![]() By Tamanveer Ahuja, Student at University of Exeter

By Tamanveer Ahuja, Student at University of Exeter

Overview of the Housing Market in China

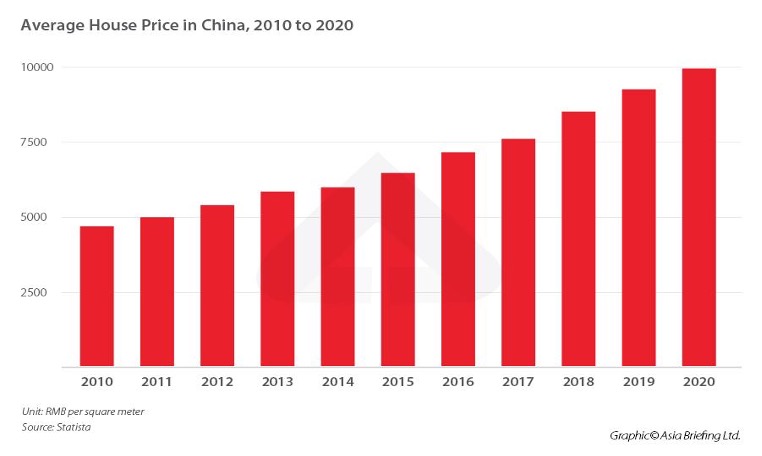

China, the second largest economy in the world, has seen significant urbanization in recent decades. The country’s population living in urban areas has increased from 20% in 1980 to nearly 65% in 2022. This resulted in an increased demand for housing in the cities, hence increasing the housing prices. According to a report by Economic Times, the real estate sector accounts for nearly 30 per cent of the total gross domestic product (GDP) and 30-40 per cent of total bank loans. Almost 70 per cent of the household wealth in China is stored in property. Thus, the real estate sector is among the most crucial sectors of the Chinese economy.

China’s economic growth has begun to slow down. In accordance with its “Zero Covid” policy, the government has implemented various lockdowns in important economic hubs like Shanghai and Wuhan as Covid-19 cases have been on the rise. Demand and production have decreased because of this. With a growth of just 0.4%, China narrowly avoided a contraction in the second quarter. The real estate crisis is one of the biggest issues that China is currently facing. Large real estate developers like Evergrande are defaulting on their debt obligation, which is causing prices and housing demand to fall.

Ponzi Scheme used by Property Developers in China

Property developers were using pre-sale property deposits to build property, they did not have cash of their own. As they persisted in doing so, a Ponzi scheme was born. Chinese housing buyers paid 30 per cent deposits and took out mortgages for the houses that were yet to be constructed. Although this might sound strange, this is quite normal in China as the housing prices were skyrocketing and everyone wanted a piece of the action. When the large property developers were unable to deliver the houses on time it became difficult to attract new investors. Older investors demanded their money back as a result, which led to the collapse of the housing market. In 2021, the Evergrande Group, the country’s biggest real estate developer, announced that it would default on its debt obligations. It had outstanding loans worth $300 billion.

Chinese government restriction on Leverage

The reason behind the property developers defaulting on their debt obligations and failing to deliver the houses in time was that they were not getting over-leveraged because of the ‘three red lines’ policy implemented in 2020 by the CCP (Chinese Communist Party). According to the “three red lines” policy, a business could not obtain additional bank loans if its debt-to-asset ratio was 70% or higher. The companies are required to uphold a 100% cap on net debt to equity. Additionally, businesses need to have enough cash on hand to pay off debt and short-term borrowing.

Nearly half of China’s leading developers crossed against Beijing’s “red lines.” Due to the sector-wide crisis in finding new funding and the maturation of outstanding debt, the stagnation of China’s real estate projects was prolonged by the “zero covid” and “three red lines” policies.

The Japan Times reports that the whole thing started with a 590-word letter written by irate buyers of the half-built Dynasty Mansion Project in Jingdezhen, Jiangxi province, whose pleas for China Evergrande Group to finish the homes they had long been paying for had fallen on deaf ears. If construction doesn’t start up again before October 20, “all homebuyers with outstanding mortgage loans will stop paying,” they threatened.

