By Agrin Ayhan, Student at King’s College London

In recent years, the United States has witnessed a rapid transformation in its role within the global energy landscape. As America’s natural gas production continues to soar, the nation now stands on the cusp of becoming the world’s largest Liquefied Natural Gas (LNG) exporter. This shift has been driven by a series of large-scale projects, most notably Sempra’s $13 billion LNG project, Venture Global’s expansion of its Louisiana facility, and the Willow oil project in Alaska.

Sempra Energy, a California-based energy infrastructure company, has embarked on an ambitious project to build a massive LNG export facility in Port Arthur, Texas. The project is estimated to cost $13 billion and will feature three LNG trains, each capable of producing 6.8 million metric tons per annum (MTPA) of LNG. Once completed, the facility is expected to have a total capacity of around 20 MTPA, making it one of the largest LNG export terminals in the world.

Venture Global LNG, a U.S.-based LNG company, is in the process of expanding its Calcasieu Pass LNG export facility in Louisiana. The project’s second phase is expected to add 10 MTPA capacity to the existing 10 MTPA facility, effectively doubling its output. This expansion and Sempra’s Port Arthur project could catapult the United States to the top of the global LNG export leaderboard.

Ventrue Global also committed to a big expansion of its Plaquemines export facility, which is under construction on the US Gulf Coast. The facility is expected to cost around $21bn and can turn about 2.6bn cubic feet a day (2.5% of the country’s gas output) into 20mn tonnes a year of LNG exports.

Approval for Plaquemines expansion puts total US LNG exports to surpass 20bn cf/d, making the US the world’s largest LNG exporter by far.

Image Source: Wood Mackenzie

While not directly related to LNG production, the Willow oil project in Alaska is a significant development in the U.S. energy industry. Operated by ConocoPhillips, the project is set to tap into one of North America’s largest untapped oil reserves. It is estimated to hold over 500 million barrels of recoverable oil, potentially producing up to 180,000 barrels per day (1.5% of current US output). Although the Willow project is focused on oil production, it serves as a testament to the U.S.’s increasing dominance in the global energy landscape.

How it will affect LNG markets and prices

As the United States moves closer to becoming the world’s largest LNG exporter, a global LNG market dynamics shift is inevitable. This development could potentially lead to increased competition among LNG suppliers, ultimately benefiting the consumers with more competitive pricing. Furthermore, an increased supply from the U.S. could help alleviate regional gas shortages and contribute to the global energy transition by providing a cleaner alternative to coal and other fossil fuels. However, I have highlighted four ways in which this boost in LNG production may affect markets.

- Supply-Demand: As the U.S. increases its LNG export capacity, the global supply of LNG will rise. This additional supply could potentially exert downward pressure on prices as the market adjusts to accommodate the increased volume. However, this effect will depend on the global demand for natural gas. If the demand growth keeps pace with or outpaces the supply increase, prices may experience little downward pressure.

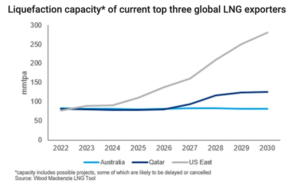

- Competition Among Suppliers: With the U.S. emerging as a dominant player in the LNG market, other major LNG suppliers, such as Qatar, Australia, and Russia, may face increased competition. This competition could lead to more aggressive pricing strategies by suppliers to secure long-term contracts and maintain market share. The heightened competition among suppliers would benefit consumers, who could enjoy lower prices as a result.

- Spot Market Pricing: As U.S. LNG exports increase, it could lead to greater liquidity and depth in the global spot market for LNG. A more liquid spot market allows for more efficient price discovery. It can contribute to narrowing the price differentials between various regional markets, such as those in Asia, Europe, and the Americas. Consequently, this could lead to more competitive and transparent pricing for consumers.

- Geopolitical Factors: The U.S. becoming the world’s largest LNG exporter may also have geopolitical implications that could indirectly impact LNG prices. For instance, Europe’s reliance on Russian gas supplies has historically given Russia significant influence over European gas prices. As the U.S. increases its LNG exports, European countries could diversify their gas supplies, reducing their dependence on Russian gas. This diversification may reduce the geopolitical premium associated with European gas prices, contributing to lower regional prices.

Agrin Ayhan

Agrin is a second-year mathematics undergraduate student at King’s College London, graduating in 2024. Along with being on the university fencing and swimming team, Agrin enjoys researching commodities and natural resources. In his spare time, Agrin likes collecting Soviet-era classical vinyls and perfecting his method of pouring a pint of Guinness.

I’m impressed, I must say. Really hardly ever do I encounter a weblog that’s each educative and entertaining, and let me inform you, you’ve gotten hit the nail on the head. Your idea is excellent; the difficulty is something that not enough people are talking intelligently about. I am very glad that I stumbled throughout this in my seek for something relating to this.

I really enjoy looking at on this site, it contains good content.

Pretty nice post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. After all I’ll be subscribing to your feed and I hope you write again very soon!

Hello There. I found your blog using msn. This is an extremely well written article. I’ll make sure to bookmark it and come back to read more of your useful information. Thanks for the post. I’ll definitely return.