By Tamanveer Ahuja, Student at University of Exeter

Gas Shortages in Europe

Winter is coming and Europe is having an energy crisis. According to Bloomberg, “Europe’s Winter Gas Shortages Set to Last at Least Until 2025”.

Europe is in the grip of its worst energy crisis in 50 years, as Russia reduces deliveries in retaliation for sanctions imposed in response to its invasion of Ukraine. The squeeze has exacerbated a cost-of-living crisis and pushed economies to the brink of recession. “We’ll see prices in Europe returning to where they were at the beginning of 2021 somewhere between 2025 and 2027,” Ed Morse, global head of commodities research at Citigroup Inc., said in a Bloomberg TV interview. The capacity for liquefied natural gas exports “doesn’t grow overnight.”

Prices have risen due to uncertainty about the flow of natural gas. Prices have risen to $500 per barrel of oil equivalent, more than ten times the normal average, fuelling fears of winter shortages and cold homes.

Economic War between Russia and Europe

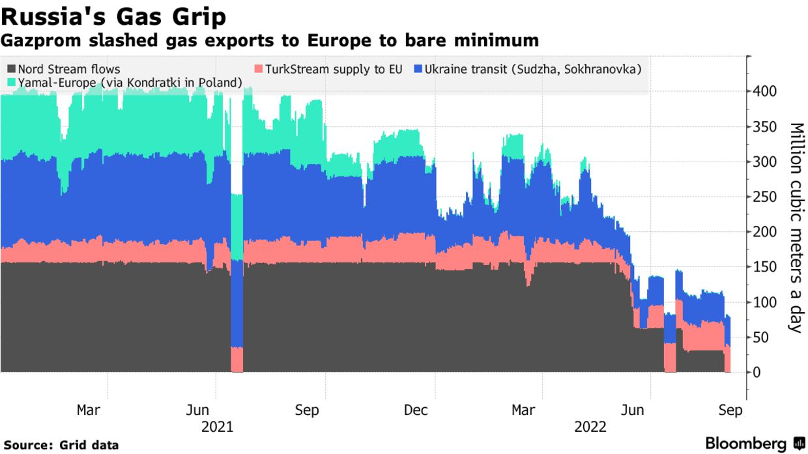

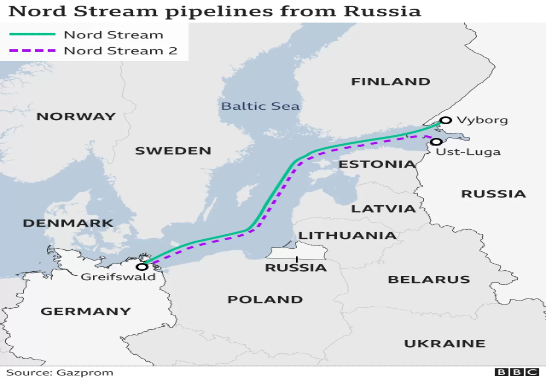

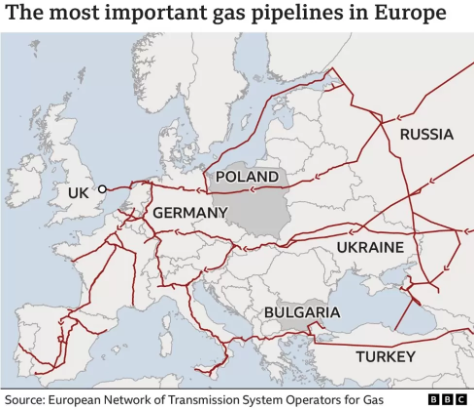

The Nord Stream 1 pipeline from Russia to Germany will remain closed due to an oil leak, according to Russian energy provider Gazprom. It has also been burning off an unusually large amount of gas from a plant near the pipeline’s beginning, for unknown reasons. President Vladimir Putin has demanded that “hostile” European nations pay for gas in Russian rubbles. This contributes to the value of Russia’s currency. When Poland, Bulgaria, and Finland refused, Russia cut off their supplies. Several European energy companies pay for gas through Russian bank accounts that convert euros into rubbles. They maintain that the payments are per the sanctions.

