Although the private equity world has been largely dominated by leverage or management buyouts by top private equity firms such as Blackstone, Carlyle Group, and KKR, many PE firms also focus on the growth equity and venture capital strategies. In this article, I will explore the various different investment strategies that PE firms employ exploring venture capital, growth equity and management buyout, and observe the differences between them. I will consider the characteristics of the target firms, including their risk and cash profiles, the stage of their corporate life as well as potential for growth, to evaluate the different strategies employed by PE firms.

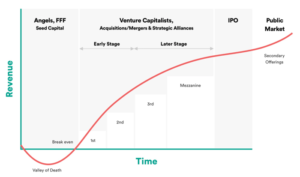

As businesses start and grow – they go through a number of different stages in their corporate life. Start-ups and small businesses that have recently launched are often loss-making in their first few years of operation. Growing businesses, on the other hand, are beginning to establish themselves within their industry and generate a stable cash flows. Then, successful businesses enter into their maturity stage, where they generate considerable amounts of cash and profits are at their peak. Finally, as industries decline or markets shift, businesses enter their decline phase as their cash and profits decrease over time. This can be illustrated on the following graph:

As such, the strategy utilised by the acquiring PE firm varies drastically depending on the stage of the corporate life of the target firm.

Venture Capital

Venture capital is often done within the early stages of a firm, where businesses are making losses but no longer seeking either angel or seed investors. Companies involved in the technology sector or occupying niche markets have the potential to disrupt the markets, gain significant market share and offer investors very high returns if they are successful. However, being at an early stage, they have significantly high-risk profiles.

The risk of investing in such ventures come from the very small operating history of these businesses. However, to compensate for the increased risk, the investors receive an equity stake within the business. From an investor perspective, this gives them a significant say in how the company is being managed but from a founder point of view, they give up some of the control.

The typical holding time of a venture capital investment is typically around 6 years. The process starts with the entrepreneur submitting a business plan to their potential investors, then if the private equity firm or VC investor is interested in the deal, the due diligence part comes into play. The company and its business model are thoroughly investigated before the investment is made. Once this round is complete and satisfies the parties involved, capital is secured. This comes most commonly in rounds of investment, where certain targets have to be achieved and progress has to be made in order to unlock the second round of financing. The final stage consists of the exit, whereby the venture capital business is taken to go through an M&A or IPO route.

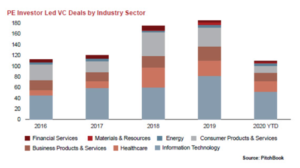

As seen below, such deals have rapidly expanded in the last decade and are mostly focused on the information technology sector.

Growth Equity

Growth Equity happens during the growth stage of companies: where they are beginning to reach profitability. Consequently, their risk profiles tend to be significantly smaller compared to venture capital but still attractive to investors as the return potential is still considerably high. Target firms are less revolutionary and game-changing but there is an opportunity to scale and grow businesses. In addition, these companies have strong and developed business plans but are mostly seeking capital to accelerate their growth. For example, businesses might seek to expand in new geographical locations, seek new clients or investment in infrastructure. These businesses are not necessarily in desperate need for capital but rather require it to accelerate the pace of their expansion. Hence, by investing within a proven business there is a significant element of de-risking.

Acquiring PE firms often evaluate their potential target investments according to a set of re-defined criteria. The target companies must have an established business plan with clearly defined goals, their consumer base has to be scalable and the market demand has to be sufficient to warrant such an investment. These companies are often held for 4 to 7 years and investment stakes are most commonly minority holdings.

Even though it is already a mainstream strategy and growing at 15% year on year, growth capital mainly focuses on smaller and mid-cap businesses. Such businesses are often found in the technology and life sciences markets, which are currently key drivers of the digital economy and consequently of global economic growth.

Leveraged Buyout

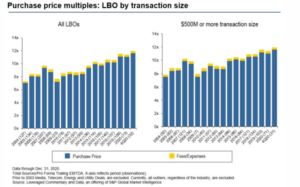

The largest and most recognisable strategy utilised by PE firms is the buyout. Some of the most famous and largest LBO deals include as Energy Future Holdings at $45bn; HCA Healthcare at $33bn; RJR Nabisco at $31B. As shown on the graph below, purchase prices have been on the rise in the past decade, with the majority of deals being concentrated in North America and Europe.

