By Barnabé Goyeau, Student at ESSEC Business School

By Barnabé Goyeau, Student at ESSEC Business School

On 27th September, the British pound plummeted to a 41-year low trading at 1.035 against the US dollar. This nosedive followed the announcement of the now-former Truss government to cut the top rate of income tax as well as to put a cap on energy bills to be funded by increased borrowing. This led to a sharp slide in UK bonds and currency as investors grew concerned about Britain’s debt levels, triggering a huge sell-off of UK bonds. The next day, on 28th September, the Bank of England launched an emergency intervention by announcing the purchase of £65 billion of long-dated UK bonds, as a way to offset the panic caused by the government’s financial plan while also fighting against rampant inflation.

On 4th October, the British pound went back to its former rate of 1.14 US dollars after the government backpedaled on its plans.

It seems the crisis has been avoided and further deterioration of the British pound has been halted. However, the GBP has been steadily declining for the past years, and recent events could explain why.

The everlasting effects of Brexit

Since Brexit was voted for in 2016, the GBP has been declining against the EUR and the USD. Great Britain’s exit from the EU directly impacts its trade balance, which is a factor in determining a currency’s strength compared to others. The Big Brexit, a report provided by the LSE for The Economy 2030 Inquiry, predicts Brexit to have an overall negative impact on Britain’s competitiveness and openness in the years to come, with a decrease in exports, productivity, and real wages, triggering a shift towards a more closed economy. This can only hurt the British pound’s exchange rate in the long term, as a decrease in exports compared to its imports means less demand for the currency.

Source : tradingeconomics.com

The aftermath of COVID-19

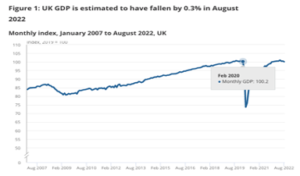

The United Kingdom’s economy is still grappling with a marked slowdown triggered by COVID restrictions. As such, the UK reported a high spike in inflation at the end of 2021 (5.4% in December 2021) coupled with a decrease in production, with manufacturing industries being the most impacted. However, the aftermath has to be nuanced: according to the ONS, the UK economy was around the same size it was going into the pandemic with a GDP growth of 0.9 % in November 2021 against a 0.7 % growth in February 2020.

Source: Office of National Statistics

War in Ukraine

In February 2022, Russia launched its invasion of Ukraine. With Russia cutting its gas exports, the impact on the UK’s economy was tremendous: the ongoing inflation since December is expected to last even longer, which negatively impacts the GBP’s value compared to other countries. Aside from the common citizen feeling the impact on their energy bills, companies feel it too as it increases their costs of production. In turn, this reduces their output and hurts the national trade balance even further.

A US Dollar going strong

Finally, it comes in a period where the USD is as strong as it gets with the Federal Reserve hiking its interest rates to fight inflation in the US. The robustness of the US economy contributes to the strength of its national currency, even when concerns have been voiced about a looming recession, the US situation looks a lot better compared to the UK, the EU, or even Japan. For UK consumers, this means less purchasing power compared to their American counterparts, which is a problem considering the US is one of their biggest trading partners. As for the British manufacturers, it translates into higher costs for importing raw materials. When combined with the already increased costs of production as a consequence of Russia cutting its gas exports, translates into an impact that is even more dramatic.

What happens now?

With all of these factors taken into account (decreased trade balance, inflation, loss of productivity and purchasing power, and a strong US dollar), and ongoing political instability with three different PMs over the last four months (Boris Johnson, Liz Truss and now Rishi Sunak), the situation for the British pound looks grim and can only contribute its sustained volatility. But is it time to dig the grave for the British pound? Not quite: the Bank of England hiking its interest and buyback decisions seem to have avoided a crisis, and it does seem to show stronger resistance than EUR/USD, and it is expected that its value will go up, some forecasts predicting the GBP/USD to trade at 1.35 by 2024 as the US economy would be increasingly vulnerable due to the current overvaluation of the US dollar. If the sun has yet to set on the British pound, it sure was short-lived (45 days long) on the Truss government

Barnabé is a French student at ESSEC Business School, hailing from the Asia-Pacific cohort. He is always ready to expand his knowledge on any subject, especially in geopolitics, new technologies, and strategy. He also loves to learn about History and practices martial arts regularly. After interning at the Bank of France as a Banking Supervisor, his ambition is to work in strategy consulting later on, putting his analytical nature and inquisitiveness to good use.