Reduced deliveries via Nord Stream, alongside lower gas, flows through Ukraine, have left European countries struggling to replenish storage tanks for the winter, prompting many to activate emergency plans that could lead to energy rationing.

Reduced deliveries via Nord Stream, alongside lower gas, flows through Ukraine, have left European countries struggling to replenish storage tanks for the winter, prompting many to activate emergency plans that could lead to energy rationing.

Moscow has blamed Western sanctions for deterring routine maintenance of the Nord Stream 1 pipeline. According to a spokesperson for Economy Minister Robert Habeck, Germany is still decoupling its energy supply from Russia. “We have seen Russia’s unreliability in recent weeks and have continued to take measures to strengthen our independence from Russian energy imports,” the spokesperson said. Russia has been accused by Germany of using gas as a political weapon. “They don’t even have the guts to say, ‘We are at war with you,'” Habeck said last month.

Moscow has blamed Western sanctions for deterring routine maintenance of the Nord Stream 1 pipeline. According to a spokesperson for Economy Minister Robert Habeck, Germany is still decoupling its energy supply from Russia. “We have seen Russia’s unreliability in recent weeks and have continued to take measures to strengthen our independence from Russian energy imports,” the spokesperson said. Russia has been accused by Germany of using gas as a political weapon. “They don’t even have the guts to say, ‘We are at war with you,'” Habeck said last month.

As Russia restricts gas supplies to the continent, threatening to push the region into recession, the only options for rapid replacement are fossil fuels, which risk upending the path toward carbon neutrality. Across Europe, governments are speeding up the use of floating LNG terminals, which take a fraction of the time to set up than their onshore counterparts. Germany, which used to rely on pipelines from Russia for more than half of its gas, is now chartering five of the floating storage and regasification units, or FSRUs, as well as two more that will be privately rented. Three are set to begin this winter. Germany currently requires an additional 40 million tonnes of LNG, according to Venture Global’s Chief Commercial Officer Tom Earl, who spoke at the Gastech conference. And, within the next seven to nine years, Europe will require up to 200 million tonnes of additional supply, “which must come not only from the United States but from other global LNG production centres,” he said.

As Russia restricts gas supplies to the continent, threatening to push the region into recession, the only options for rapid replacement are fossil fuels, which risk upending the path toward carbon neutrality. Across Europe, governments are speeding up the use of floating LNG terminals, which take a fraction of the time to set up than their onshore counterparts. Germany, which used to rely on pipelines from Russia for more than half of its gas, is now chartering five of the floating storage and regasification units, or FSRUs, as well as two more that will be privately rented. Three are set to begin this winter. Germany currently requires an additional 40 million tonnes of LNG, according to Venture Global’s Chief Commercial Officer Tom Earl, who spoke at the Gastech conference. And, within the next seven to nine years, Europe will require up to 200 million tonnes of additional supply, “which must come not only from the United States but from other global LNG production centres,” he said.

Possibility of an Economic Crisis

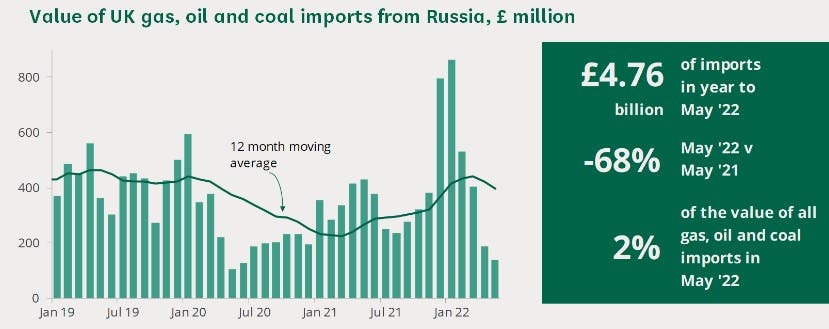

The total value of all imports from Russia to the UK in June 2022 was 98% less than in June 2021.