The LBO strategy is most often adopted within the later stages of a business, where target firms are large, scalable, and have long-established capital structures in place. As such, investors are most often attracted to the low-risk profiles that comes from investing within companies that are already successful and well established within their market. Potential target firms involve those potentially in need in need of a vertical sector change, where there are distressed shareholders, or even simply an undervalued public company.

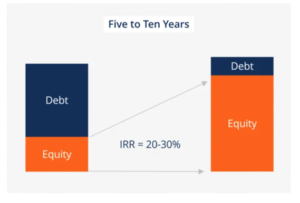

Investing in large mature companies is an important element that many investors are seeking, as these companies provide a significant element of de-risking. They operate in already established markets, have large consumer bases and do not have the typical risks associated with the development of a new product or idea. However, the element of risk in this strategy comes from financing the investment with a high portion of debt. This is mainly the reason why this strategy is adopted within large and stable companies, which involves very little risk.

As illustrated above, the average holding period of such an investment is between 5 to 10 years in which the PE firm’s equity returns grows significantly. By financing the investment with a large portion of debt, a higher return on equity and internal rate of return can be achieved.

Other strategies:

It is important to note that PE firms do not only focus on the core strategies of venture capital, growth equity, and buyouts. There are many other alternative strategies like value and impact investing, buy and build, management buy-ins, and others that are commonly adopted by various private equity investors. Such strategies can also be adopted in combination with the core ones as outlined by large private equity firms.

In addition, over the last decade, impact investing has been gaining increased traction, within the financial sector as well as general consumer sentiment. Impact investing focuses on extending beyond the pure profit motive, such as investing in businesses that are socially responsible, produces environmentally ethical products or fights for injustices around the world. Another strategy is value investing is a strategy that is mainly adopted by investing in a business that is in trouble or in a more extreme case be part of an insolvency situation. This can be done for example by buying distressed debt.

Other strategies like ‘buy and build’, that have a more strategic goals can be adopted by large businesses. In order to grow, they are highly acquisitive and buy the businesses that can bring them the largest synergies. This leads to the the acquiring business to become larger and lower its fixed costs, become more efficient and profitable.

Conclusion

Private equity firms have a range of varying investment strategies they may employ, which depends on the firms’ risk appetite and their desired returns, which dictates the strategy pursued. Venture Capital offers the possibility of higher returns, but has a dramatically higher risk profile relative to a typical large-scale LBO, with growth-capital sitting somewhere in between.

References

“As LBOs Surged in Q4′20, US Purchase Price Multiples Hit New Heights.” 2021. S&P Global Market Intelligence. January 22. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/as-lbos-surged-in-q4-20-us-purchase-price-multiples-hit-new-heights-62227223.

Gough, Owen. 2018. “What CEO Do You Need for Each Stage of Your Company’s Growth?” Growth Business. January 8. https://www.growthbusiness.co.uk/ceo-need-stage-companys-growth-2553371/.

“Growth Equity Primer: Investment Strategy Overview.” 2021. Wall Street Prep. Accessed October 11. https://www.wallstreetprep.com/knowledge/growth-equity-guide/.

Latham; Watkins. 2020. “The Rise of Growth Equity — Connecting PE and VC | Latham; Watkins.” Latham.London. December 16. https://www.latham.london/2020/12/the-rise-of-growth-equity-connecting-pe-and-vc/.

“Leveraged Buyout (LBO).” 2021. Corporate Finance Institute. Accessed October 11. https://corporatefinanceinstitute.com/resources/knowledge/finance/leveraged-buyout-lbo/.

Patel, Kison. 2021. “10 of the Most Famous Leveraged Buyouts (LBOs) in History.” DealRoom. November 7. https://dealroom.net/blog/the-most-famous-leveraged-buyouts-in-history.

“What Is Venture Capital (VC) & How Does It Work? | CB Insights Research.” 2020. CB Insights. June 2. https://www.cbinsights.com/research/report/what-is-venture-capital/.

“What You Need to Know about Impact Investing.” 2021. The GIIN. Accessed October 11. https://thegiin.org/impact-investing/need-to-know/.