By Alisson Pacheco Ramos, Master in Management at Audencia Business School

Since January 5th, 2023, the Corporate Sustainability Reporting Directive (CSRD) has been in effect in the European Union, requiring companies to start reporting data in 2025 based on their fiscal year 2024 performance. Contrary to previous directives, this one has a much broader impact on non-financial reporting in the EU and even globally since its impact is beyond the EU and can now concern a significant proportion of European SMEs. Under this new directive, companies generating over €150 million in the EU market, or those with an EU-based subsidiary or a branch earning more than €40 million, must now comply with the new sustainability reporting standards, regardless of their country of origin. Non-EU headquartered companies will be subject to these requirements starting from fiscal year 2028, with reporting due in 2029.

While the scale of the CSRD’s impact is clear, understanding what the directive truly entails is essential. At its core, the CSRD builds on earlier frameworks but now provides a more standardized set of European Sustainability Reporting Standards (ESRS), effective from January 1, 2024, with progressive expansion. According to the French Markets Authority (AMF), “The CSRD amends four existing European legislations: the Accounting Directive, the Transparency Directive, the Audit Regulation, and the Audit Directive.” This means the CSRD will harmonize sustainability reporting from a broader range of companies, increasing transparency and accuracy of Environmental, Social, and Governance (ESG) disclosures.

Compared to its predecessor, the Non-Financial Reporting Directive (NFRD) from 2014, the CSRD will apply to “all companies listed on European regulated markets (except micro-undertakings)” and follow the principle of ‘double materiality.’ Companies must now report detailed information on the material sustainability risks, opportunities, and impacts using the European Sustainability Reporting Standards (ESRS). Assurance of this information will be conducted by auditors or independent experts, and it will be mandatory, complying with European assurance standards.

For maximum transparency, all CSRD-compliant sustainability information will now be displayed publicly in a dedicated section of the management report, sitting alongside financial information, allowing all stakeholders, from investors and regulators to the public, to access and evaluate a company’s ESG performance.

A new perspective: how CSRD can change investors’ decision-making towards better ESG performance

With the regulatory groundwork laid, it’s crucial to understand why the CSRD matters on a broader scale. Beyond compliance, the directive is reshaping the relationship between companies and their stakeholders—especially investors. By making granular and reliable ESG data from thousands of companies publicly available, the CSRD has the potential to transform how investors evaluate companies and integrate sustainability metrics into decision-making. ESG considerations are no longer secondary; they are becoming central to investment strategies, risk management, and long-term value creation. As public awareness of environmental and social issues grows, so does investor demand for transparency and accountability in corporate sustainability practices, as noted by Nuveen Investments directors in a blog on Harvard Law School’s Corporate Governance Forum.

This growing demand will now be met for companies operating in the EU, as well as for the largest global companies. Over the coming years, investors will gain a clearer view of company performance across 12 ESG criteria outlined in the ESRS. Key environmental standards include Climate Change (with metrics, targets, and transition plans for mitigation and adaptation), Pollution (covering air, water, and soil pollution disclosures), and Resource Use and Circular Economy. On the social side, companies must report on Workers in the Value Chain (labor practices), Affected Communities, and Consumers and End-Users (community engagement).

Source: PwC NL, “Corporate Sustainability Reporting Directive”

With these disclosures now mandatory for companies with 250+ employees, over €20 million in assets, or €40 million in net turnover, even larger SMEs will need to provide detailed ESG data. This expands the range of available information, allowing investors to make more informed decisions when investing in mid-sized companies, including higher-risk startups that have scaled to this size. As a result, growing companies will be incentivized to integrate strong ESG initiatives early on, making environmental and social considerations part of their core strategy. Investors, in turn, will increasingly favor companies with ambitious yet realistic ESG goals.

How investors consider ESG: Balancing ESG and Financial performance

Recent surveys show that institutional investors and private equity firms are increasingly integrating ESG factors into their strategies, viewing companies with strong ESG performance as less risky and more resilient to long-term challenges and extreme events.

An EY Insights 2021 article by the EY Global Climate Change and Sustainability Services Leader, Dr. Matthew J. Bell, showed how companies that maintained their ESG measures during the COVID pandemic “have likely improved their corporate reputations and potentially gained more business,” especially when having “treated their staff and suppliers well.”