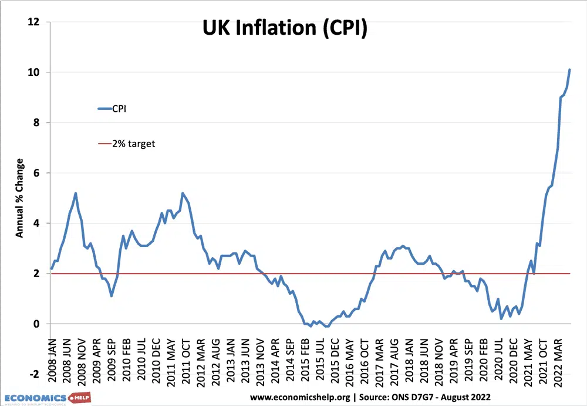

Even though the US doesn’t import any gas from Russia and the UK has not imported any gas from Russia for more than three months in a row, they still get affected when Russia restricts supplies to mainland Europe as this leads to global gas prices rising. The rising cost of energy has driven a spike in inflation in the United Kingdom, while Germany has suffered the worst inflation since the 1970s energy crisis.

According to JPMorgan Chase & Co. analysts, the consumer cost-of-living crisis has “only just begun.” According to the bank’s retail analysts, consumer spending on discretionary items in the UK could fall by a mid-single-digit percentage in 2023 compared to 2019. While yet-to-be-announced government support measures from new UK Prime Minister Liz Truss “could be meaningful,” they added, “JPM economists are mindful that this brings a risk of faster rate hikes, simply delaying rather than removing recessionary risk.” They conclude, “Winter is (still) coming” for the United Kingdom.

The ‘not-so-great’ British pound has plummeted to its lowest level against the US dollar since 1985. The Bank of England and the new government are in a complete mess; the United Kingdom has the highest inflation in the G10 (forecast to hit 22%), the highest taxation in 70 years, the highest probability of a recession in the G10, the biggest drop in living standards since 1956, large current account deficit, currency performing like an emerging-market and more rate hikes are expected.

“A balance of payments funding crisis may sound extreme, but it is not unprecedented: a combination of aggressive fiscal spending, severe energy shock, and a fall in sterling resulted in the United Kingdom requiring an IMF loan in the mid-1970s,” Gopal explained. Sterling could fall 30% of DB estimates in an extreme EM-style sudden stop scenario.

“A balance of payments funding crisis may sound extreme, but it is not unprecedented: a combination of aggressive fiscal spending, severe energy shock, and a fall in sterling resulted in the United Kingdom requiring an IMF loan in the mid-1970s,” Gopal explained. Sterling could fall 30% of DB estimates in an extreme EM-style sudden stop scenario.

Governments to unleash Billions to help with Energy Bills

Deutsche Bank says the risk of a ‘sterling crisis’ is rising as Truss becomes UK prime minister – Sterling could fall 30%. Truss wants to pass £130 billion in energy relief legislation, but where will the money come from?

There are growing concerns that this could lead to balance-of-payments problems and a currency crisis akin to that seen in emerging markets. “With the current account deficit already at record levels, sterling requires large capital inflows, which will be aided by improved investor confidence and falling inflation expectations.” However, the opposite is true according to a note issued by Deutsche Bank on Monday.

Germany has announced a €65 billion (£56.2 billion) package of measures to alleviate the threat of rising energy costs, as Europe struggles with limited supplies following Russia’s invasion of Ukraine. German Chancellor Olaf Scholz told journalists that the government would make one-off payments to pensioners, people on benefits and students. There would also be caps on energy bills, some 9,000 energy-intensive businesses would receive tax breaks to the tune of €1.7bn. The British government also recently announced a “freeze” on household utility bills of £2,500 for the next two years. This “cap” will be paid for with borrowed/printed money. In short, higher prices lead to more government borrowing and printing, which leads to more inflation and even higher prices.

