By Veronica To, Treasurer of King’s College London Commercial Awareness Society

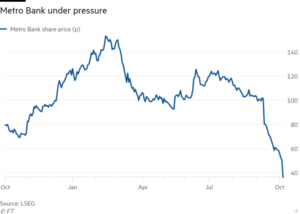

Metro Bank plc, a UK high street retail and commercial bank, desperately saved itself by agreeing to a £925 million refinancing deal after weekend-long negotiations with investors on Sunday, 8 October 2023. This package consists of a £325 million capital raise, including £150 million of new equity from shareholders and £600 million of debt refinancing. This last-minute save comes after Metro Bank needed to raise cash to organise its finances, which sent its share price plunging last week.

Source: The Financial Times

Background: What happened to Metro Bank’s finances?

Metro Bank’s asset portfolio was vulnerable to rising bond yields and the current interest rate environment. Metro also had inherent flaws, including high funding costs, an expensive branch-centred business model, and an accounting scandal in 2019 when Metro’s shares fell 39% after it admitted to a £900 million error in commercial loans. Then come September 2023, when it announced an indefinite delay in obtaining regulatory approval for capital relief, triggering a plunge of more than 50 percent in its share price.

Metro Bank found that it had insufficient capital to meet regulatory requirements due to loans it received, leaving it to urgently secure funds for a looming payment of £350 million. Additionally, Metro had requested permission from the Bank of England’s Prudential Regulation Authority for a reduction in its capital requirement for residential mortgages, but unfortunately, this request was denied.

Colombian billionaire Gilinski Bacal to Metro Bank’s rescue

As part of the rescue deal, Jaime Gilinski Bacal of Spaldy Investments Limited – which was already a shareholder – will contribute £102 million of new equity as part of the wider refinancing plan, taking its stake in Metro Bank from 9 percent to around 53 percent. Gilinski Bacal, whose personal wealth is estimated by Forbes at $5.4 billion, is drawn to purchasing distressed banking assets at bargain prices and turning them into acquisition vehicles. Metro is Gilinski Bacal’s 14th cheap acquisition in the financial sector.

Was the last-minute save worth it, and will it last?

Metro Bank’s £925 million rescue deal comes at great cost, and in the future, it may have to sacrifice its expensive branch-based model and quality customer service that sets it apart from rival banks. Its well-known 76 physical branches are likely the main reason why it currently has close to 3 million customers. As Metro Bank aims to slash around £30 million of costs a year from 2025 as part of the rescue package, it is predictable that some of its 76 branches must close down along with future job losses among its 4,000 employees. The staff costs make up around 45% of Metro’s total costs, leading Shore Capital analyst Gary Greenwood to say he “would be surprised if some of the cost-cutting doesn’t involve employee impact”. Taking away its red and blue branches would be a fatal blow for Metro, which would then not be able to stand out against rival banks who have already been shedding branches for years to focus on mobile banking.

In addition, a problem arises from the fact that one individual – Gilinski Bacal – is using Spaldy Investments Limited’s vehicle stake to occupy 53% of the shares in Metro Bank. From a governance point of view, the concentration of shares raises questions about Metro’s ability to act independently. It could lead to significant control over decision-making, especially on whether to stick with or abandon Metro Bank’s branch-based approach. However, Gilinski Bacal insists that the fundamental strategy will remain unchanged, adding that the rescue package will help Metro reach its potential.

Although the last-minute reprieve and do-over will buy Metro Bank some time, this will all depend on the longevity of its refinancing plan. It is difficult to imagine how Metro Bank’s costs can be meaningfully reduced without compromising the uniqueness of the branch-based strategy and high customer service; perhaps it will have to redirect its efforts.

Veronica To

Veronica To is a second-year LLB Law student at King’s College London, graduating in 2025. She is currently the Treasurer of KCL Commercial Awareness Society and enjoys gaining a deeper understanding of the fundamentals of business, their drivers, and strategies.