Source: General Electric

By Alisson Pacheco Ramos, BA in Management & Finance at Audencia Business School

Renewable energies, and among them offshore wind, could be our only hope to reach net zero emissions by 2050. The International Energy Agency (IEA) supports this claim: to reach this goal, we need to have nearly 90% of electricity produced from renewables. However, offshore wind is facing a series of challenges today that could slow down its implementation.

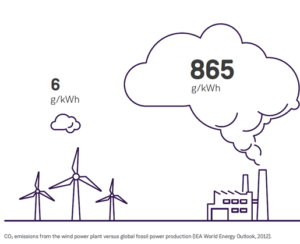

The main challenge faced by offshore wind power today is financial: the costs of implementing this form of energy are proving to be higher than expected, not least because of galloping inflation, but also because financing is largely based on high-interest loans, and recently the increase in the price of raw materials and manufactured equipment has dealt another blow to the industry. Indeed, according to Bloomberg, “capital costs and prices for turbines, cables, and other equipment” have drastically increased lately, driven by the inflation of copper and steel prices among other materials, even though they had declined greatly over the last decades. And this drives up the price offered by wind turbine manufacturers. Yet, the stakes for the rapid implementation of offshore wind power are high. In fact, offshore wind could play a crucial role in producing a large amount of low-carbon electricity, as it only emits 6 grams of carbon dioxide (CO2) for every kilowatt hour of electricity produced (the equivalent of an electric oven being used for 20 minutes). In contrast, fossil power production emits, in the case of coal, up to 900 g of CO2 per kWh produced.

Source: Siemens-Gamesa, “Environmental Product Declaration SG 8.0-167 DD”.

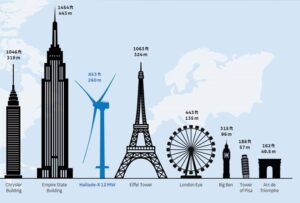

Moreover, offshore wind turbines have two advantages: with their taller size – as seen in the presentation image – they can reach higher, more consistent winds, and with their location off the coast, the winds are stronger and more constant year-round than inland. This is why offshore wind turbines produce at their maximum potential 36% of the time on average, whereas onshore, they only reach around 24% (in Europe, according to WindEurope).

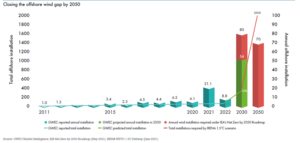

Thus, this graphic below, made by the Global Wind Energy Council (GWEC), shows the role of offshore wind power in mitigating carbon emissions. The graphic bars show the annual rate of installations required to reach the IEA’s previously mentioned Net Zero by 2050, and the continuous red line shows the total number of offshore wind installations required by IRENA (International Renewable Energy Agency) to limit global warming at +1.5°C:

Source: 2023, Global Wind Energy Council (GWEC), “Global Offshore Wind Report 2023”.

Offshore wind: its momentum is slowed by financial obstacles

To meet these ambitious objectives, a few countries have already started to invest in offshore wind projects massively. Among these countries, the US stands out, as it has virtually no offshore wind farms installed today, yet the President wants to have 30 gigawatts (the equivalent of around 30 nuclear reactors, around half the number of reactors in France) installed by 2030.

Despite this good intention, reality is now catching up with the US administration: project approval times are still too long, with each project requiring years of complex procedures, and the federal energy subsidy program, the Inflation Reduction Act, is still falling short of covering 50% of project costs instead of the current 30%. This, combined with the fact that there is a 50% increase in the invoice presented by operators (the companies in charge of installation and maintenance of the wind farm) to the public authorities, has dire consequences for the viability of offshore wind projects.

For example, the Spanish energy giant Iberdrola has recently agreed to pay 60 million dollars to cancel two offshore wind projects off the coast of Massachusetts. Moreover, Danish energy company Ørsted (the first company ever to install an operational offshore wind farm in 1991) recently lost a bid to develop the offshore wind farm at Rhode Island due to “rising costs” that “made the proposal too expensive”; this made their market value drop by a whole quarter of its initial value, and they announced a potential loss of $2.34 billion on its U.S. projects.

On the other side of the Atlantic, nine European countries, including Germany, the Netherlands, Denmark, the UK, and Ireland, have stated their target of installing a total of 120 gigawatts of combined offshore wind power capacity in the North Seas by 2030. This represents more than quadruple the current capacity installed.

Despite this things have not been going smoothly there either: the stated-owned Swedish energy company Vattenfall has decided to halt one of the largest wind farm projects in the world, a 1.4GW wind farm off the coast of Britain that could have provided electricity for 1.5 million homes, after experiencing a 40% cost increase in the project.

