By Veronica To, Treasurer of King College London’s Commercial Awareness Society

Undoubtedly one of the most anticipated initial public offerings of the year, Arm Ltd’s successful IPO on the Nasdaq exchange on Thursday, 14 September 2023, has stirred hope for IPO market recovery.

Background to Arm’s IPO

Arm is a British semiconductor chip company that designs processors and chips such as systems and platforms. Its designs are found in various devices, and its technology is found in around 95% of the world’s smartphones, including Apple, Android, and Samsung. Eventually, Arm was bought by SoftBank Group Corp in 2016 for $24 billion, a 43% premium over ARM’s share price at the time.

An IPO is when a business sells a portion of its shares to the public for the purpose of raising money for expansion, investments, or to reduce debt. The company will retain management control of the business and will remain a substantial shareholder. In this IPO, Softbank retains a 90.6% stake in Arm. Once the business becomes a public company, it will need to disclose financial information in interim and annual results to update shareholders. In this case, SoftBank, the Japanese investment giant and owner of Arm, is utilising this IPO to recoup some of its investment in Arm.

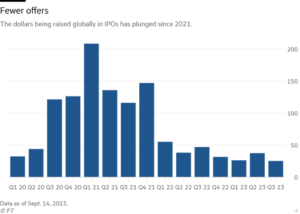

The global IPO market has been quiet since 2021. According to Law firm White & Case, the 284 IPOs (excluding SPAC listings) listed in Q1 2023 is the lowest recording since the COVID-19 pandemic first affected markets in Q2 2020, with total deal value merely reaching US$25 billion in Q1 2023. This falls in comparison to US$35.7 billion in deals in Q2 2020. This underperformance is the result of US interest rate hikes, and US equity markets leaning towards the technology sector which has seen massive inflation and the rising cost of capital.

Source: The Financial Times

Great success

Underwriters went with a safe figure to price shares at a figure of $51 per share, as they believed shares would trade up due to the current health of the IPO market. However, Arm’s success has proved otherwise, closing at $63.59 at the end of its first-day trading on the Nasdaq exchange, valuing Arm at $54.5 billion. Overall, the IPO raised almost $5 billion for SoftBank, making it the largest US listing since 2021. Major customers and partners such as Apple and Nvidia have become cornerstone investors to show confidence in Arm, buying $735 million worth of Arm stock as part of the listing.

Arm’s success can be attributed to its willingness to diversify its business from being reliant on the mobile market, which is currently experiencing a downturn, to expanding into new business platforms involving automotive and data centre chips.

A blow to the London stock market?

Arm’s successful IPO is a win for the Americans as Arm chose to list its shares in the US and not the UK. Hermann Hauser, who was involved in the development of the first Arm processor, stated that the UK’s decision to leave the European Union was in part to blame for Arm’s shares being listed in the US, as Brexit had affected the standing of the London Stock Exchange. Furthermore, there are concerns surrounding whether there is enough support for the UK to become a tech powerhouse, given the major regulatory hurdles SoftBank faced in the abandoned plan to sell Arm to rival US chip giant Nvidia Corporation last year. Nonetheless, Softbank has proved extremely successful in taking Arm to the next level.

SoftBank’s Chief Executive Masayoshi Son’s strategy

According to the Financial Times, several individuals involved in the listing have stated that SoftBank and its CEO, Masayoshi Son, were more focused on ensuring the stock trades well than maximising their initial earnings. This approach appears to prioritise SoftBank’s interests, rather than serving the public’s interest in reviving the market. It is known that SoftBank has a large portfolio of start-up investments it hopes to list, and Son may want to prioritise those ventures. This has resulted in one person who worked on the Arm IPO to say: “This is going to be their biggest asset going forward, so every decision they make should be around protecting the value of the 90 percent [of Arm that SoftBank still owns], not optimising the value of the 10 [percent].”

Nevertheless, Arm’s IPO has successfully tested the market’s appetite. As investors are hungry for new listings, other companies will notice and eagerly prepare for IPOs of their own. IPOs for grocery delivery app Instacart and marketing software group Klaviyo are expected to further test investor appetite next week on 19 September 2023.

Veronica To

Veronica To is a second-year LLB Law student at King’s College London, graduating in 2025. She is currently the Treasurer of KCL Commercial Awareness Society and enjoys gaining a deeper understanding of the fundamentals of business, their drivers, and strategies.