By Alisson Pacheco Ramos, Master in Management at Audencia Business School

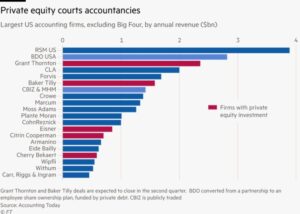

Accounting firms across the globe, including major players in the U.S. such as Baker Tilly and Grant Thornton, have caught the eye of investors as they increasingly become the acquisition target for private equity (PE) firms. According to a recent report by Financial Times as many as 10 of the 30 largest U.S. accounting firms could soon be owned by PE firms, with expansion into international markets likely to follow.

This trend started in 2021 when the investment management firm TowerBrook Capital Partners made waves by investing in New York-based EisnerAmper’s advisory services. At the time, EisnerAmper ranked as the #17 largest U.S. accounting firm. Such an investment, according to Forbes, was viewed as somewhat of “an oddity” in most of the accounting industry. However, the firm has since surged in value, rising to the #14 spot today.

Grant Thornton is now the largest accounting firm to be backed up by PE, and we can see this below.

Source: Financial Times (2024), Private equity groups step up pursuit of white-collar partnerships.

Why it’s a winning strategy for Accounting firms

For accounting firms, partnering with PE firms has mostly proven to be a winning strategy. One key advantage is the access to capital, which firms can leverage to adopt cutting-edge technologies, enhance their infrastructure, and expand into new markets. This capital injection also allows accounting firms to benefit from the operational expertise PE firms provide, leading to cost-cutting measures, improved profitability, and greater market efficiency.

By rolling up or merging smaller firms, PE investors create economies of scale, allowing for more competitive pricing, better resource allocation, and an accelerated growth trajectory—especially in international markets where these firms may have struggled to gain a foothold independently.

However, perhaps the most crucial benefit for accounting firms is the ability to attract new talent. According to Forbes, the profession has faced a steep decline in the number of licensed Certified Public Accountants (CPAs). The American Institute of Certified Public Accountants reports an 18% decrease in CPAs being awarded degrees compared to six years ago and a 32% drop since 2016 in candidates passing all the exams required to become licensed.

In response, PE-backed accounting firms have enhanced their ability to offer competitive salaries, performance-based incentives, and comprehensive training programs. This helps firms attract new job seekers and retain top talent, which has become a pressing need as the industry grapples with a talent shortage due to a declining public image of the accounting sector.

Additionally, PE investment enables accounting firms to modernize their workflows. Technologies like artificial intelligence (AI) are increasingly being adopted to reduce mundane tasks such as data entry or routine financial reviews. This not only boosts efficiency but also makes roles more engaging for younger professionals by freeing up time for more complex and interesting work. Since these technological upgrades are quite expensive, the capital that PE firms inject into accounting firms becomes critical to making these advancements a reality, ultimately improving the overall work environment.

Why are Private Equity firms so interested in Accounting firms?

Despite grappling with reputational challenges, accounting firms are emerging as attractive investment opportunities for PE firms. One key reason, as highlighted by the Financial Times, is the reliable stream of stable, recurring revenues that accounting firms generate through audit and advisory services. These cash flows remain steady, even in economic downturns, making accounting firms resilient investments. Furthermore, the fragmented structure of the accounting sector presents ample opportunities for consolidation. By merging smaller, independent firms, PE firms can create more efficient, larger organizations that benefit from economies of scale and greater market share.

Another factor driving the interest of PE firms is the significant potential for international growth. Many accounting firms are part of global networks but operate locally. By acquiring firms across borders, PE investors can streamline decision-making processes, reduce inefficiencies, and create a more cohesive global service offering. This approach not only positions accounting firms to better serve multinational clients who can potentially pay more for their services but also enhances their appeal in fast-growing markets, ultimately bringing greater long-term value.

