By Spencer Leflon, Research Analyst at King’s Private Equity Club

- Published as part of our ‘Deep Dive’ Section, promoting in-depth pieces which analyse underrepresented issues and challenge conventional narratives.

As telecommunications companies (telcos) are mature businesses, they have trouble generating revenue growth. But with the onset of the pandemic, the need for faster broadband speeds and increased connectivity in rural areas has given telcos an opportunity to find renewed growth. New growth avenues such as 5G and OpenRAN, which are being adopted faster than expected, rely heavily on infrastructure. However, the large capital investments needed to fund connectivity infrastructures, such as cell towers and fiber networks, have sparked a wave of skepticism in public markets. Hence, we will be exploring the growing interest private equity firms and telecommunications companies are developing for each other.

In fact, due to lower free cash flow and doubts on the actual returns of these investments, telcos have experienced dull valuations.

This has been reflected by some companies deciding to go private with the feeling of being undervalued by the market. For example, Xavier Niel, the founder of Iliad, one of the biggest mobile operators in France, issued a share buyback this summer to take his company private. Furthermore, the private media company, Altice, acquired SFR the second-largest French operator in 2014. Altice also bought a 12% stake in BT in June 2021 and increased its stake to 18% in December 2021, making it BT’s main shareholder. The acquisitions in BT by Altice are surrounded by speculation of Patrick Drahi’s (Altice’s owner) interest in spinning off OpenReach, BT’s fiber network. More recently, KKR issued a $38B bid for Telecom Italia, which if successful would have been the biggest buyout in European history. The bid was rejected; however, demonstrating the attraction private equity firms have to telcos.

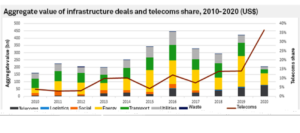

According to Prequin data, shown in the chart above, telecoms’ share of private equity infrastructure deals has jumped almost 23% with the onset of the pandemic. This provides an insight into the growth of data usage and the need for improved infrastructure surrounding connectivity. But it also demonstrates the opportunities for PE firms that lie in telcos’ infrastructure deals.

Opportunities in Infrastructure

As telcos are looking to attract more investors and generate more cash flow to relieve their high leverage, some are starting to sell their infrastructure businesses such as their fiber networks (Fibercos) or their cell towers (Towercos). As can be reflected by the discrepancy in EV/EBITDA multiples between telcos and infrastructure, divesting infrastructure from the telcos’ balance sheets is a way of unlocking value by reducing debt and reaping the benefits of high multiple infrastructure sales. In fact, according to UniCredit 2022 estimates, Telecom Italia and Telefonica which are two major European telcos are trading respectively at 5.5X and 5.6X EV/EBITDA versus INWIT and Cellnex which are two major European Towercos trading at 16.5X and 15X EV/EBITDA respectively. This demonstrates that by selling infrastructure, telcos can unlock cash inflows to finance the high CAPEX they are undertaking and therefore improve their share price. This also opens the door for PE firms to take over.

With the rise of 5G and the increasing demand for broadband, Fibercos and Towercos are essential to provide connectivity. These assets capture the revenue brought by accelerating demand. For PE firms this is a golden opportunity as these assets are cash generative and passive investments, guaranteeing steady inflows of cash in the long term without having to make many changes to the current strategy. This allows PE firms to follow a “buy and build” strategy where they make add-on acquisitions by investing in more and more towers to consolidate market share.

With Towercos trading at all-time high multiples, it can be more attractive for PE firms to partner with mobile network operators (MNOs) as some telcos seek to share their infrastructure investments and keep partial control. This allows telcos and PE firms to share the costs of investing in towers and cash flow generation.

Exit Opportunities

Acquiring telecommunications infrastructure offers lucrative exit opportunities for PE firms. With a record number of infrastructure acquisitions, PE firms can sell their Towerco assets to other Towercos seeking to consolidate market share. As previously discussed, Towercos are trading at record multiples, making the sale of tower assets an opportunity to make higher money multiples. For instance, Telefonica which is one of the biggest Spanish telecom operators sold its tower business Telxius to American Tower Corporation in 2021. The transaction was worth €7.7B for an estimated 30.5X EV/EBITDA multiple. The deal included the sale of 30,722 cell towers. Telxius was backed by KKR and reduced Telefonica’s debt by €4.6B, demonstrating the benefits infrastructure deals can have for both telcos and PE firms.

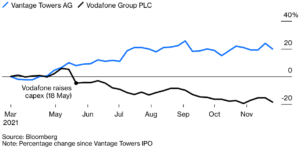

PE firms can also exit their infrastructure investments through an IPO such as when MNOs spin off their Towercos publicly. For example, Vodafone spun off their Towercos business called Vantage Towers in a successful IPO, as can be seen in the graph below.

