By Tamanveer Ahuja, Student at University of Exeter

Introduction:

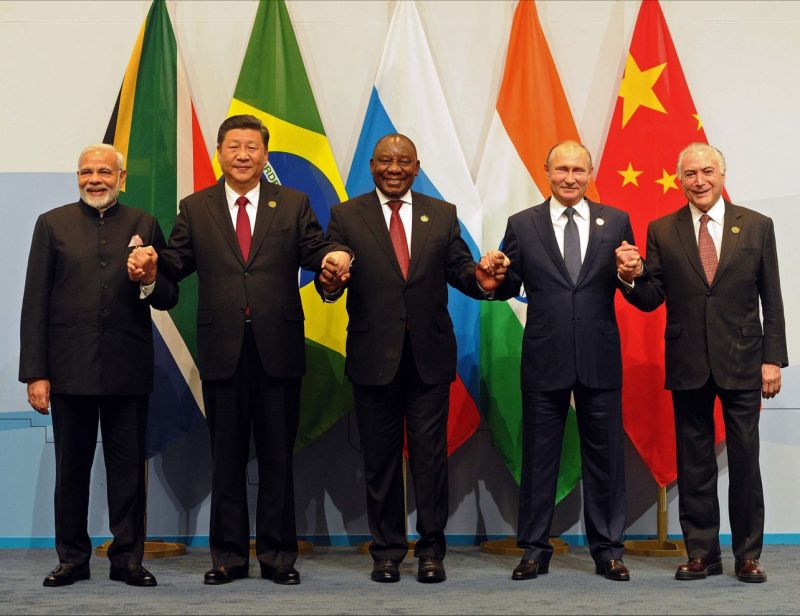

In a surprising turn of events, recent reports have indicated that the BRICS countries, namely Brazil, Russia, India, China, and South Africa, are considering the introduction of a gold-backed currency at their upcoming summit in August. This potential decision holds profound implications for the global economy, as it has the potential to disrupt the existing petrodollar system and challenge the US dollar’s status as the world reserve currency. With the BRICS member states representing a significant portion of the world’s population and GDP, it is imperative to delve into the potential consequences of this shift and its impact on the international monetary order.

The Petrodollar System and the US Dollar’s Reserve Currency Status:

To fully comprehend the significance of the BRICS countries’ reported plans, it is essential to first understand the petrodollar system and the role of the US dollar as the global reserve currency. Following the collapse of the Bretton Woods system in 1971, the US dollar replaced gold as the foundation of the global monetary system. This transition enabled countries to receive dollars for their oil exports, benefiting the United States as these dollars were reinvested in the US financial markets, bolstering liquidity and maintaining low-interest rates.

The Importance of BRICS Countries:

The BRICS countries collectively possess a substantial share of the global population and account for approximately 25% of the global GDP based on purchasing power parity. With their economies continuing to grow, any potential shift away from the US dollar by these nations could have significant repercussions on the global financial landscape.

