By Paola Martos Collazos, Research Analyst at King’s Private Equity Club

As the global economy recovers from the Covid-19 pandemic, Latin America has become a ‘regional hotspot’ for PE as 70% of private equity firms plan to invest over the next 5 years in this region (Private Equity Wire, 2021). This article aims at providing an understanding to its audience of Latin America’s main opportunities for PE and the risks and barriers to investing in the region.

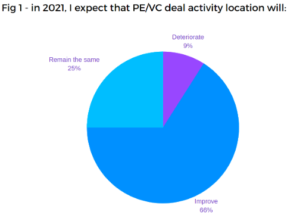

Likewise, data from Preqin Pro shows the annual number of PE transactions in Latin America increased from 133 in 2010 to a high of 400 in 2019 (Joyce, 2020). Despite this region being known to have corruption, lower-quality institutions, weak ease of doing business, and lack of enforcement in business transactions which makes it riskier for firms to invest, PE and VC trends have been growing and PE, as well as VC firms, are optimistic about the future outlook of their investments in Latin America (Figure 1) (S&P Global Marketing Intelligence, 2021).

What makes Latin America attractive for PE investors?

ROAM Capital’s chief executive Phillipe Stiernon disclosed that there are opportunities of ‘up to $100 billion over the next decade for PE managers, driven broadly by a growing middle class, younger population and benign regulatory frameworks across most countries in the region’ (Baruch, 2021a).

Stiernon also listed three key benefits for investors:

1) You get to diversify your limited partners (LPs) base. In Latin America, there are pension funds, banks, and very wealthy families with AUM readily available to invest. Diversifying any component of investments will always lower its risks; 2) Secure ‘on-the-ground’ strategic partners. This benefit has to do with the specific tacit and local knowledge that Latin American LPs can provide for investors who are based outside of Latin America but invest in Latin America;

3) Increase the manager’s negotiation leverage against European and US LPs. As the availability of leverage dictates the terms of investment agreements, by having more potential partners you can risk not agreeing with some or letting them go because you now have more funding elsewhere.

Apart from that, in Latin America, there are low levels of PE penetration which makes it a less saturated market and ready for more opportunities, in particular, within the infrastructure sector. Latin America is at a specific stage of development in which seeking to improve its infrastructure has become a priority for the region. Infrastructure investments are less risky since development projects are long-term contracts. Investing in infrastructure in Latin America is also a great opportunity to incorporate ESG factors (Writer, 2021). Lastly, there are potential opportunities for the growth of fintech and the rise of impact investing. “Latin America has seen a boom of tech companies with the number and value of unicorns nearly doubling every year” (Thiollier, 2021).

What are some challenges of investing in Latin America?

Clearly, there are certain barriers that have impeded many investors to take the risk of investing in this region. The different culture is the main challenge of investing in Latin America. Cultural differences, especially for western investors, can be significant. Unfortunately, many deals in Latin America are surrounded by corruption and bribery. A study performed by Auxadi found that 40% of firms commented that cultural differences are a barrier to deploying capital in Latin America (Auxadi, 2021).

Another challenge is the institutional framework differences. 44% of respondents in the study mentioned Institutional differences. Within the institutional differences which involve the environment in which businesses work, there are legal and regulatory framework differences. All the bureaucracy and red tape involved with starting and running a business and working in the formal sector discourages many investors since transaction costs are extremely high and the process is timely which encourages functionaries to demand bribery and illegal compensation to speed up the process.

Social challenges are another problem. For instance, it is worldwide known that before and during the pandemic, Chile faced social and political distress with protests against inequality and the social pension schemes. The protests in Chile can have an impact on their pension systems which are the main sources of PE in the region. Peru recently followed a similar path with more political distress and protests against the government.

Biggest LatAm Markets

Brazil

Brazil has the largest private capital market in the region and is the busiest market for M&A activity but still lacks the ability to catch the attention of international buyers due to its high volatility and relatively small size compared to other markets (Baruch, 2021b).

Nonetheless, since the presidency of Jair Bolsonaro, several investor-friendly reforms have been implemented. The Brazilian Declaration of Freedom Rights aims to prevent government involvement from slowing down any possible innovation such as increasing transaction costs or impeding the entry of foreign businesses. Another reform called Mais Brazil Plain promotes a business-friendly environment, reduction in interest rates, improvement of legal circumstances, and expansion of the credit market. These efforts will see investments come into the country at rapid rates in the future (Morrison Forester, 2020).