Conclusion

Telecommunications companies and PE firms, therefore, have reasons to work together. It is attractive for telcos to get rid, at least partially, of their highly leveraged infrastructure investments to improve their balance sheets. It is also attractive for PE firms to acquire infrastructure assets such as Towercos due to their passive nature and the cash they generate. They also happen to currently be trading at very high multiples and offer smooth exit opportunities.

References

- 2022. [online] Available at: <https://www.nb.com/en/global/nb-blog> [Accessed 1 March 2022].

- 2022. [online] Available at: <https://www.pwc.com/us/en/industries/tmt/library/telecom-media-deals-insights.html> [Accessed 1 March 2022].

- 2022. [online] Available at: <https://www.research.unicredit.eu/DocsKey/emergingmarkets_docs_2021_180566.ashx?EXT=pdf&KEY=l6KjPzSYBBGzROuioxedUNdVqq1wFeRoSIN084bMP6FuoAhlg8moqA==&T=1> [Accessed 1 March 2022].

- 2022. [online] Available at: <https://www.ey.com/en_gl/strategy/how-the-tower-sector-is-contributing-to-the-european-economy> [Accessed 1 March 2022].

- Fitchratings.com. 2022. [online] Available at: <https://www.fitchratings.com/research/corporate-finance/capex-in-fibre-5g-limits-european-telecoms-free-cash-flow-27-01-2022> [Accessed 1 March 2022].

- Advisory.kpmg.us. 2022. Another hot quarter for tech, media, and telecom (TMT) deals. [online] Available at: <https://advisory.kpmg.us/articles/2021/tmt-deal-making-q3-21.html> [Accessed 1 March 2022].

- Bloomberg.com. 2022. Bloomberg – Are you a robot?. [online] Available at: <https://www.bloomberg.com/opinion/articles/2021-12-01/european-investors-are-inviting-a-private-equity-raid-on-their-telecoms> [Accessed 1 March 2022].

- Calatayud, A., 2022. European telecom towers become hot assets amid rollout of 5G. [online] Penews.com. Available at: <https://www.penews.com/articles/european-telecom-towers-become-hot-assets-amid-rollout-of-5g-20210125> [Accessed 1 March 2022].

- M&A Explorer. 2022. Global private equity delivers groundbreaking 2021. [online] Available at: <https://mergers.whitecase.com/highlights/global-private-equity-delivers-groundbreaking-2021> [Accessed 1 March 2022].

- Capgemini Worldwide. 2022. It’s time for TowerCos to think big. [online] Available at: <https://www.capgemini.com/2021/12/its-time-for-towercos-to-think-big/> [Accessed 1 March 2022].

- Koschmieder, C., 2022. Private equity has its sights set on telecom infrastructure investment – Talent [R]evolution. [online] Talent [R]evolution. Available at: <https://blog.outvise.com/private-equity-has-its-sights-set-on-telecom-infrastructure-investment/> [Accessed 1 March 2022].

- Spglobal.com. 2022. Long-term demand for communication tools pulls PE capital into sector. [online] Available at: <https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/long-term-demand-for-communication-tools-pulls-pe-capital-into-sector-62785434> [Accessed 1 March 2022].

- Spglobal.com. 2022. Private equity TMT activity making comeback in Europe. [online] Available at: <https://www.spglobal.com/marketintelligence/en/news-insights/blog/private-equity-tmt-activity-making-comeback-in-europe> [Accessed 1 March 2022].

- Es.kearney.com. 2022. Read @Kearney: Telecom assets: unlocking the trillion-dollar treasure chest. [online] Available at: <https://www.es.kearney.com/communications-media-technology/article/?/a/telecom-assets-unlocking-the-trillion-dollar-treasure-che-1> [Accessed 1 March 2022].

- Kearney.com. 2022. Read @Kearney: The rise of the tower business. [online] Available at: <https://www.kearney.com/communications-media-technology/article?/a/the-rise-of-the-tower-business> [Accessed 1 March 2022].

- room, C. and room, P., 2022. Telefonica sells Telxius tower division to American Towers Corporation at record multiples for 7.7 billion euros – Telefónica. [online] Telefónica. Available at: <https://www.telefonica.com/en/communication-room/telefonica-sells-telxius-tower-division-to-american-towers-corporation-at-record-multiples-for-7-7-billion-euros/> [Accessed 1 March 2022].

- BCG Global. 2022. Tower Companies Explore New Avenues for Growth. [online] Available at: <https://www.bcg.com/publications/2022/towercos-explore-new-avenues-for-growth> [Accessed 1 March 2022]