By Ivan Vrhovac, King’s College London Alumn

Africa faces a massive energy gap; telecommunication tower network rollouts are accelerating much faster than grid connections as consumer demand for mobile connectivity is strongly outpacing the infrastructure installation most Sub-Saharan countries’ governments have undertaken.

Enter ESCO’s, or Energy Services Companies.

ESCO’s are entities providing energy solutions and designs with the end goal of supplying energy and achieving energy savings.

The emergence of the trend has notably been observed within Mobile Network operators (MNOs), especially in Africa, where they have been gaining momentum ever since 2017 through the direct supply of electricity to telecommunication towers.

In practice, this is realised through small investment funds, which invest and install energy infrastructure next to telecommunication towers, currently predominantly powered by diesel generators, and replace them with solar panels and batteries, which are a more ecological and reliable source of energy.

Africa is a delicate place for telecom rollout as vast terrains are deserts and forests, and grid installation presents an obvious geographical and operational challenge. Moreover, the continent’s imbalance in connectivity between urban and rural areas and the discrepancy of electricity prices between regions result in evident profitability challenges facing an operator. In response, mechanisms to assure and standardise energy supply are vital for the smooth functioning of a country. This leaves room for innovative solutions to ‘bridge’ the demand-supply disparity.

The main MNOs in the market are Orange, the $44bn French group mostly covering West African countries, and the UK’s Vodafone ($46bn), mostly present in East African areas. Other operators include South Africa’s MTN, Safaricom, Airtel, Zamani, and Moov Africa. This is important since most countries have a 2-supplier model, allowing users to switch SIM cards and alternate suppliers as different operators produce different network strengths depending on the time & region.

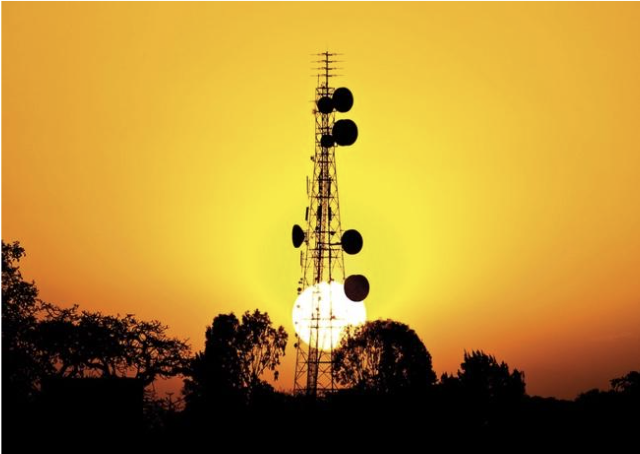

Telecom tower “hosting” multiple MNOs

Source: Infrastructure Investor

Construction companies operating in Africa, South America, and Asia that usually develop solar panels and other infrastructure appliances within their classic scope of work are the very originators of these small Investment Funds, which lie within their organisations, and serve as ESCO providers. This is convenient as it allows construction companies to utilise their supply chains, manpower, and operational know-how to decrease the costs of installation for the assets installed, which enables them to offer attractive prices to their clients, such as telecom operators.

The idea is simple: the operator signs a 10-15-year contract with the ESCO provider, defining monthly payments over the contract’s length in return for benefiting from the electricity emerging from the installed solar panels.

This liberates the MNO from upfront CAPEX costs associated with the infrastructure, but also from the OPEX costs such as the personnel for day-to-day maintenance & security of every site, which is also usually provided in the contract.

The model is proving very popular, as more and more telecommunication operators understand this mutually beneficial relationship, justifying it mostly as a mechanism to double-down on their core business and optimise CAPEX, spending it on other, more innovative investments such as 5G, fiber rollout or other connectivity technology.

By extension, this also implies easier development of new telecom towers in rural areas since the expected upfront investment for an operator drops significantly in an “ESCO” scenario.

The interest in financing ESCO’s was also recognized by public financial institutions such as the Norwegian Investment Fund for Developing Countries (NORFUND), Proparco, the private sector financing arm of the French Development Agency (AFD), and AfricaGoGreen, a fund launched by the Kreditanstalt für Wiederaufbau (KfW) to promote private investments that mitigate or reduce greenhouse gas emissions (GHG).

These national and supranational funds subsidize ESCO providers, allowing them to obtain favourable financing for their investments. This makes it attractive for additional ESCO providers to enter the market, which only predicts even more efficient markets.

A “Hybrid” ESCO site with PV panels, fuel generators, and battery cabinets

Source: Sacred Sun

Furthermore, it shows us how rather early adoption of innovative and eco-friendly Private Equity solutions in Africa, the world’s poorest continent, can be beneficial to all stakeholders; investment funds looking to open small and mid-cap investment verticals in Frontier markets, MNOs who can diminish Capex spending, and most importantly, the environment, as diesel generators are removed, reducing fuel consumption and CO2 emissions.

“Pure Solar” ESCO site

Source: Afrik21

(It is estimated the whole African Continent has about 300,000 telecom towers depending on diesel generators.)

With Africa’s network coverage as a relevant question for Western companies’ continuing influence over the continent, the innovative ESCO model has proved it can be used as a stimulus to increase the number of future telecom towers, providing cleaner and more widespread network access while contributing to the well-being of the countries and communities in question.

Sources:

Tower Exchange

https://www.towerxchange.com/article/2c9ok0p22qflf1nw3nrwg/closing-africas-energy-gap

Orange ESCO

https://www.orange.com/en/how-orange-reducing-its-environmental-footprint-africa-and-middle-east

Aktivco Signs 7m$ equity facility

Greenwich partners support Orange in its Energy Transition in the DRC

Prosper Africa

https://www.prosperafrica.gov/wp-content/uploads/2023/01/Near-Universal-Connectivity-in-Africa.pdf

S&P Global Industry Trends 2022

https://www.spglobal.com/_assets/documents/ratings/research/101068713.pdf

Ivan Vrhovac

Ivan is a King’s College London graduate from Croatia. He is interested in the public markets, macroeconomic developments, and new industry trends. He enjoys meeting curious people and learning about different cultures.