By Brun Zulfikarpasic, Research Analyst at King’s Private Equity Club

Venture Capital has been at the forefront of start-up investing for the past 30 years and can be given credit for the existence of most large corporations today, like Microsoft, Zoopla, Uber, and Google. It is extremely difficult for venture capitalists to choose where to invest as most start-ups have a business plan which is just a concept and most of them do not have any previous managerial experience. On the other hand, as they still invest quite early the potential for growth is endless. Venture capitalists themselves, raise money from pension funds or high net worth individuals with a promise of consistent returns. Saying this, every VC firm has different strategies and risk tolerances which is what separates them. However, we are going to look at the most common areas which VC firms look at to find the right companies and invest in the right people to make themselves profitable.

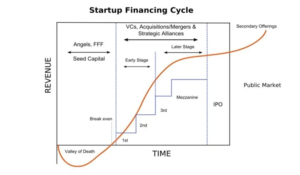

When new companies are incorporated, they can turn to angel investors and venture capitalists for funding. The main difference is angel investors usually come at the earliest (incorporation) stage of a company’s life, while VC firms come at an early or later stage of the company’s development. Furthermore, VCs do not only provide start-ups with funds but also with their networks and expertise, however they need to make sure that the company they are investing in has large potential.

Figure 1 – Venture Capital Entry Period

The management team is the core value that is looked at by the biggest venture capitalists as these are the people who will be executing the idea and hopefully making it work. They are looking for individuals who are well established within the industry and have previous experience of building a successful company. The saying “they would prefer to invest in a bad idea led by an experienced team rather than a great business plan led by a team of inexperienced managers” is critical. On the other hand, if a VC firm sees potential in a specific idea or a product, but they do not have faith that the people have the knowledge and expertise to materialise that idea, they will connect the start-up with experienced individuals in that sector from their wide network (which they accumulated while investing in previous start-ups). In this case, a VC might ask for a higher equity share for providing them with further resources.

Looking more in-depth, they evaluate the team by looking at three things:

- Track record – looking at the team’s past and their performance in previous ventures, school, sports, and even personal life. If a person has a history of not delivering, they might repeat their mistakes.

- Reliability –the team has to be honest and trustworthy as it is extremely difficult to work with people who do not keep to their word.

- Is the team likeable? – the executives should be likeable as they are the ones leading their company and eventually presenting to the customers

A great product or service is crucial for a successful company. These products should solve existing problems in the society and bring value to people, they are not interested in “copycats”. The product should also hit the market quickly as VCs want their company to be the first to hit the market and capture the largest market share by being a pioneer.

Looking at the most successful start-ups in the past few decades, such as Airbnb, Instagram, Tesla, and Pinterest, they all share the same thing: a product that is immensely popular today. In a democratic world, you cannot get people to buy a product by mere persuasion or by forcing them, so unless it truly fills a gap in the society and they love it, the company will not succeed.

Market size is the third thing VCs look at, as it is crucial for the future growth of the firm. The new company should not be targeting a small community, but rather the whole country or even looking at an international presence. Scale Venture Partners stated they are looking at companies that can enter a large market with a potential of $1 billion USD in revenue. This further relates to the potential return on investment by calculating which return on invested capital the VC firm can make. Typically they try to balance their investments equally between earlier and later-stage start-ups, generating higher and lower returns respectively, while still maintaining plausible risks.

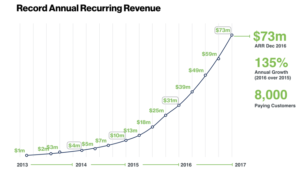

Risk is being assessed on the basis of competition and if the product is relevant today or in the near future. They are not looking for a product that is decades ahead of its time. They also look at regulations and legal issues which they might face, in turn slowing down the expansion and future profits. Further, VCs are looking at annual recurring revenue for the past eight quarters and ideally, it should have an increasing trend line (meaning net new AR grows in each quarter). An ideal ARR can be seen below:

Figure 2 – Desired Annual Recurring Revenue

This confirms that the market is right and that there is demand for the product, and in turn mitigate the risk. Speaking of demand, VCs are looking if the product/service is solving a problem currently faced by society. It is easier to create a product where there is demand for it than to find demand for a product you have created. Finally, as they are not interested in a long-term investment they look at possible exit strategies to make their return on their investment (such as an IPO or a buyout). They are essentially looking for companies that are willing to grow exponentially in a short period of time, e.g. 2 to 5 years.

As the old saying goes cash is king, and firms need to have it, as it is crucial for their survival. Venture Capitalists are looking for companies that can last at least two years with their current cash reserves and the money raised. Those two years should give the company enough time to grow and access further funds from other sources, so the VC is not required to invest further.

In conclusion, venture capitalists look at people leading the idea and firm in the right direction, a product that differentiates itself from others by solving a certain issue or filling an existing gap in that sector, market size as they want the company to expand as quickly as possible with a vast possibility of growth, low risk as it determines if they will make any return on their investment, and lastly cash which, by most, is believed to be the most important asset for a start-up.