Navigating complex markets: The role of PE expertise

The role of PE firms in the context of private equity-backed acquisitions goes beyond simply adding value to companies through their sheer financial power. Sometimes, deals can suffer from taking place in “poor information environments”, which are markets where transparency is limited, and reliable data on potential acquisitions is harder to come by. While accounting firms typically operate within well-regulated industries, entering new or emerging markets through cross-border acquisitions can introduce complexities. Regulatory standards, client bases, and competitive dynamics often vary significantly between regions across the world, creating environments where the full picture of an acquisition target may not be immediately clear.

By leveraging these strengths, private equity firms can successfully transform regional accounting firms into global players, helping them navigate diverse regulatory landscapes and unlocking new growth opportunities in high-potential markets. In doing so, PE-backed accounting firms are better positioned to achieve long-term profitability since they can serve multinational clients while expanding their geographic reach. This ability to mitigate risks in less transparent environments, backed up by recent evidence, ultimately reinforces the appeal of accounting firms as strategic, high-growth investments for private equity firms.

The potential negative implications of PE investing in accounting firms

Though it may seem like a win-win, private equity investment in accounting firms brings challenges that could affect the sector’s stability and reliability. Historical attempts to unify partnerships across different regions, such as KPMG’s failed European merger in 2007 or EY’s abandoned breakup in 2023, reveal the friction that can arise from cultural and operational differences. Private equity’s drive for uniformity and efficiency could exacerbate these tensions, especially if the PE firm’s strategic direction diverges significantly from the accounting firm’s previous path.

A deeper concern is the potential impact on audit quality. While regulations mandate that audit firms remain under auditor control, private equity’s involvement raises questions about influence. Short-term profitability goals could subtly shift priorities, threatening the independence essential to audit operations. With audit practices already under scrutiny, the risk goes beyond operational misalignment – it could undermine trust in financial oversight. This, in turn, brings potential legal risks, given the strict regulations surrounding the accuracy and independence of audits.

This risk is amplified by the fact that PE investors seek significant returns within compressed timeframes. The pressure to deliver rapid growth and profitability could push accounting firms to prioritize short-term financial gains at the expense of long-term client relationships and audit quality. Indirect forms of control, such as management fees, can add to this pressure. For instance, a PE firm might recommend reducing the number of auditors while maintaining the same workload to cut costs despite the negative effect this could have on audit quality. Accounting firms may feel compelled to follow this advice to avoid conflict or face increased fees, even when it undermines long-term standards.

Additionally, there is an ambiguity surrounding PE exit strategies. While PE firms typically look to exit through trade sales or IPOs, these paths are far from straightforward. Instead, some firms like HgCapital Trust have sold stakes to other investors – passing part of their ownership to another PE firm – but the complexities of cross-border roll-ups may limit future sale options. The uncertainty of exit routes, whether through other PE firms, pension funds, or even the partners themselves, could leave firms in a state of flux, affecting their long-term stability.

Moreover, the speed with which private equity has entered the accounting sector means that any missteps could ripple through the industry quickly. While PE investment accelerates the adoption of advanced technologies and enhances talent acquisition, its aggressive strategy could introduce risks that neither firms nor regulators are fully prepared to handle.

Ultimately, while private equity has unlocked new growth opportunities for accounting firms, the long-term outcome depends on how well the balance between profitability and professional integrity is maintained. As the accounting sector continues to evolve, these investments could shape not only firm performance but also the broader trustworthiness of the industry – potentially prompting regulatory changes that could complicate the accounting process for all parties involved.

Alisson Pacheco Ramos

Alisson Pacheco Ramos is a Peruvian student pursuing a Master's degree in Management and finance at Audencia Business School in Nantes, France. She is passionate about Finance and Strategy Consulting. Her motivation for social innovation, responsible business, and sustainable development as a strategy drives her to always surpass herself and anticipate the future, transforming large-scale, high-impact businesses. Her ability to communicate effectively in multiple languages is a valuable asset, she combines her excellent analytical skills in financial services, network excellence, digital, and cost analysis with knowledge of Law, Accounting, digital marketing, and renewable energy to advocate for impactful solutions firmly rooted in scientific evidence, spanning Business, Markets, and Sustainable Finance.