By Yunfei Gao, Research Analyst at King’s Private Equity Club

2021 was a breakout year for environmental, social and governance issues (ESG). The 26th United Nations Climate Change Conference (COP26) concretised the goals of the Paris Agreement, and the signatory countries will inevitably legalise their respective commitments in their own countries or integrate them into the government’s work program. Hence, this article will discuss how ESG investment developed to the level today and its current pressing challenges.

With the United Nations initiative to incorporate ESG issues into investment analysis and decision-making processes, more and more investment institutions are examining enterprises’ medium- and long-term development potential through the ESG dimension and seek opportunities that can create economic and social value opportunities and have sustainable growth investment targets.

ESG investment incorporates factors such as a company’s impact on the environment, fulfilment of social responsibilities, and corporate governance structure into its investment analysis, aiming to obtain sustainable long-term investment returns.

Specifically, the assessment dimensions of ESG investment philosophy:

From an environmental perspective, it mainly evaluates the green investment in the production and operation activities of the enterprise. For example, the recycling and sustainable utilisation of natural resources and energy, the disposal of hazardous wastes, and whether the government’s environmental supervision requirements are effectively implemented.

From the social perspective, it examines the expectations and demands of the enterprise, the government, employees, customers, creditors, and relevant stakeholders inside and outside the community, and pays attention to whether the enterprise’s stakeholders can achieve balance and coordination.

The corporate governance perspective includes board structure, shareholding structure, management compensation, and business ethics. It concerns dimensions such as the interests and responsibilities of shareholders and management, avoiding corruption and financial fraud, improving transparency, independence of board composition, professionalism, etc.

Conducting ESG investment requires extensive scrutiny of companies. Various indicators are used to determine the value of enterprises by examining the interaction between companies and the environment, society, and internal enterprises.

Throughout the development history of ESG investment, its prototype can be traced back to the “ethical investment”. This strategy was pursued by investors in churches at the end of the 19th century. At that time, investors were required to refuse to invest in alcohol, tobacco, gambling, arms, and other fields.

In the 1970s, ethical investment began to expand, and responsible investment gradually emerged. Typical cases include investors’ boycott of investments related to the Vietnam War and the Apartheid in South Africa. In fact, the world’s first responsible investment fund, the Pax World Fund, emerged in 1971. As the fund did not invest in Vietnam War-related businesses and emphasised labour rights issues, it provided investment options for investors opposed to war and weapons manufacturing.

Since the 1990s, with the rapid increase in population and the acceleration of industrialisation, severe environmental pollution, resource scarcity, climate change, and other problems have materialised. As ESG investing is starting to be mentioned more and more , words such as “sustainable development” and “green finance” have begun to enter people’s daily lives.

Source: Deloitte analysis

In recent years, ESG investment has shown an exponential growth trend. The asset under management in ESG-geared funds was $590 billion in 2015, which rose to more than $1 trillion in 2020. According to a Deloitte report, investments on sustainable energy, industrials, and mobility consist of the main sectors of ESG investments, areas that show great potential for M&A opportunities for valuable targets.

A “demining” tool

Despite the rapid rise of ESG investing in the world, controversies surrounding these topics have never ceased. Those who oppose ESG investment, namely Warren Buffett, believe that social and environmental responsibilities should not be imposed on companies and investors. They argue that the essence of a business is to maximise profits for shareholders. In an interview with the Financial Times, Buffett said that the company’s money belongs to shareholders, and maximising shareholder value is the single highest responsibility of company managers. Therefore, suggesting that investors’ cash should not be used for social good.

In addition, the inability of sustainable investments to make money for L.P.s in the short term is also a core argument against ESG investing. In this regard, however, research data has shown a positive relationship between ESG investment and long-term investment returns.

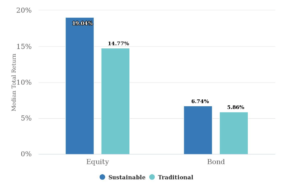

For investors, practicing ESG investment, it is helpful to tap high-quality companies with sustainable development potential and economic and social value from a non-financial perspective to obtain long-term investment returns. The Morgan Stanley Institute for Sustainable Investing found that in 2020, the median total return of U.S. sustainable equity funds surpassed traditional peer funds by 4.3%. The median total return for U.S. sustainable bond funds outperformed traditional peer funds by 0.9%.

