber unit have focused on public companies till now, but private funds are soon to be come under its microscope. Hence, it is required by the funds to adopt written policies and procedures to detect cyber security and data breaches. Given this new direction by the regulatory bodies, PE funds managers should adopt the regulatory policies and take steps to ensure compliance.

iv. Foreign Taxes- The legal nature of the investee, jurisdiction and status, may introduce tax implications towards the fund that could subject it and its equity holders to foreign taxation. For example, certain payments made by foreign companies may be subject to withholding taxes; and the tax treatment of businesses (i.e., whether active or passive) and of varying types of transactions will differ based on the tax treatment of the entity, the nature of its business, and levels of control that could be deemed to exist from the investment.

v. Anti-Money Laundering systems- FCA by way of its “Dear CEO” letter outlined that PE funds will see an increased scrutiny over their anti-money laundering control. It is understood that weak controls have led to market abuse, financial crimes, and harm to market integrity. It is announced that the regulations are tightening, and the FCA shall conduct regular periodical reviews for the funds to assess the effectiveness of the new guidelines. FCA directs the senior management to have clear responsibilities and roles to deliver high standard of governance and follow the required compliances.

vi. Corporate social responsibility- Separate legal personality is a core structure for PE funds. In the past, fund managers have been able to manage its subsidiary portfolio companies, being aware that any liabilities shall have no affect or risk to the fund or its managers. With the ascent of corporate social responsibility in the market area, the courts and regulators have more powers to interfere with the parent companies of a fund and held them liable for any mis-actions. There is an increased liability on PE funds to scrutinise its subsidiary companies.

Conclusion

It is a rare occasion the PE firms end up in court. From the above, presently PE funds are at their most vulnerable. To mitigate some of the legal risks associated with such deals and transactions following needs to be considered by the fund managers:

a) Participants in the market transaction should proceed with caution, due to uncertainties in the legal and regulatory landscape.

b) Tax treaties and agreements among different countries, may also affect the reporting and filing requirement in different jurisdictions, which shall in turn affect the foreign payable taxes and restrictions towards the flow of funds. Foreign taxation requirements associated with the investee should be reviewed and assessed carefully before entering deals.

c) Regulatory due diligence procedures for collection of data of the investee is of utmost importance for fund managers. Failure to do the same puts the funds under breach of data privacy rules of different jurisdictions.

d) The more that PE fund managers are seen to be dictating policies and procedures to their portfolio companies and getting involved in their operational implementation, the greater the risk of claims of direct responsibility to third parties.

Greetings! I’ve been following your site for a long time now and finally got the courage to go ahead and give you a shout out from Huffman Tx! Just wanted to mention keep up the fantastic work!