By Saleem Malik Calle, Research Analyst at King’s Private Equity Club

When reading news on private equity deals, one often hears and reads about mega-funds completing deals and their ventures. Large firms often over-shadow mid-cap firms and their activities. I was given the opportunity to interview one of LIAN Group’s current partners: Josue Lopez. This interview was conducted with the purpose of gaining an insight into the mid-cap world of private equity. In addition, this interview provides a detailed look into how a firm works from within.

LIAN was founded in 2017 by Nessim-Sariel Gaon and Fiorenzo Manganiello, the current managing partners who come from an institutional background. The company is headquartered in Luxembourg but has offices in large cities worldwide. One of their first investment projects was focused on Bitfurry, indicating LIAN has been involved in the tech and decentralised finance sector for some time now. LIAN has been labeled as a “millennial VC” because of its young workforce and management. This is evident as the firm is made up of 40 employees with an average age of 26.

LIAN differs from typical PE firms as it aims to make its projects socially conscious by having a positive impact on the community surrounding its investments and creating value through sustainable development and growth.

“What is the LIAN group?”

“LIAN is a firm, not a fund. The reason why I make this distinction is to show that we are not only an entity that manages capital. Instead, we see ourselves as an entity who works closely with our clients and portfolio companies to maximise generated value, create healthy and sustainable business models/strategies, and build long-lasting relationships along the way.”

LIAN acts as a Swiss investment vehicle that can deliver Private Equity investment opportunities in the Technology and Real-estate sectors on a deal-by-deal basis. Josue emphasises that LIAN currently “has the most efficient deal sourcing and management in Switzerland”. Their clients include family offices, private banks, and UHNWI (ultra-high-net-worth individuals). The firm manages capital and investments on their behalf. Deal structure within the fund revolves around regular and flagship investments. Standard deals involve investments that are less tolerant of high risk and create stable value over the long term. Alternatively, the Flagship fund is used to invest in riskier alternative assets with a higher level of speculation through internal capital and financial leverage.

The firm is a privately tailored fund. Investment opportunities are analysed, tailored, and delivered to the right investors and vice versa. There is much importance placed on finding the right kind of investor for the right entity, considering LIAN focuses on specialisation to maximise the value it can generate for investors.

Investment Approach, Climate, and Management

“What are the key building blocks of your investment approach and management?”

“A lot of our investments are centred around decentralised finance and financial technologies. The focus on these new and disruptive technologies and our modern outlook on business opportunities stem from our young and innovative employees. We have also shown interest in emerging markets. Specifically, El Salvador, as it is striving to become a centre for cryptocurrency. Our strategy combines traditional investing with a modern outlook which allows us to offer the right kind of capabilities for any kind of project.”

“Why does most of your firm focus on disruptive technologies?”

“Our focus comes from our investment thesis: generate good returns while democratising private equity. Disruptive technologies have proved to generate a lot of growth and investment opportunities for numerous investors. Many of our projects also revolve around renewables. We aim to invest in companies that can generate disruption and are sustainable. Given that conventional and non-disruptive industries are losing value.”

By the end of 2021, deal activity peaked in European private equity markets. The total value of all the deals completed by Q3 was estimated to be €126.4 billion, a 202.8% increase from the previous year. The technology sector in Europe accounted for more than 30% of the total deals completed in 2021. The increase in total value is influenced by the large amounts of confidence firms have placed in disruptive technologies to generate value. This can be attributed to long-term growth potential and the industry’s resilience through the recent economic downturn.

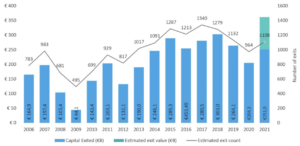

Private Equity Exit Activity, Source: Ernst & Young

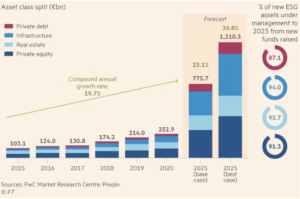

Sustainability has become a priority for private investment firms over recent years. The increase in demand for sustainable investments is causing firms to re-think business models and strategies. Research from PWC indicates that ESG assets are estimated to make up 27 to 42 percent of private assets in Europe by 2025. The European Union’s sustainable finance disclosure regulations have set new rules for the game and are changing the investment environment in Europe.

ESG in European Private Markets, Source: PwC Market Research Centre

“How do you use specialisation to unlock and maximise the value of your investment?”

“We take on a very specific mindset when managing companies which enables us to better analyse our investments and draw a path to success”

“Can over-specialisation create adversities for the firm?”

“It definitely can. While managing our project with COWA, a sustainable crypto mining company, we created a team to specialise in the crypto space. Over-specialisation caused the generation of unrealistic ideas and opportunities. Sometimes the need to innovate and grow, paired with unrealistic expectations, can have adverse effects on productivity.”

“What are the upsides of creating value over the long-term?”

“Long-term investments enable the generation of passive income for perpetuity. This brings a short-term repayment period which allows us to focus on long-term growth and development.”

“What are the downsides to long-term investing?”

“The greatest adversities come from investing in an early-stage business. Main risk factors include no financial projections or fundraising analysis. Early-stage businesses have a large intangible value. So, we focus on properly analysing and evaluating a company. A personal downside of working in the PE industry is fundraising. It is hard to convince investors while being a 22-year-old partner at the firm. But, this is offset by our focus on marketing and intricate financial analysis. You have to be willing to put in the work.”

“How do you source ideas for investments and the right people to work with?”

“We invest in people, not ideas. Meaning that ideas are not the hard part, instead, it has to do with how the idea is executed. It’s about how a person can bring value to the company. More than financials, it’s about how the people behind an idea can generate value if it is properly executed.”

“How does an emphasis on building and nurturing long-term relationships benefit you and the firm?”

“It benefits the whole organisation. It is always important to maintain good relationships with others although you might not invest in the idea. In the world of business, building bridges will help you succeed.”

Conclusion

“What other sectors has the firm considered expanding to?”

“Most investments focus on the disruptive space but not only technologies. We want to provide opportunities at an institutional level while keeping the small and focused firm mindset.”

Josue mentioned that LIAN is expanding to emerging markets with the purpose of creating value for local communities. The aim is to de-monopolies private consumer-based industries in emerging markets to allow certain consumer goods to become more affordable. Developed and emerging markets are two different sectors but “vertical and horizontal movements of the firm allow for easy investment opportunities in different economies”.

He also emphasised that now is a turning point for the firm. After experiencing substantial growth, they are “ready to look for larger pies” and look forward to “seating at the same table as larger firms”.