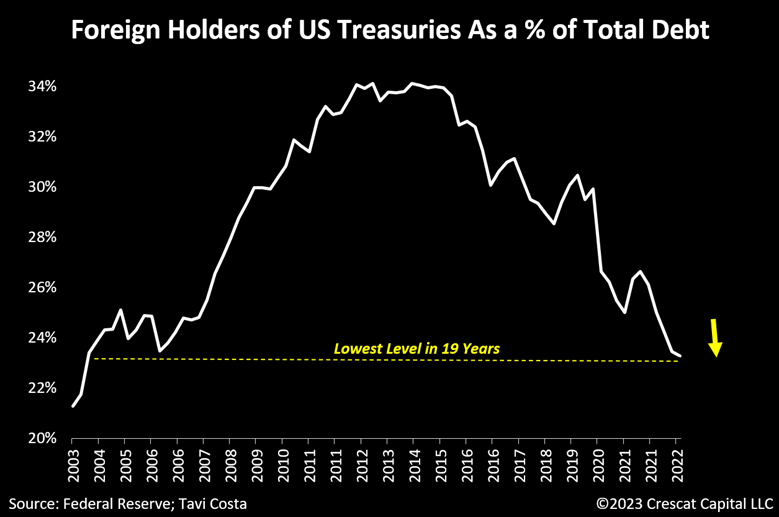

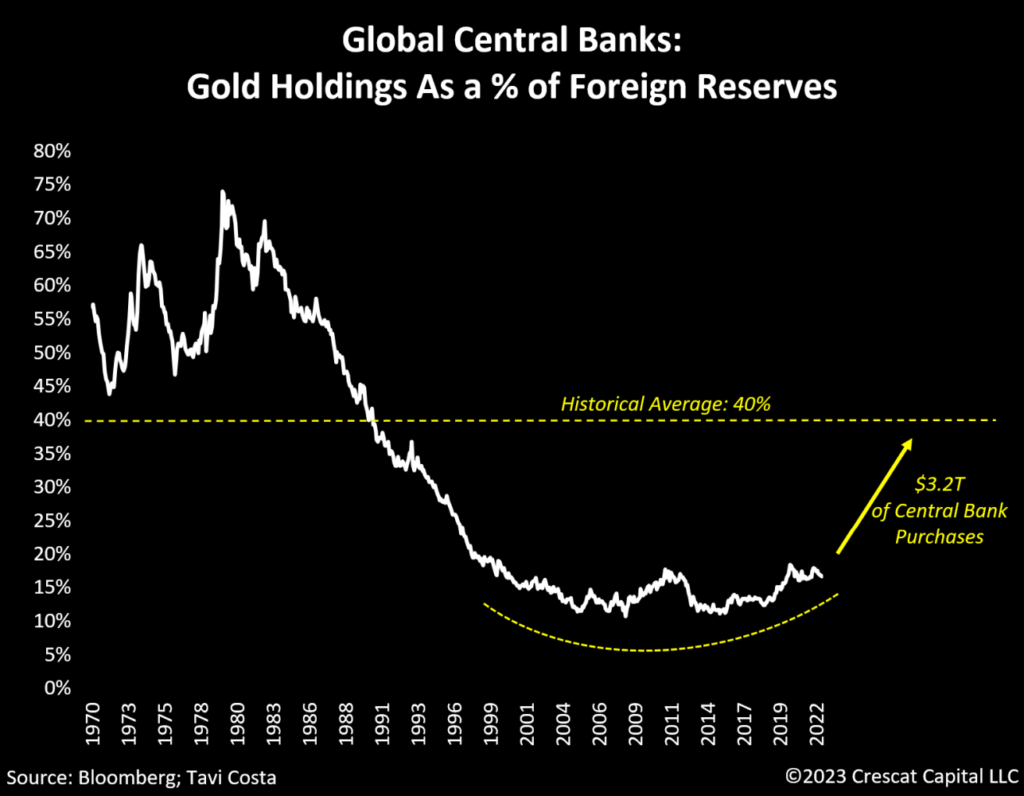

Confirming these speculations, the Russian government has announced that the BRICS nations are planning to introduce a new trading currency backed by gold, as reported by state-run RT. This development aligns with the ongoing trend of de-dollarization in the global economy, with central banks worldwide increasing their gold reserves to diversify away from the US dollar. Furthermore, geopolitical uncertainties stemming from the US government’s use of the dollar as a tool against Russia during the Ukraine invasion have motivated certain nations to explore alternative currencies. While the news is anticipated to provide considerable support to gold, analysts caution that its full impact may take time to materialize in the market.

Implications of De-Dollarization:

If countries begin transitioning away from the US dollar and seek alternative currencies, it will inevitably reduce the overall demand for the dollar. The implications of de-dollarization, particularly through the introduction of a gold-backed BRICS currency, would have far-reaching economic and geopolitical consequences. It would diminish the dominance of the US dollar as the world reserve currency, consequently shifting the balance of power in global finance and diminishing the influence of the United States. Additionally, such a move would grant the BRICS nations greater economic autonomy, enabling them to conduct cross-border trade and manage reserves without being overly reliant on the dollar, thus mitigating potential economic vulnerabilities.

The introduction of a BRICS currency backed by gold would streamline trade among member nations, eliminating the need for bilateral agreements denominated in non-dollar currencies and facilitating increased trade volumes. Moreover, de-dollarization represents a broader geopolitical shift away from US hegemony, symbolizing the rising influence of emerging powers such as China and Russia. This shift could potentially give rise to new alliances and economic blocs, ultimately reshaping the geopolitical landscape and reducing US geopolitical leverage.

Financial markets would also experience significant repercussions, with investors and financial institutions diversifying their holdings away from dollar-denominated assets. This diversification could potentially impact the stability and value of major currencies and increase market volatility. Within the BRICS bloc, the introduction of a common currency would deepen economic integration and cooperation, enhancing intra-BRICS trade, investment, and financial ties.

