By Brun Zulfikarpasic, Research Analyst at King’s Private Equity Club

As the global reserves of fossil fuels are slowly being depleted, companies and researchers are considering new ways to replace the role of natural gas and oil. The first solution that the majority of people intuitively think of is that of renewable energy sources and, albeit it being a desirable alternative, different countries often lack the climatic and meteorologic conditions necessary to generate energy in such a way. This adds to the other pressing issue of energy storage, which can turn out to be a particularly difficult task when it comes to renewable energy: the highly inefficient and expensive storage methods that are most common today are a testimony to this.

This is where the role of hydrogen comes in: it solves the problems of storage as it can be stored in gaseous or liquid form, in the same fashion as oil or natural gas. Yet, it is immensely more sustainable as the only byproducts are heat and water and, for any given volume, hydrogen stores around three times more energy than do oil or natural gas.

Currently, there are three types of hydrogen: namely, these are grey, blue, and green hydrogen. Grey hydrogen is generated from natural gas through a reforming process and hence does not solve the issue of sustainability. Secondly, blue hydrogen is produced in the same way as grey hydrogen; however, the CO2 which is being released during the production process is being re-captured, thus making blue hydrogen a seemingly more sustainable alternative. Lastly, green hydrogen is produced by splitting water using electrolysis, the water molecules are split into H2 and O2. H2 can then be stored, and the oxygen can either be released into the atmosphere or packaged and used for other purposes. The process of producing green hydrogen, electrolysis, requires electricity which can be produced using sustainable methods, consequently, production and use of green hydrogen are 100% sustainable and accessible at any time.

Currently, multiple companies on the market are producing green hydrogen and numerous networks are being built to distribute it across the EU and the US. The major issue currently facing the hydrogen market is the market itself, as it is relatively small. The general population has still not had time to comprehend the concept of using hydrogen to fuel their cars, power, and heat their homes, and cities are not yet ready to implement hydrogen into their ecosystems. Daring companies, such as Hyundai, are already building Fuel Cell Electric Vehicles which utilise hydrogen by using a fuel cell to convert it into electricity which drives the wheels through an electric motor. Moreover, companies like Porsche believe that “the combustion engine is going to dominate the automotive world for years to come” (a vision that is testified in their project to produce “eFuel” made by combining hydrogen with carbon dioxide, in which the resulting outcome is a liquid which is injected and utilised by engines in the same way as petrol or diesel fuels). Furthermore, even plane manufacturers such as Airbus and FlyZero are developing advanced technologies to enable planes to run solely on hydrogen.

There are major advances happening within the industry, however, for hydrogen to replace fossil fuels and become more dominant throughout the world, more funding is required for early start-ups trying to enter the field. These early-stage companies are a vital part of the hydrogen ecosystem to live up to its expectation. The market needs companies that can produce hydrogen, manufacture cars (Toyota), trucks (Nikola Motors), buses (Hyzon Motors), and planes (ZeroAvia); create countrywide networks to transport it (TrueZero); produce hydrogen-powered grids for cities, and invent hydrogen-powered heating systems.

As the war in Ukraine has affected global trade and sanctions have been imposed on Russia, countries will be facing shortages of numerous products such as wheat and nickel. This will encourage governments to seek alternative ways to substitute the lost supplies in another way. Countries like the UK and the US have even gone as far as banning the import of Russian oil. It is extremely hard for most countries to stop importing Russian fossil fuels, however, the unnecessary war will incentivise a large number of people to move away from Russian goods, bringing more venture capital firms, governments, and organisations to find alternative ways which can replace their country’s dependency on Russia. Additionally, Russia is threatening to ban the export of oil to major Western economies which brings even bigger implications for countries seeking a smooth transition from Russian reliance.

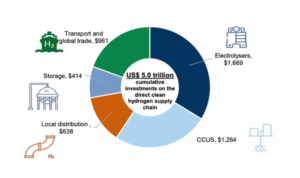

Hydrogen Technology Ventures is an investment firm focusing on venture capital, growth equity, private equity, and project finance that has been working on providing capital to companies and promoting net-zero infrastructure. Currently, there are not that many Venture Capital funds that are focusing on the same issues and heavily investing in hydrogen startups. Most investments are coming from governments and other large organisations such as Ardian, a world-leading private investment and asset management firm. Another firm that has been involved in supporting hydrogen seed companies is Amazon which has invested a significant amount into Infinium, a company specialising in developing Electrofuels (e-fuel) to replace current fossil fuels. Goldman Sachs is expecting that investments of around $5 trillion are needed in the hydrogen economy for the world to become net zero.

Source: Goldman Sachs

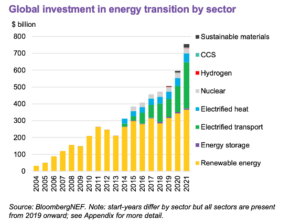

Today, this seems extremely implausible as there is simply not enough funding going into the hydrogen economy. As can be seen from the Bloomberg report, the investment in Hydrogen amounts to a very small percentage of the overall energy investment in the world.

Source: Bloomberg NEF

The war in Ukraine has caused a large deficit in energy for most countries, in turn encouraging more VC firms to start seeing hydrogen startups as an extremely profitable investment due to countries’ dependency on alternative ways to sustain their economy for the long run. In the short term, governments might turn to other countries with available resources, however, more will start paying even closer attention to the future of energy. Not to be mistaken, funding to Hydrogen startups has been higher in the last 5 years as compared to the past, however, the war might just be the final push the world has needed to transition to more sustainable energy with net-zero emissions.

I have recently started a blog, the information you offer on this website has helped me greatly. Thanks for all of your time & work.