Source: Morgan Stanley analysis

Audrey Choi, CEO of the Morgan Stanley Institute for Sustainable Investing, said sustainable funds’ strong risk and return performance during an unusually volatile year further dispels the persistent misconception that sustainable investing requires sacrificing performance.

According to United Nations Principles of Responsible Investments (UNPRI) report data, ESG investment has the effect of long-term efficiency enhancement and risk mitigation. After institutional investors incorporate ESG assessment into their investment decisions, they can significantly improve the risk control capability of their investment portfolios, reduce portfolio volatility, and improve their long-term profitability.

ESG is becoming an important “demining” tool in investment as it allows to identify the quality of a company from multiple dimensions. ESG can also help investors discover potential risks in the investment process and discover better opportunities. At the same time, it can also conduct value assessment and investment analysis of the invested companies more accurately and ultimately bring about relatively stable investment performance.

The challenges of ESG development

There are both opportunities and challenges for private equity fund managers to integrate ESG investments. The following is the sharing of three overseas ESG investment experiences.

ESG grey areas

It has been pointed out that private equity managers are lagging behind secondary market fund companies when adopting ESG criteria in their strategies. Private equity is lagging not because of less transparency; rather, it is because PE fund managers tend to invest in smaller companies and therefore lack the resources to integrate ESG standards into their operations. However, the industry is moving towards greater ESG integration.

Investors might dig deep and make their judgments on individual issues. ESG may be an effective way to characterise, but it is not so black and white. According to an investment manager at a German church pension fund, his suggestion of investing in companies dealing with weapons or fracking issues, was quickly rejected under ESG standards. But he believes that such a project requires a more in-depth discussion, which he sees as having ESG value. Indeed, some funds are able to invest in gun manufacturers as they focus on the sustainability integration. These funds target companies showing elements of sustainable work.

Stronger governance features

According to Mark Hedges, Chief Investment Officer at Nationwide Pension Fund in the U.K., following the adoption of a new responsible investment policy, it is inevitable that investors and private equity managers will discuss ESG. ESG is now also a key element on due diligence questionnaires.

It is believed that private equity managers may not be vocal enough about their ESG work, while secondary market fund managers promote green investments offerings significantly more strongly. Private equity managers are aware of trends in the industry and are ready to listen to investors. Their focus is on what can be done to impact their investment business directly and still achieve their target returns.

The revolution has not yet succeeded

Private equity managers have much work to do to integrate ESG standards. Significant gaps remain between concerns about individual ESG issues, and the actions being taken to address them. Part of the reason is that in the private sector there are fewer regulatory requirements for reporting than public companies. However, the very nature of private equity is to focus on smaller, resource-poor businesses and allow them to grow. Therefore, in a sense, this is an industry that is a natural fit for the convergence of ESG standards, as it can be classified as a long-term investment approach to enhance business value.

Source: PwC analysis

Many managers have signed up to UN PRIs and have implemented ESG policies in recent years. According to a research report, about 40% of the Italian pension’s total assets are invested in ESG-compliant strategies or assets. For the remaining 60%, however, this is not the case. In fact, not all private equity firms are ready to tackle the ESG section of the due diligence questionnaire.

Conclusion

Whether it is the society’s awareness of protecting the environment or the desire for capital to cater to the market, ESG has indeed achieved a new level in recent years. How private market participants can discover the value of integrating ESG and form experienced, and institutionalised management will become the decisive factor for the ensuing development of the industry. Private equity firms putting ESG at the heart of their strategy will be the game changer in the new sustainable world. On this road, success may be closer and faster than we think.

References

https://www.pwc.com/gx/en/private-equity/private-equity-survey/pwc-pe-survey-2021.pdf

https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/mergers-acquisitions/sea-m- a-unlocking-transformative-m-and-a-value-with-esg-report.pdf

https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/private-equity/private-equity- pdfs/ey-putting-esg-at-the-heart-of-existing-portfolios.pdf?download

https://www.unpri.org/download?ac=10795 https://www.morganstanley.com/articles/case-for-sustainable-investing