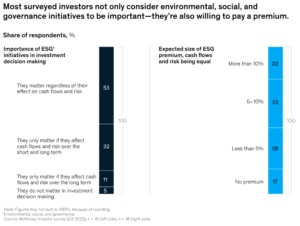

According to a 2020 Institutional Investor survey cited in the same article, 98% of investors assess ESG, with 72% conducting a structured review and 39% considering a more thorough approach. More recent data supports this trend: a 2023 McKinsey survey found that 85% of chief investment officers consider ESG important in their decisions, and 60% review their entire portfolios for ESG factors. Additionally, investors are increasingly willing to pay a premium for companies that show a clear link between ESG efforts and financial performance. Below are all the answers obtained in the McKinsey survey.

Source: McKinsey & Company, “Investors want to hear from companies about the value of sustainability”

However, when looking deeper into what matters most to investors, a 2024 Stanford Survey of decision-makers in 47 institutional investment firms revealed that Governance (responsible management, including how the company interacts with its surrounding stakeholders) is the top factor for 68% of investors, while Environmental factors are a priority for 23%, and Social issues are secondary (just 2%). This focus on governance comes from the fact that investors prioritize shareholder value, seeing governance as the key to short-term performance, with 76% that believe governance quality impacts 2-year results. While 80% agree ESG affects financial performance, the focus remains on governance and climate change, with 93% identifying climate change as a key factor likely to influence performance within the next 2–5 years.

The same Stanford survey revealed another key insight: only 40% of investors would drop a company with strong financial performance but poor ESG characteristics, while 84% would avoid investing in a firm with strong ESG credentials if its financial performance were unattractive. Rather than focusing on companies with the best absolute ESG performance, most investors (77%) assess ESG relative to peers and primarily “weed out the worst offenders,” as noted by David F. Larcker, Emeritus Professor at Stanford and co-director of the Hoover Institution Working Group on Corporate Governance. This approach highlights the ongoing challenge for companies: while ESG performance is important, it must align with strong financial returns to attract investors.

Challenges in implementing CSRD and implications on companies’ performances

Meeting the CSRD requirements will introduce new challenges for companies operating in the EU. As a recent Thesis from Utrecht University points out, companies must now gather additional data for their reports, potentially requiring them to expand or even create entire ESG departments. This will increase compliance costs for companies, but those that navigate these hurdles successfully will gain a competitive advantage, with greater access to sustainable finance and stronger trust from investors. The thesis also notes that companies with existing non-financial reporting practices will face fewer cost increases, giving them a head start and positioning them for better market valuations in the long term.

This finding suggests that a winning strategy for investors is to focus on companies with a strong track record of ESG practices, particularly those that have already implemented detailed metrics and incorporated significant ESG data in their annual reports. By investing in these companies – especially in the short to medium term, as the CSRD is enforced – investors can capitalize on their early ESG advantages, as these companies are more likely to perform well under the new regulations.

This is supported by robust evidence. Numerous studies, including a meta-analysis by NYU, show a significant positive relationship between ESG practices and financial performance. Specifically, 58% of corporate studies from 2015 to 2020 found improved operational performance tied to ESG. The benefits of ESG are even more pronounced over longer time horizons, as companies with strong ESG practices tend to be more resilient during social or economic crises. Their enhanced risk management and innovation capabilities also contribute to better financial outcomes.

However, it’s important to note that simply disclosing ESG metrics is not enough to drive better financial performance. As the NYU study highlights, companies that disclose ESG metrics without substantial action behind them do not necessarily outperform others. What makes a difference is their proactive approach to ESG, particularly in anticipation of regulations like the CSRD, where the weight of ESG legislation is stronger in the EU.

Also, it’s worth noting that Social and Governance scores tend to have a more significant impact on firm value than Environmental scores. While the combined ESG score positively correlates with profitability, the strongest positive effects are often seen in Social and Governance areas. This aligns with investors’ preference for Governance factors, as they reflect how well a company manages stakeholders and operations. However, the importance of Social issues is often underestimated. For instance, companies offering fewer benefits to workers may struggle to retain talent, leading to higher turnover and potentially losing the opportunity to build a strong, experienced team that is precisely the driving factor of a company’s value and profitability.