Again, the same kind of reasons come up: in the case of Vattenfall, the British government had guaranteed last year that this project would still have inflation-linked prices over a 15-year period, with a starting price of £37.35 per megawatt-hour (MWh) produced (1MWh being the equivalent of the consumption of 2 refrigerators running for a year) at 2012 prices.

In reality, the maximum price the government later fixed to prevent consumers from being penalized by the recent inflation of energy prices, which is fixed at £44/MWh (2012 price), is actually considered too low for developers today.

These three massive offshore wind projects in the US and Europe would have added 3.5 gigawatts of power, which is more than 11% of the total offshore wind fleet currently in place on the shores of the US and Europe, according to Bloomberg. And an additional 9.7 gigawatts of potential US projects are in jeopardy today since offshore wind farm developers would reconsider the contracts, they signed since they could be selling at prices that they now start to consider too low to make it worth it.

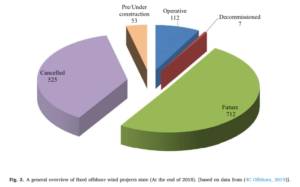

Nevertheless, these massive project cancellations are not such a recent phenomenon; a study from 2020 had already observed a very high rate of canceled projects (37%) by the end of 2018:

Source: Díaz, H., & Guedes Soares, C. (2020). Review of the current status, technology and future trends of offshore wind farms. Ocean Engineering, 209, 107381.

Besides, investment hasn’t completely stopped either. Some projects across both sides of the Atlantic are still underway despite the increased costs, like the recent bid from the oil giants TotalEnergies and BP, at €12.6 billion ($14 billion) to build offshore wind farms in the German North Sea.

A need for better government policies

The events happening today, most of all the war in Ukraine and the recent pandemic which have put supply chain pressures worldwide, and the soar in energy demand due to high temperatures this summer in the Northern hemisphere, have precipitated these events, particularly in Europe, where according to Bloomberg, there is a growing need to break away from reliance on Russian oil and gas, further accelerating demand for low-carbon energy production.

Considering how governments are still looking for ways to produce green energy while reducing costs for consumers, they have to be able to take the risk of investing and guaranteeing reasonable retail prices for energy developers, so as to meet their ambitious goals and take into consideration the fact that offshore wind can still have high development costs. This has been recently confirmed by researchers from Chalmers University of Technology in Sweden: “[…] policy-makers can, and should, intervene in order to stimulate investment in renewable energy technologies”.

Besides the financial problems mentioned before, the offshore wind industry, particularly in the United States, is facing other challenges. There’s still a shortage of skilled labor, but there is also a problem when it comes to connecting the wind farm to the grid.

There is indeed a shortage of cables, and cable-lying vessels as well, which are the only ones capable of carrying out this operation. In fact, there are only around fifty cable-laying ships in the world. To make matters worse, in the USA, Le Monde reports that there is still a protectionist US law requiring ships sailing along the coast – including those installing wind turbines – to have an American flag, built in the USA and manned by American crews.

A cable layer of the Nexans brand, based in Norway.

Source: TradeWinds news, “Nexans to build ‘most technologically advanced cable layer ever’ to target US and Europe”.

Another factor that is currently slowing down the development of offshore wind energy to this day, is the delay that it takes to grant permits, which both in the US and Europe, is still substantially long, and the administrative procedures quite lengthy. For example, according to the American Clean Power Association, the average time it takes to grant a permit for installing a wind farm in the US is around 4.5 years. This problem has also been confirmed by the IEA as a “key concern for investors and financiers”.

Taking into account how crucial it is to accelerate the transition to renewable energy across the world, policymakers must be able to confront these issues and mitigate them, before it’s too late; the current crisis offshore wind projects are facing, with major companies abandoning ship, must be a wake-up call to governments, so that they can keep their commitments to rapidly implement this form of energy, which is one of our best allies in the fight against global warming.

Alisson Pacheco Ramos

Alisson Pacheco Ramos is a Peruvian student pursuing a Master's degree in Management and finance at Audencia Business School in Nantes, France. She is passionate about Finance and Strategy Consulting. Her motivation for social innovation, responsible business, and sustainable development as a strategy drives her to always surpass herself and anticipate the future, transforming large-scale, high-impact businesses. Her ability to communicate effectively in multiple languages is a valuable asset, she combines her excellent analytical skills in financial services, network excellence, digital, and cost analysis with knowledge of Law, Accounting, digital marketing, and renewable energy to advocate for impactful solutions firmly rooted in scientific evidence, spanning Business, Markets, and Sustainable Finance.