Image Source: Business Today

By Mahimna Chourey, Student at the Central Foundation Boys School

On March 31, 2023, the United Kingdom successfully concluded negotiations to accede to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) as a strategic endeavor to leverage its newfound post-Brexit autonomy. However, the decision to join this esteemed trade bloc warrants a thorough analysis to determine its soundness and alignment with the UK’s broader economic and diplomatic objectives.

What is the CPTPP?

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) represents a cohesive union of select economies that are distinguished by their remarkable growth trajectories, positioning them as prominent drivers of economic expansion in the modern era. The group of eleven founding nations, namely Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam, already represents a significant 13% share of the global income and £110 billion of UK trade. With the inclusion of the United Kingdom, the collective economic value of this esteemed partnership is projected to reach a staggering £11 trillion, further solidifying its impact on the global economy.

The primary focus of the bloc centers around the reduction of tariffs, with member countries collectively committing to eliminate 98% of trade barriers on goods. Other important features of this agreement include tariff-free sourcing of various components for final products, such as automobiles, from member nations, enhancing trade facilitation and integration among the participating economies, and encouragement of fair trade.

Why has this move been described as a silver bullet?

- Balance of payment stability:

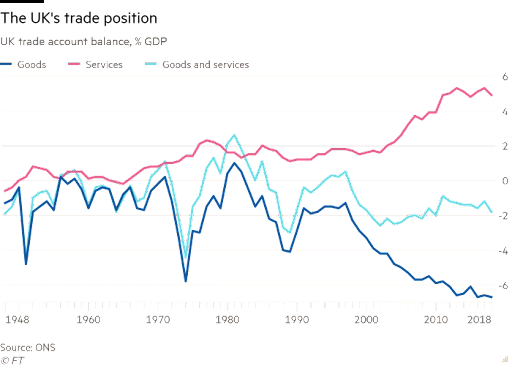

Since 1981, the United Kingdom has consistently registered a negative balance of trade in goods, which has been the main reason for the UK’s current account deficit. Statistically speaking, the overall trade deficit was £87 billion in 2022, and the trade in goods deficit widened by £1.4 billion to £64.1 billion in the three months to January 2023.

The CPTPP will benefit UK exporters and hence heal the ever-worsening wound in two main ways: removal of tariffs and diversification of supply chains. The agreement reduces tariffs on 95% of goods between its members and enables over 99% of UK exports to be eligible for tariff-free trade, thus aiding exports such as cars, machinery and dairy products. In addition, diversification of supply chains makes it feasible for UK firms to buy and use foreign raw materials, while provisions supporting digital and services trade makes it easier for UK tech firms to expand and cheaply supply digitized services. As a result, the anticipated increase in export revenue is expected to offset the current account deficit, contributing to sustained balance of payment stability for the UK.

- Low unemployment:

The total value of UK exports to countries in the CPTPP amounted to £60.5 billion in the four quarters ending Q3 2022, and this value will only increase after the UK joins the bloc. Drawing upon the fundamental economic principle of derived demand, the heightened production requirements for increased exports and the expansion of (tech) firms would necessitate an increased number of workers, thus increasing employment.

- Improved standard of living:

According to former UK Prime Minister Liz Truss, joining the CPTPP would “deliver quality jobs and greater prosperity for people here at home”. With the ongoing cost of living crisis in the UK, living standards in Britain are expected to fall at the fastest annual rate since the mid-1950s, but increased average incomes and access to high-quality imported goods can reverse this change. Better choice, quality, and affordability of goods and services paired with increased employment can help increase living standards in the UK along with reducing the strain of cost-push inflationary pressure.

- Economic Growth:

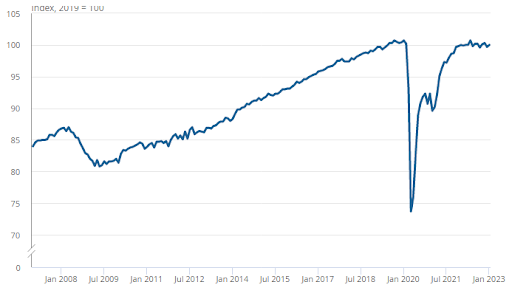

Source: ONS

The economic growth trajectory of the UK has encountered stagnation over the course of the past year, with a marginal 0.1% expansion in Gross Domestic Product (GDP) during the fourth quarter of 2022, narrowly averting a potential recession. Enhanced export revenue, business expansion, rising average incomes and affordability, as well as heightened foreign direct investment, collectively contribute to the growth of the UK’s GDP.

The subdued economic growth of the British economy in recent times can be attributed to the deferred impact of inadequate investment practices and cost-push inflation from the pre-Brexit era. Therefore, cheaper import prices and increased foreign direct investment (FDI) has the potential to yield significant benefits, particularly if it leads to enhanced investment in capital technology and a reduction in short-term focus. In 2021 alone, the United Kingdom received £182 billion in investments from CPTPP countries, representing a significant share of at least 9% of the total inward investment. With the expectation of further growth in this investment, it is reasonable to anticipate a favorable impact on the long-term economic growth of the UK.

What is the catch?

Emily Thornberry, a prominent dissenting voice and former international trade secretary, expressed her concern about the British government’s decision to “rush into joining another one (trade bloc) on the other side of the world without any meaningful public consultation at all”. Although the deal was ultimately approved, Emily Thornberry was not the sole notable figure to express disagreement with this decision, and understandably so.

To begin with, there is a considerable degree of uncertainty regarding the potential increase in UK export revenue, as the country already maintains bilateral trade agreements with nine out of the eleven member nations of the CPTPP, which is why the UK government’s own projections indicate that the anticipated contribution of joining the CPTPP to the size of the UK’s economy over the next decade is estimated to be merely 0.08%. Furthermore, the UK presently enjoys low or zero-tariff trade with most CPTPP members, which means that for the majority of goods, there will likely be no tariff changes resulting from its accession to the trade area.

Additionally, the potential for increased beef imports from countries such as Australia and New Zealand as a result of the CPTPP raises concerns about the adverse impacts on UK farmers, as it places them at a competitive disadvantage. This is especially worrisome considering the significant contribution of the beef supply chain, which amounts to approximately £2.8 billion to the UK economy, and the negative impact this could have. Another reason for concern among UK farmers is over the reported willingness of the government to grant free access to agricultural products that may not meet the same rigorous standards, as part of a recently negotiated trade agreement with Australia (the negotiations themselves entail substantial costs as well).

Last but not least, the incorporation of investor-state dispute settlement (ISDS) provisions in the CPTPP presents a significant hurdle for the government, by granting foreign investors the authority to initiate legal proceedings in response to policies that are perceived to have negative effects on their investments, thus impeding the UK’s ability to implement protectionist measures.

Mahimna Chourey

Mahimna is a young economics enthusiast, displaying a profound passion for blogging and social service. He has developed a keen interest in the intricacies of macroeconomics and developmental economics, and envisions pursuing a major in economics at the university level. His primary objective is to disseminate the knowledge of economics across the globe and champion the significance and applicability of this subject in mitigating the global financial divide.

I like this web site very much so much fantastic info .

I am incessantly thought about this, thankyou for posting.