Mexico

Mexico has a history of low business confidence in the government which clearly discourages investment in the country. However, recently the Mexican government has increased the ease of cross-border transactions. This decreases the cost involved in acquiring companies or investing in them and thus lowering the barriers that discourage investment in Mexico (Morrison Forester, 2020). Mexico is the second-largest economy in Latin America and has an ideal geographical location with access to the largest and most prosperous market in the world while also being part of the United States-Mexico-Canada Agreement (USMCA). It belongs to the 30% of countries in the world with the best transportation infrastructure in the world. All of these factors continue to make Mexico an attractive destination for investment (Mexico Now, 2022).

Colombia

As mentioned previously, Latin America is experiencing a boom in its tech industry. In this regard, Colombia has a very special start-up-friendly environment which is very attractive for foreign PE investors. The food delivery app Rappi has received funding of more than $1.4 billion. Bogota has increased its visibility as a destination for VC raising $1.76 billion and Medellin, awarded innovative city of the year by the Wall Street Journal, has been the route of many tech-based startups to enter Latin America. This has been possible due to the government’s support and commitment to technological development in the country (Morrison Forester, 2020).

Chile

Chile despite being a smaller market in terms of population size has been very attractive to Western buyers. The Chilean market has been the least risky market in the entire region (Faria, 2016). However, since 2019, Chile has been experiencing social unrest and political instability in the form of prolonged protests and now a redefinition of their Constitution which suggests a risk increment.

Overall, most countries in Latin America are making efforts to attract PE investments from foreign sources. It is certain that without an environment in which the government is working in synergy with the private sector there are fewer incentives to invest in the region.

Professional Opinions on the matter

Some professional opinions regarding the matter of challenges and opportunities in Latin America from people in PE that invest in the region are important to have first-hand understanding of the region’s position.

In your professional opinion, what is a unique challenge and/or opportunity in Latin America that differentiates it from other developing regions such as Asia and Africa?

After posing this question, one of the respondents provided her opinion regarding Brazil. She denoted that there is a unique challenge in Brazil with respect to the lack of direction of the government. Countries need strong leaders with concrete purposes, focused on the country’s development, with clear plans for health and education, to serve the huge Brazilian population’. Unfortunately, it is not only Brazil with this kind of problem but a common characteristic in most Latin American countries.

Ralph Reynolds, the founder of Bienville Capital Management, also presented an insightful response to the question. Although Latin America is one region, it is so diverse. It is very hard to argue about the concept of Latin America as a whole because it is different from country to country. We have to distinguish the countries’ historical backgrounds with ‘Chile on one end of the spectrum and Venezuela on the other’. As well, understanding where each country stands in the economic policy orthodoxy is crucial. Here he is alluding to the idea of the Chilean market as an outlier. Chile has always been the furthest on one side of the spectrum in history and economic policy. Chile was built in a similar way to the United States thus it has been a calm environment to invest in for Western investors. However, the political and social landscape in present Chile is changing investors’ perspectives of Chile’s future completely.

They also answered the following question which is of particular interest to students and recent graduates looking for a position in the financial industry within emerging markets.

What are the particular skills that you look for in candidates, especially recent graduates that would be dealing with investments in emerging markets?

The CEO of a PE fund mentioned that they especially look for technical skills in candidates. These are the understanding of financial statements and the understanding of primary indicators in the market. An intuitive mindset is also important to identify key trends in the market and sectors that have a high potential for consolidating investment opportunities.

In Daniela Pfeiffer’s opinion, Partner at DXA Invest, when doing investment in Brazil, managers have to be patient and resilient given the high volatility of the market in order to balance out the expectations of downturns and success periods. In times of crisis, the recovery tends to be slower and longer, so the manager must be confident about his or her position and have patience ‘without hastily realizing the asset’.

Conclusion

These Latin American countries show great potential compared to their counterparts from the Global South but their potential cannot be fully realized given these three main barriers: social, cultural, and institutional. By no means do these barriers or challenges suggest that Latin American culture should be changed. Nonetheless, investors should accommodate the ways of doing business in the region they are deploying their capital and governments should decrease the legal and regulatory constraints of investing in the region. Accommodating local knowledge is better than trying to blueprint business transactions. Success in taking advantage of the benefits of this region will depend on those firms who best combine local knowledge and international best practices. Indeed, Latin America is a riskier place to invest than other markets given its high volatility and common political instability. Nevertheless, referring to a common financial saying: “with high risks come high rewards”. It is always best to be one of the first than the last.