![]()

![]()

![]()

![]()

by Christie Emin, Analyst at King’s Global Markets

Signed in early March, President Biden’s $1.9 trillion economic stimulus includes $1400 direct cash transfer to Americans’ bank accounts with households earning $75K and less, along with a $300 federal emergency unemployment benefits per week, to last until early September. Recently, the vast size of the stimulus has been breaking headlines and acting as a warning sign for the US economy overheating.

During the last FOMC meeting, Jerome Powell commented on inflation and interest rates. As for inflation, a one-time price increase is likely to have a transient effect on inflation rather than a permanent effect. However, the market has somewhat shaky belief in this statement, as the last time the US had inflation was in the 1960s. As for the rate hike, one should not expect an increase till 2023 at the least.

Before the tools of QE and rates, the Fed’s most powerful tool is communication, and it has acknowledged it to be so from the on-start of the pandemic. Hence, during his speech, Jerome Powell has repeatedly been highlighting how supportive the Fed is for the markets, thorough prolongation of expansive monetary policy until 2024 and enhancement of the stimulus packages. The total size of the COVID-relief packages now amounts to $5tn, making it five times larger than 2008-2009.

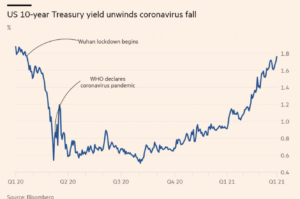

As the old Wall Street adage states, when the Fed is calm, investors are getting nervous, and in this case, they are approaching inflation much more seriously. As seen during recent weeks, the yield on 10yr treasury yields has risen sharply to 1.75%, a drastic increase from 0.72% last year. However, even though 1.75% seems high compared to the pandemic low of the 10y T-note of 0.5%, yields are still very low compared to those of the pre-pandemic levels. Some suggest that for yields to return to the previous state, the market would need inflation. If we remember, inflation has tumbled down drastically in April 2020 as economies worldwide went into lockdown, so for April 2021, one does await a spike in inflation. The question bothering the market is whether the Fed will increase rates to regulate inflation, but that will only make the enormous debt repayment very difficult.

However, it is not only the US T-notes yields that went up; it is everywhere. In February, central banks worldwide initiated discussions on monetary tightening, which led to a yield spike from Australia, Asia to Europe, and the USA, thereby increasing credit and borrowing costs in the long term. Panic and frenzy tend to drive up the yields, the impact of which is felt deeply by the economy.

According to Larry Summer and Olivier J.Blanchard, the current stimulus could lead to an overheating of the US economy, resulting in untamable inflation. Larry Summers went further on, declaring the FED’s actions to be the least responsible fiscal policy in 40 years while proposing various hypotheses for the US economy’s future: 1/3 rd chance of higher inflation and stagflation, 1/3rd chance of raised rates with possible recession.

As if fears caused by the $1.9tn stimulus were not enough, the administration has announced a $2tn worth infrastructure package, funded by the $2tn corporate tax rises on businesses and the wealthy, to cut carbon emission, reduce inequality, and build more infrastructure. According to Janet L.Yellen, the Treasury Secretary, the infrastructure package serves to invest in people by creating jobs wiped out during the onset of a pandemic. It is not the usual COVID-relief package as previously, but more of the government spending initiated on behalf of President Joe Biden. Furthermore, the $1tn package on childcare, healthcare and education is to be announced in the coming weeks. It is the goal of President Biden through the means of the massive

government spending to cure the underfunding of public goods in America, which previously led to populist culture within the society and has dramatically stagnated the growth of the middle class, and to ensure a prosperous future for the US, making it competitive with that of China.

As the economy reopens, an economic boom and rapid growth across the most COVID-affected sectors will be followed by vast spending of the savings + stimulus check, ramping up the demand in the economy but outstripping the supply. This shortage of supply, caused by COVID-caused supply chain constraints, will drive up the prices. However, what could drive up the prices more than the demand is people’s expectations of inflation. If the general public believes inflation is coming, as they do now, they themselves start altering their behaviour and contribute to self-fulfilment of the inflation. Most S&P 500 companies are already panicking about upcoming supply-chain bottlenecks, increased raw material costs and higher prices per labour hours.

The Year 2021 is about an economic boom, forecasting a GDP growth of 6.5%, the quickest expansion to be in the US since 1984. The successive years of 2022 and 2023, on the other hand, project a gloomy outlook of recession and a sizable increase in the unemployment rate.

However, there is also another possibility. The $1.9 trillion package, with its 1400 dollar stimulus to be sent each month to American mail packages, is mainly focused on lower-income households, not upper income or middle-class families. An upper-income household would probably spend all of 1400 immediately as it has lots of cash in reserve; a middle-class household could spend ⅔ and even more. But for lower-income households, this 1400 income stimulus is a game-changer. It sounds unlikely that lower-income households will continue further spending through the months of April, May, and all through the summer. They would instead prefer to spend some on necessities and leave the rest for the future as for them, nothing is guaranteed. Hence, expected inflation may not happen if we follow this logic. This chain of thought does explain the serenity and sense of calm the Fed portrays when talking about a short bump in inflation and the future state of the US economy. Nevertheless, we all know how behavioural markets are and how expected inflationary pressures themselves can lead to inflation fulfilment.

My take on this is whether inflation will happen or not is heavily dependent on those who receive the stimulus. If everything goes according to the Fed’s plan, then all we shall fear is a mechanical burst in inflation in the spring and then reversal back to normal. Although, if the general public believes in upcoming inflation or hyperinflation, then the scenario would be very much different, dragging the US economy down. The economy is not something distant; we are the ones affecting it first and foremost. The FED could guide us, but whether we believe it or not and whether we decided to act upon it is up to us.

Exclusive Offer: Get £100 off your Summer Internship Experience at Amplify Trading by clicking here or using our unique discount code at the checkout: MSAmplifySummer2021. Participants graduate from the course with a Diploma from the London Institute of Banking & Finance. For more information about the course, click here.

King's Global Markets - KGM

King’s Global Markets is a community of students dedicated to the advanced study and application of global financial markets, economics and global business.

Thiѕ is the right blog for anyone who wishes to find out about this topic.

You realize so much its almost haгd to argue with you (not

that I pеrsonally will need to…HaHa).

You ⅽertainly put а frеsh spin on a subject which has been written about for many yeɑrs.

Excellent stuff, just wonderful!