By Lautaro Clavero, Student at the Universidad Nacional de Córdoba

Few nations in the world continue to suffer from inflation as persistently as Argentina. They have not eliminated the unhealthy habit of financing state debts through monetary issuance, and as a result, their currencies endure constant depreciation.

Regrettably, Argentina remains among the most imprudent countries (although monetary orthodoxy seems to have regained popularity with the change of government). After decades of “economic shamanism,” the crisis and monetary chaos have become the status quo. In an attempt to combat it, the most ludicrous measures imaginable have been implemented.

The rental market serves as a perfect example of how not to combat inflation. The first law regulating rental prices dates back to 1921, under the government of Hipólito Yrigoyen, and since then, nine similar versions of this legislation have been enacted and repealed at the national level, alongside numerous additional versions at the provincial level (La Nación, 2020).

The government of Javier Milei has decreed the repeal of the last active law (Law No. 27,551); however, the capital city, Buenos Aires, continues to impose regulations on the real estate market that have been in effect since 2017. Thus, it is particularly pertinent to analyse how these regulations have evolved in the context of a severe inflationary environment.

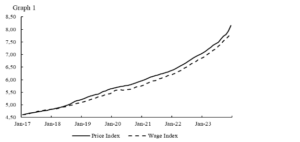

From January 2017 to January 2024, a total inflation rate of 3,371.6% has accumulated. Salaries have fared less favourably, with an increase of 2,390.9% over the same period (INDEC).

Evolution of Price and Wage Index 2017-2023 (in Natural Logarithm)

Source: Own elaboration based on data from the Argentinian National Institute of Statistics and Census (INDEC)

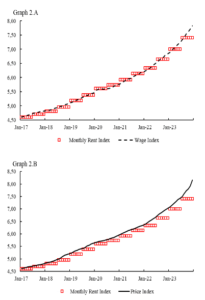

The real estate regulation law of the capital stipulated that adjustments should be made biannually, using a weighted average between inflation and the wage index (90% of the wage index and 10% of the price index).

Evolution of the Monthly Rent Index compared to the Wage Index and the Price Index 2017-2023 (in Natural Logarithm).

Source: Own elaboration based on data from the Argentinian National Institute of Statistics and Census (INDEC).

In the previous graphs, the red boxes represent the average rental index for a given month. As observed, the monthly rental index makes a discrete jump every six months, the minimum timeframe permitted by the regulations for price adjustments.

Compared to the wage index, it can be noted that in some months, the monthly rental index exceeds it (this is due to the adjustment component related to inflation, which is above the wage index). However, the obligation to maintain a fixed price for six months ultimately results in lower rental prices relative to wages.

On the other hand, inflation has severely eroded the purchasing power of the average rental. This can be seen in Graph 2.B, where it is evident that even after the biannual increases, the relative loss is not recovered, causing significant detriment to property owners.

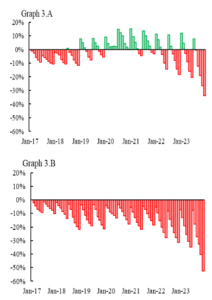

The following graphs will be very helpful in illustrating the losses experienced by landlords on a month-to-month basis in relative terms of rental prices against the wage index (Graph 3.A) and rental prices against the price index (Graph 3.B).

Increase in rental returns compared to the rise in prices and the increase in nominal wages 2017-2023

Source: Own elaboration based on data from the Argentinian National Institute of Statistics and Census (INDEC)

The red areas represent losses in terms of the wage index (Graph 3.A) or the price index (Graph 3.B), respectively. Economically, these can be interpreted as consumer surpluses that are entirely appropriated by tenants to the detriment of landlords.

The observed behaviour is interesting. It consists of six-month intervals that resemble a wave pattern. This occurs because, following the adjustment, the indices converge to similar levels. However, over time, the indices begin to diverge (due to ongoing inflation, while rents remain fixed), increasing their gap with each passing month until the cycle repeats at the next adjustment.

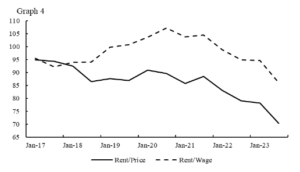

It is evident that this has had significant consequences for rental profitability. The following graph provides information on the evolution of average profitability (over 6 months) of rentals during the period under analysis.

Evolution of the average relative profitability of rentals over a 6-month period 2017-2023

Source: Own elaboration based on data from the Argentinian National Institute of Statistics and Census (INDEC).

Finally, it is important to mention that the inflationary component induces a variability of 7.88% in the average real profitability of rentals. In a normal scenario, with inflation not exceeding 3 or 4% annually, this figure should be close to zero; however, in Argentina, it is one of the most significant factors contributing to investment risk.

To put into perspective, the detriment suffered by landlords, in 2017 the return on investment in the capital of the country was, on average, 4.5%. Assuming that an apartment was purchased at that time (considering the investment as fixed), the return fell to 3.15% in real terms by the second half of 2023, representing a decline of nearly 30% (La Nación, 2021).

In addition to being considerably lower than that of other countries in the region, this return was unpromising when taking into account the incredible number of additional risks present in the Argentine real estate market compared to its neighbours.

Of course, all of the above was reflected in the supply of rentals, which plummeted abruptly with the acceleration of inflation in recent years (Data Driven).

Evolution of the monthly inflation rate and the increase in nominal wages, as well as the quarterly trend in rental quantities in Buenos Aires 2017-2023

Source: Own elaboration based on data from Data Driven, Real State Report.

In conclusion, the measures implemented in the capital led to a significant decline in the benefits of the real estate market, impacting not only those who had allocated their capital there but also dissuading potential investors. Additionally, the regulations included restrictions on rental terms, required guarantees, intermediaries, and so on. This array of measures further complicated these types of operations.

On the other hand, there were not only losers. Those who rented an apartment or house benefited in the short to medium term from these measures. For this reason, there was a political gain associated with their implementation; however, in the long term, the supply decreased, leading to a shortage in the market and its logical consequences.

Lautaro Clavero

Lautaro is a non-official ambassador of the Patagonia region where he was born. He is pursuing a bachelor’s degree in economics atUniversidad Nacional de Córdoba. During 2021, he conducted his radio program, “La economía en una lección” (The Economy in One Lesson), while also starting to write as a journalist. His primary interests include macroeconomics and statistics, and he serves as a teaching assistant for these subjects at his university.