Possibility of a Banking Crisis

It is feared that this freeze in the real-estate sector could spread throughout the banking sector and cripple the Chinese economy.

The fact that suppliers are not paying developers, banks are already not getting paid by developers, and finally, Chinese citizens are refusing to pay developers with their mortgages has left Chinese banks with little cash on hand. Earlier this year, nearly four hundred thousand customers’ deposits have already been frozen by five Chinese banks, which has caused great distress among Chinese citizens.

CCP understands the need for a $148 billion bailout fund for real estate projects and has already established one. New loans will be given to the heavily indebted real estate sector to finish unfinished apartments owed to angry homebuyers. CNBC reports that according to the Chinese Banking and Insurance Regulatory Commission (CBIRC), banks should, whenever possible, provide developers with the financing they require. By enabling the swift restart of aborted real estate construction and early delivery of homes to buyers, the regulators hoped to stabilise the housing market.

The question that arises is will the government intervention and their actions be enough or if the damage has already been done?

[…] The Chinese housing market has already cratered, leaving many citizens completely dependent on the g… […]

Some really wonderful posts on this internet site, thanks for contribution. “I finally know what distinguishes man from other beasts financial worries. – Journals” by Jules Renard.

Thank you for your kind words! I’m glad you found the article interesting. Indeed, financial concerns are a unique aspect that sets humans apart. Jules Renard’s quote beautifully captures this essence.

You can follow the aftermath of the collapse of Evergrande in this article: https://edition.cnn.com/2023/03/23/investing/china-evergrande-debt-restructuring-deal-intl-hnk/index.html

If you have any further thoughts or insights on the topic, feel free to share. Your contribution to the discussion is greatly appreciated!

Thank you for another fantastic post. The place else may anyone get that kind of information in such a perfect method of writing? I have a presentation subsequent week, and I am at the look for such info.

Thank you for your feedback. When it comes to staying informed about financial matters, I personally rely on reputable sources such as Financial Times and insightful individuals on LinkedIn who provide detailed analysis on the latest news. I would like to recommend Eddie Donmez as a reliable source for financial news. If you have any further questions or if there’s anything else I can assist you with, please feel free to let me know.

You made some nice points there. I did a search on the matter and found nearly all people will agree with your blog.

Thank you for your feedback.

F*ckin’ amazing things here. I am very happy to see your article. Thank you a lot and i am looking forward to contact you. Will you please drop me a e-mail?

Hey, you can reach me at tamanahuja19@gmail.com.

This really answered my problem, thank you!

I’m glad to hear that it was helpful. Please feel free to read through other articles and let me know if there is a particular topic you would like me to write about.

Whats Happening i’m new to this, I stumbled upon this I have discovered It positively helpful and it has helped me out loads. I’m hoping to contribute & help different customers like its helped me. Great job.

I’m glad you found the article helpful. If you’re interested in understanding the aftermath, I suggest reading this article:https://edition.cnn.com/2023/03/23/investing/china-evergrande-debt-restructuring-deal-intl-hnk/index.html

If you have any further thoughts or insights on the topic, feel free to share. Your contribution to the discussion is greatly appreciated!

Enjoyed reading through this, very good stuff, regards.

I have been surfing online more than 3 hours today, but I by no means discovered any interesting article like yours. It is beautiful worth sufficient for me. Personally, if all site owners and bloggers made just right content as you probably did, the net will be much more helpful than ever before.

Only wanna remark on few general things, The website layout is perfect, the content material is real wonderful : D.

Hi my loved one! I wish to say that this article is amazing, nice written and come with almost all significant infos. I would like to see extra posts like this.

I’m still learning from you, as I’m improving myself. I definitely enjoy reading all that is posted on your blog.Keep the tips coming. I loved it!

Heya i am for the first time here. I found this board and I find It really useful & it helped me out a lot. I hope to give something back and help others like you helped me.

Appreciating the hard work you put into your website and in depth information you provide. It’s awesome to come across a blog every once in a while that isn’t the same unwanted rehashed material. Great read! I’ve saved your site and I’m including your RSS feeds to my Google account.

I’ve recently started a site, the information you offer on this site has helped me greatly. Thanks for all of your time & work.

Thank you for sharing with us, I believe this website truly stands out : D.