Central Banks’ Increasing Gold Holdings:

An intriguing trend that aligns with the potential shift away from the dollar is the surge in central banks’ gold reserves. Despite occasional fluctuations caused by factors such as Turkey’s recent gold sales, many central banks have been net buyers of gold. For instance, Poland increased its gold reserves by 19 tons in May, signalling a renewed interest in fortifying its holdings. China’s central bank has also been consistently accumulating gold, both through officially reported purchases and potentially undisclosed acquisitions. These actions have led to speculation that China possesses more gold than it officially discloses. Other central banks, including those of Russia, Singapore, India, and the Czech Republic, have likewise increased their gold reserves.

Future Outlook:

Gold has historically been considered a safe-haven asset and a store of value. While the CFO of the BRICS bank has stated that there are no immediate plans for the announced currency, the growing calls for de-dollarization from countries worldwide cannot be ignored. The wheels seem to be in motion for more significant developments in the near future.

“Talk of BRICS gold-backed currency seems like an echo chamber. They do not have the gold to back a currency meaningfully,” said Marc Chandler, managing director of Bannockburn Global Forex. Many analysts have been speculating about a new global currency to challenge the U.S. dollar’s role as the world’s reserve currency. In late March, Former Goldman Sachs chief economist Jim O’Neill wrote in a paper published in the Global Policy Journal that the U.S. dollar’s dominance is destabilizing global monetary policies. He added that a BRICS currency, challenging the U.S. dollar’s dominance, would bring stability to the global economy. “Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic,” he said.

Conclusion:

The reported plans of the BRICS countries to announce a gold-backed currency at their August summit signify a potentially seismic shift in the global economic landscape. With the BRICS member states representing a substantial portion of the world’s population and GDP, their move away from the US dollar could have far-reaching consequences. The increasing gold holdings by central banks further emphasize the strategic importance of gold as a reserve asset. Although specific details and the timing of any potential currency announcement remain uncertain, it is evident that the world order is rapidly evolving. Awareness of these developments is crucial for comprehending the evolving global economy and adapting to the potential shifts that lie ahead.

I do like the manner in which you have presented this particular situation and it does provide us a lot of fodder for consideration. On the other hand, coming from what I have seen, I basically trust when the actual feed-back pack on that people today remain on issue and not start on a tirade of the news du jour. Yet, thank you for this excellent point and even though I can not concur with this in totality, I respect your point of view.

Thank you for taking the time to read and engage with my article and sharing your thoughts. Thank you for your kind words about the presentation. I’m happy to hear that it has given you a lot to think about.

If you are interested in reading more about the gold prices, have a read on this link: https://www.bloomberg.com/news/articles/2023-07-26/jpmorgan-sees-gold-charging-to-records-in-2024-as-fed-cuts-rates?utm_source=website&utm_medium=share&utm_campaign=linkedin

Also, feel free to suggest any other topics you would like me to write about.

Best Regards,

Tamanveer

Normally I do not read article on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, very nice post.

I appreciate your feedback and I’m happy to hear that you found the article enjoyable. It might be worth keeping an eye on gold prices over the next year as they are expected to soar.

Also, feel free to suggest any other topics you would like me to write about.

Best Regards,

Tamanveer

Enjoyed reading through this, very good stuff, regards.

Great post. I was checking continuously this blog and I am impressed! Extremely useful info specifically the last part 🙂 I care for such information a lot. I was seeking this particular information for a long time. Thank you and best of luck.

You can certainly see your skills within the work you write. The sector hopes for even more passionate writers such as you who aren’t afraid to mention how they believe. Always go after your heart. “History is the version of past events that people have decided to agree upon.” by Napoleon.

I went over this site and I believe you have a lot of great information, saved to fav (:.

As I website possessor I believe the content here is really excellent, thanks for your efforts.

You can definitely see your enthusiasm within the work you write. The world hopes for even more passionate writers like you who are not afraid to say how they believe. At all times go after your heart.

Whats up very nice web site!! Man .. Beautiful .. Superb .. I will bookmark your site and take the feeds additionally…I am satisfied to search out a lot of useful information here in the post, we want work out extra strategies on this regard, thank you for sharing.

I genuinely value your work, Great post.

An interesting discussion is definitely worth comment.I believe that you need to write more on this subject matter, it mightnot be a taboo subject but usually folks don’t speak about suchtopics. To the next! Many thanks!!