By Pramiti Vaidya, BSc. Finance student from Narsee Monjee Institute of Management Studies

What are Green Bonds?

Green Bonds are fixed income securities which are committed to finance or re-finance specifically designed green projects, which will help support the climate and environmental projects. Green bonds are a very important component of green finance and provides a means to finance the transition towards a more sustainable and low carbon economy.

The Present and Future of Green Bonds in the European Union:

While The European investment bank (EIB) inaugurated the green bond market in 2007 with its Climate Awareness Bond, this market has only represented 3 to 3.5% of the overall bond issuance ever since. The Commission’s proposal mainly aims to establish an official EU standard for green bonds which is aligned with the EU taxonomy for sustainable activities which are mainly based on the supervisory framework and the registration for external reviewers of European green bonds.

EU is the global leader in the green bonds market, with 48% of global issuances in 2020 being dominated in euros and 51% of the global volumes of green bonds issued in the EU. In 2020, US was the top country of issuing green bonds followed by Germany, France, China. Sweden and Spain are also among the top 10 countries worldwide.

On 13th October 2021, the EU launched its first ever green bond to record demand. This was the first step to potentially become the biggest issuer of eco-friendly debt with a record sized deal. The 15- year green bond was aimed to raise €12 billion but received more than €135 billion of demand which made it the largest green bond launch and the highest level of demand for a green bond sale to date. The EU’s executive branch has now decided to issue up to €250 billion in green bonds by the end of 2026 as a plan to finance 27 nation bloc’s recovery from the Coronavirus.

EU has the ambition to become a leader in the market of green bonds. As a part of the “Green Deal” ambition, the EU has decided to cut emissions of gases that cause global warming by 55% and has set a target of being carbon neutral by 2050. The EU itself and other EU supranational and sovereign issuers are likely be the largest single class of green bond issuers over the coming years. Green bond issuance by the European Commission under the Next Generation EU (NGEU) programme would probably amount to €250 billion over the next three years, which is roughly equal to total global issuance of green bonds in 2020. Till date, issuance by ten EU sovereigns amounted to over €80 billion, and is set to increase rapidly given strong investor demand and the presumed benefits to funding costs in sovereign debt markets. The EU and other public sector issuers have now adopted the EU green bond standard in their own capital market activities in order to ensure credibility. The European continent surpassed a cumulative $500 billion of green issuance at the end of April 2021, according to the Climate Bond Market Intelligence.

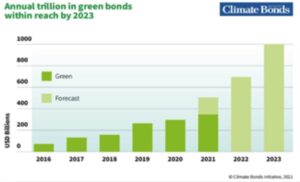

The green bond market is gaining momentum both globally and at EU level, green bonds have grown by an average of 50% during a time span of 2015-2020. Forecasts predict it will reach US$1 trillion of yearly global issuance in 2023 as seen in the Graph 1.

Graph 1:

Source: Climate Bond Initiative

Main obstacles in developing the green bond market for issuers and investors and the inherent problems of the Green Bond standards in EU.

The three main barriers in developing the green bond market are:

a) Lack of agreement on the common definition of green projects and green bonds.

b) Complex review procedures for green bonds.

c) Lack of investable projects and assets.

The problems which investors face:

a) Costly.

b) Difficulty to identify high quality green bonds.

The problems which issuers face:

a) Additional costs of issuing green bonds due to market fragmentation.

b) Uncertainty around green assets.

c) Potential reputation risk.

The EU Green Bond standard has a number of problems with a rigorous tax regime of transparency and supervision. Only those projects which are in line with the EU taxonomy of sustainable activities are eligible for funding, there is a substantial number of information which has to be provided by the issuer of the bond.

Green bonds are a crucial part for financing the low-carbon transition, given their typical long durations and end-loaded repayment structures, which fits well with the large infrastructure projects. The use of the EU green bond label will be voluntary, so the extent to which investors use it and mobilise capital for the low-carbon transition should be one measure of its success. The green bond standards will also define a framework for green assets in capital markets. As such, these bonds should foster scale and liquidity of the asset class, so that investors can discern a yield curve specific to green debt instruments. Green bond funds and the securitisation of green bank loans could mobilise additional funds, but it will depend on ensuring a uniform standard across different issuers and jurisdictions.

Contributor to The London Financial

We combine research produced by students and early professionals into a single website, breaking down the barriers to entry individuals face in a number of industries.

Contributor opinions are their own and do not necessarily reflect the stance of the LF.