Global implications of CSRD and future outlook

As the CSRD brings ESG considerations into sharper focus, the global implications of this directive are becoming clear. With its far-reaching standards and mandatory reporting, the CSRD sets a precedent for sustainability reporting that could influence global markets and reshape the future of investment strategies beyond Europe.

As nearly all large companies operating in the EU, including multinationals, are required to comply with the CSRD, even those headquartered outside the EU will be compelled to improve their ESG performance. Given that the EU represents a significant portion of the global economy (14.17% of world GDP on PPP as of April 2024), the CSRD’s influence is already shaping global market dynamics, including non-EU regions. PwC’s analysis below provides a clearer picture of the CSRD’s far-reaching global impact.

Source: PwC, “Worldwide impact of CSRD – are you ready?”

Once companies determine if the CSRD applies to them, they must decide at which organizational level to report – whether at the entity level, the global level, or somewhere in between. This decision significantly affects the resources required for compliance and how companies will manage the scope of their ESG reporting.

As the global impact of the CSRD extends beyond the EU’s borders, it sets new expectations for transparency and accountability in ESG reporting that multinational companies must adhere to if they operate within the EU market. This creates a ripple effect, pushing companies outside of Europe to adopt similar reporting practices to remain competitive. As global investors and stakeholders increasingly prioritize sustainability, the CSRD serves as a benchmark that could inspire other economic powers around the world to implement similar regulations. Non-EU companies that fail to align with these evolving standards risk not only reputational damage but also losing access to vital European capital, as investors increasingly prioritize companies with strong ESG commitments, particularly in areas like Governance and Climate Change.

Furthermore, the CSRD’s rigorous framework may encourage international trade partners to enhance their sustainability standards to maintain access to the EU market. In this sense, the directive is not merely a European regulatory tool – it’s a catalyst for broader market transformation, driving global economic systems toward more sustainable and transparent practices. This shift will not just impact large corporations but will also encompass smaller enterprises, such as medium-sized SMEs.

Increased transparency will empower journalists, NGOs, and institutions like universities to closely monitor companies’ progress in various ESG criteria, such as achieving net-zero emissions or improving labor conditions. It will also expose instances of greenwashing, holding companies accountable in ways that could significantly influence their market value. Public backlash for lack of action or contradictory claims may deter clients and, in turn, investors, making transparency and genuine commitment to ESG essential to their long-term success.

For investors, the distinction between ESG ‘Leaders’ and ‘Improvers’ – terms used in a 2020 Rockefeller Asset Management study—will become clearer over time. ‘ Leaders are companies that make significant strides in ESG, while ‘Improvers’ show potential for generating long-term returns by strengthening their ESG efforts. On the other hand, those lagging behind, labeled as ‘Decliners,’ face increasing risks and will be seen as too risky by investors.

As PwC’s ESG specialists have advised, “companies should start to prepare for their reporting obligations now” for the implementation of CSRD, even if the regulations won’t apply to some of them immediately. They emphasize that the CSRD is not more than “a compliance exercise”; it aims to drive meaningful behavioral change across industries.

What may have initially seemed like a regulatory update specific to the EU is, in fact, a monumental shift in how businesses must operate. Companies will now need to rethink their business models, ensuring they don’t fall behind in meeting the rising expectations in ESG performance. As investors continue to deepen their understanding of ESG, particularly in social criteria, which are still overlooked today, these factors will increasingly influence financial value and profitability. The future belongs not only to the companies that can face the challenges of Climate Change but also to those that adapt to social and paradigm shifts, rethink how they use materials and reduce waste, embrace new management practices, and prioritize humane, transparent governance. These are the companies that will thrive in the years ahead.

Alisson Pacheco Ramos

Alisson Pacheco Ramos is a Peruvian student pursuing a Master's degree in Management and finance at Audencia Business School in Nantes, France. She is passionate about Finance and Strategy Consulting. Her motivation for social innovation, responsible business, and sustainable development as a strategy drives her to always surpass herself and anticipate the future, transforming large-scale, high-impact businesses. Her ability to communicate effectively in multiple languages is a valuable asset, she combines her excellent analytical skills in financial services, network excellence, digital, and cost analysis with knowledge of Law, Accounting, digital marketing, and renewable energy to advocate for impactful solutions firmly rooted in scientific evidence, spanning Business, Markets, and Sustainable Finance.