By Mario Bredicean, Research Associate for the King’s Commercial Awareness Society

Marko Kolanovic, chief strategist at JPMorgan, was interviewed in early October on CNBC, where he explained that he had been bearish on the stock market since the beginning of the year. He remains bearish and expects a pullback in the S&P500 of 20% soon. Given economic factors such as the stock rally within the last few months and improving employment statistics in the US, perhaps a more uncertain view is appropriate for the average investor.

The Stock Market This Year

In the CNBC interview, Kolanovic stated that it was a mistake to have a price target of 4200 for the S&P 500 going into 2023. In fact, the index gained 11.24% year to date and is currently at around 4,254.00. Even highly knowledgeable financial professionals seem to occasionally be incorrect. It may be the case that the effective strategy of dollar-cost averaging, especially for the individual investor, continues to be a great method for sustained returns. Curiously, some see an even higher return from the index by the end of the year, contrasting significantly with Mr Kolanovic’s view.

The Job Market

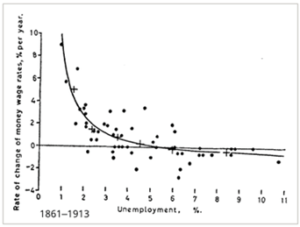

There is potential optimism arising from increasing employment. According to the WSJ, 336,000 jobs were added by employers in the US in September, and notwithstanding later recovery, this meant ‘[b]ond and stock prices fell sharply… reflecting how economic strength reduces the likelihood that the economy is close to a recession…’. This can be viewed as an indication that the US economy is expanding, and a recession is unlikely. Justin Lahart, however, has a warning about complacency, pointing out that employment increased through the last months of 2007 right before ‘job losses started to mount’ in early 2008. Uncertainty is thus a reasonable reaction to the data and detailed analysis would be needed to get an accurate understanding of employment as a factor affecting the economy in 2023. Interesting to note is the fact that inflation rises with increased employment, as the short-run Philips curve below demonstrates. US unemployment is around 3.8% now, which would in principle be attributed to inflationary pressure – which during times of good economic conditions is desired to achieve inflation of 2% per annum.

The Yield Curve

At the time of writing the yield curve is inverted due to high interest rates and market sentiment that the short-term presents risks of recession. However, the curve is currently normalizing; the 30-year Treasury yield has risen by more than 100 points since July of this year and the 10-year yield is close behind. This might suggest that the economy will experience growth in the next 12 months and could limit concerns of recession. A possible explanation for the trend toward normalization is that the rate hike policy of the Federal Reserve over the last year has demonstrated to market participants that inflation will be persistent and that the contractionary monetary policy is invoking cautious optimism that the Federal Reserve Board is successfully tackling inflationary pressure.

Concluding Thoughts

Macroeconomic happenings are hard to accurately predict in the long term and many variables can have opposing effects on important metrics such as inflation, the rates that Central Banks set, and the impacts of events on markets. This article, focusing on the US, has attempted to give an overview of some indicators suggesting that a bearish outlook on the stock market is not necessarily warranted. The fact that a recession ‘will eventually come’ (in Kolanovic’s words) does not necessarily mean that investors should step out of the market and potentially miss out on the upside in the near future.