In 2018, the former US president Donald Trump warned NATO of their energy dependence on Russia. The United Nations had “openly laughed” at Donald Trump for raising doubts about their commitment to Russian energy when he was “100 per cent correct,” says Sky News contributor Megyn Kelly. “There’s a shot of the German delegation just sitting there mocking him,” she told Sky News host Paul Murray. “They got such a kick out of what they perceived as his ignorance.”

Recently the ECB has raised interest rates by 75 BPS which is the largest in its history. The EU is paying for its own mistakes, and its targets for saving energy and reducing emissions are hopelessly out of step with reality.

You really make it seem really easy with your presentation but I find this matter to be really one thing which I believe I would by no means understand. It seems too complex and extremely broad for me. I am having a look ahead to your next submit, I’ll try to get the hold of it!

Thank you for your feedback! I’m glad you found my presentation easy to follow. Don’t hesitate to reach out if you have any questions or if there’s anything I can do to help you better understand the subject. And I look forward to your continued engagement with my content!

Excellent read, I just passed this onto a friend who was doing some research on that. And he actually bought me lunch because I found it for him smile Therefore let me rephrase that: Thanks for lunch! “Any man would be forsworn to gain a kingdom.” by Roger Zelazny.

Thank you for your kind feedback and for sharing the information with your friend. I’m glad to hear that my work has been helpful and even resulted in a pleasant lunch for you. I appreciate your gratitude and the quote you’ve included from Roger Zelazny. If you have any further questions or if there’s anything else I can assist you with, please don’t hesitate to let me know.

I would like to show some thanks to this writer for rescuing me from this type of incident. Because of researching through the world wide web and coming across recommendations which were not beneficial, I was thinking my entire life was over. Living without the answers to the difficulties you’ve fixed as a result of this article is a crucial case, and those that might have in a wrong way damaged my career if I had not encountered the blog. Your own know-how and kindness in maneuvering everything was priceless. I don’t know what I would’ve done if I had not come across such a stuff like this. I can also at this moment relish my future. Thanks a lot very much for this reliable and sensible help. I won’t think twice to propose the blog to anybody who needs and wants guide on this situation.

Greatly appreciated! Check out my new article on Gold-backed BRICS currency.

Some really interesting details you have written.Aided me a lot, just what I was looking for : D.

I appreciate your feedback, and I’m pleased to hear that my article was helpful to you. Thank you for taking the time to share your thoughts.

I am usually to running a blog and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and preserve checking for new information.

Thank you for your feedback. I’m pleased to hear that you found it interesting. Please feel free to read my other articles and suggest any topics you’d like me to write about.

wonderful points altogether, you just won a emblem new reader. What may you suggest about your publish that you made some days ago? Any positive?

I like this post, enjoyed this one thank you for putting up. “I would sooner fail than not be among the greatest.” by John Keats.

Hi! This post could not be written any better! Reading this post reminds me of my good old room mate! He always kept chatting about this. I will forward this page to him. Fairly certain he will have a good read. Thank you for sharing!

I was wondering if you ever thought of changing the layout of your site? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or two images. Maybe you could space it out better?

I gotta favorite this website it seems handy very beneficial

A powerful share, I simply given this onto a colleague who was doing slightly analysis on this. And he in actual fact bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the treat! However yeah Thnkx for spending the time to debate this, I feel strongly about it and love studying more on this topic. If attainable, as you develop into experience, would you mind updating your weblog with extra details? It’s highly helpful for me. Huge thumb up for this weblog post!

You can certainly see your enthusiasm in the work you write. The world hopes for even more passionate writers like you who aren’t afraid to say how they believe. Always follow your heart.

Enjoyed reading through this, very good stuff, regards. “All of our dreams can come true — if we have the courage to pursue them.” by Walt Disney.

Hi there, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam feedback? If so how do you protect against it, any plugin or anything you can recommend? I get so much lately it’s driving me crazy so any assistance is very much appreciated.

hi!,I like your writing very much! share we communicate more about your article on AOL? I need a specialist on this area to solve my problem. Maybe that’s you! Looking forward to see you.

Good write-up, I am regular visitor of one?¦s blog, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

I am glad to be one of several visitors on this outstanding internet site (:, thanks for putting up.

I loved your blog. Awesome.