![]()

![]()

By Zahraa Ayob, Analyst at King’s Private Equity Club

- Published as part of our ‘Deep Dive’ Section, promoting in-depth pieces which analyse underrepresented issues and challenge conventional narratives.

As the Coronavirus surfaced, spreading worldwide disruption to the financial sector, there were concerns not only regarding publicly traded equities, but private equity as well. This article will be comparing private equity returns to public markets from the commencement of Covid to the present moment, taking into consideration the introduction of various monetary policies alongside market disruptions, such as announcements of new strains of the virus. The timeline begins pre-Covid, followed by the overall crash in March 2020, whereby both private and public equity saw an overall decrease in returns, levelling out the playing field. However, it seems private equity continues to outperform public equity, despite the outperformance gap being narrowed owing to the constant supply of monetary and fiscal stimulus.

Pre-Covid

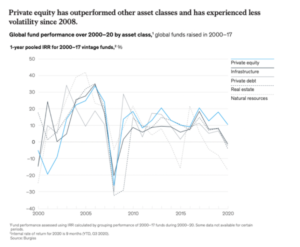

The pre-covid economic climate enabled a significant outperformance of private equity in comparison to public. During the decade prior to 2020, more than $2 trillion (1) had been invested into buyout funds, as they had always delivered the highest return. A buyout takes place when a buyer acquires more than 50% of a company. Investors buy underperforming or undervalued public companies in hopes of taking them private, reinstating a healthy financial position and consequently taking it public again through an initial public offering (IPO). The charts below demonstrate the outperformance regarding the internal rate of return (IRR) of private equity within the United States and Europe in the past two decades. The IRR is a money-weighted performance metric reflecting the timing and size of the underlying cash flows (2). The charts show that, buyout funds have consistently outperformed stock markets such as the S&P 500 in the US and the FTSE 100 in Europe.

Chart 1: https://www.bain.com/insights/public-vs-private-markets-global-private-equity-report-2020/

As noted by the asset management firm BlackRock, the consistent outperformance of private equity is attributed to a “combination of operational improvements, active ownership, more direct corporate governance, better alignment of interests and longer investment horizons” (3). Private equity has been the more attractive investment in recent years, as the investment focus has shifted to technology companies, combined with higher levels of financial leverage (4). The increased level of leverage has caused many banks to shy away, resulting in investments routing from the shadow banking system of unregulated credit funds. In many cases, the private equity firm will set this up themselves. Therefore, private equity funds have found ways to ensure consistent returns, enabling the outperformance of public equity.

March 2020: Coronavirus

As the news began to spread in March 2020, resulting in global shutdowns, all financial markets had been disrupted owing to the uncertainty and fear associated with the virus.

Within the private equity sector, fundraising had experienced a massive decline, thus affecting buyouts and growth equity. Mckinsey & Company reported in their global private markets review of 2021 that worldwide buyouts, which made up half of the fundraising, were experiencing a 28% year-on-year decline (5). Volatility was not limited to fundraising, as deal activity had also seen a decline, however both rebounded within the second half of the year. Similarly, stock markets had crashed. The Dow Jones fell nearly 3000 points, the largest drop in US history (6), along with the FTSE 100 dropping 10.9% (7). Investors had been overwhelmed by fear, therefore closing all positions, and seeking safe havens.

Chart 2: https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20private%20markets%20annual%20review/2 021/mckinsey-global-private-markets-review-2021-v3.pdf

Whilst reviewing the 2008 financial crisis, market data had suggested that private equity backed companies had experienced higher market share along with asset growth with minimal investment cuts (8). The chart below demonstrates the improvements within the private equity industry following 2008 compared to other asset classes. During economic distress, private companies tend to be more resilient, as they have greater access to external funding in financial downturns, however, government intervention alters the economic landscape.

Present-day: Impact of Government Intervention

Governments’ response to the pandemic consisted of expansionary economic policy to rehabilitate the economy. As markets reaped the benefits of the abundance of monetary and fiscal stimulus provided, the outperformance gap of private equity had narrowed.

The market environment in recent years has been more prepared, in comparison to 2008, as recognised in the chart previously mentioned. This is due to the capital structures consisting of higher equity and lower cost of debt, thus reducing risks. Many private equity funds have shifted their portfolio companies to fewer cyclical markets (9), therefore ensuring less sensitivity during periods of economic downturn and contraction. As a result, during periods of contraction, private equity backed companies could improve their market position, operations and embrace new investments.

Fast-forward to the present, the past two years in the pandemic consisted of multiple lockdown policies, interest rate adjustments, low oil prices and thus multiple central-bank responses. Through the constant supply of fiscal and monetary stimulus, the government was able to cushion the financial losses and re-stimulate the economy by taking advantage of spending and taxing powers. Fiscal measures include paid sick leave, financial support for businesses and furloughed employee salaries. Monetary policy includes injecting capital (quantitative easing) into the financial sector, therefore increasing liquidity and policy rate cuts. Fiscal stimulus boosts aggregate demand and overall employment, resulting in more consumer spending and higher consumer sentiment (10). Overall expansionary economic policy leads to increased economic activity, therefore enabling increases within the stock market as well. In addition to this, the quantitative easing programme lowered the cost of borrowing and interest rates, thus providing consumers with more capital to be re-invested into the economy.

Therefore, the impact of government spending boosted the stock market. Adversely, private equity has faced challenges. Leveraged buyouts (LBO) are the most affected by quantitative easing (11), as it means there is an enhanced credit supply and more risk-taking. Private equity funds loosen credit constraints, enabling growth and productivity within the companies they are invested in. Therefore, in presence of favourable credit conditions, as presented by monetary stimulus, leads to increased competition within the private equity sector, pushing investors to over-leverage and over-pay. This explains the narrowing of the outperformance gap, as the public markets had benefitted from non-stop stimulus, and private equity acquisition multiples had risen.

Conclusion

In conclusion, private equity has continuously provided higher returns in the past decade because of improved operations, and the ability to stabilise within contractions in the industry cycle. The new economic climate presented by the pandemic led to significant declines within both markets. However, the introduction of fiscal and monetary stimulus boosted the public market, adversely affecting private equity in relation, explaining the narrowing of the outperformance gap. Overall, despite public equity closely matching private equity performance, the latter remains superior regarding returns in comparison to public equity, even in a state of economic downturn.