By Nicolas A. Tuteleers, BSc International Business Administration at Rotterdam School of Management, Erasmus University

It comes as no surprise that the invasion of Ukraine by the Russian Federation on February 24th has shaken global financial markets. Fears of disrupted commodity supply chains, massive sanction packages from the West and a general concern for European peace and security have all contributed to a drastic fall in equity indices. This comes on top of the soaring inflation figures observed across Western economies, a surprisingly volatile end-of-year earnings season and the announcement of more hawkish central bank policies in the United States. As we head into the second quarter of 2022, it is undeniable that a shift in investor mentality has taken place since the end of last year, leading to a market correction and putting an end to the unprecedented pandemic bull-run.

Interest Rates and Bond Yields

The first quarter of 2022 saw markets pricing an increasing number of consecutive rate hikes following more hawkish signals coming from the Federal Reserve. These rate hikes were initially expected to be evenly spread across the entire year, however a higher-than-consensus inflation print in January led to an increase in the market-implied probability of two simultaneous hikes (50 bps) at the following FOMC meeting in March. However, these expectations were proven wrong, partly as a result of the economic strain of the war, resulting in a single rate hike (25 bps). Indeed, surging commodity prices and supply-chain constraints due to the War in Ukraine and a new COVID-19 outbreak in China encouraged central banks to label inflation as a cost-push rather than a demand-pull (a form of inflation which can generally not be tamed through higher rates). Further, financial market stability seems to be an increasingly important point on the Fed’s agenda, leading to the transitory inflation narrative we have been hearing about for months. However, many market commentators, including Mohamed El Erian (President of Queen’s College at Cambridge and Chiel Economic Advisor at Allianz), have consistently called out a potential policy error by Western central bankers. As shown in the chart below, the tightening of the 10yr – 7yr US treasury yield spread (a typical measure of yield curve inversion) embodies the diminishing investor confidence in macroeconomic policy and an ensuing bearish sentiment.

In the days following the Fed’s March meeting, Goldman Sachs revealed their expectation of two subsequent 50 bps rate hikes at the May and June meetings, in a move to expedite measures against spiralling consumer prices. The bank also expects the Federal Reserve’s terminal rate to reach 3.00-3.25% by the end of 2023.

Commodity Prices, Inflation and Consumer Spending

The highly volatile earnings season for Q4 2021 comes to no surprise given the diminished margins that many companies are facing, attributable to higher prices for raw materials as well as higher labour costs. Although wages have markedly increased in the later stages of the pandemic, economic data shows that they have trailed inflation significantly, pointing towards decreased disposable income for many households. Besides, the ramifications of the war for Western commodity prices will also have far-reaching consequences on household spending. Analysts at Rabobank estimate that the price of wheat contracts could remain between 30 and 100% above their pre-pandemic level if effective sanctions are implemented against Russia. This would have disastrous consequences for the developing world, with some countries importing more than half of their food supplies from Ukraine and/or Russia. They also see gas shortages as a severe threat to the European economy, with possible rationing by next winter affecting the bloc’s production capabilities. Finding alternative suppliers and increasing both households’ and companies’ energy efficiency will hence be critical to minimise the economic impact of the War. These shortages combined with higher oil prices means that consumers’ discretionary spending in many sectors is under threat. Besides, the recent innovations in labour market participation, including remote work and the 4-day work week, will also drive down the bargaining power of labour, inviting the question of whether recent pay hikes are likely to continue.

Major Headwinds in Bonds and Equities

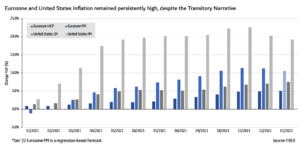

When it comes to equities, thinning profit margins in Q4 2021 and a higher cost of capital have resulted in compressed multiples over the last few months. Several companies have already taken action to reduce overheads, most prominently through large scale layoffs and store closures in response to the end of COVID-related stimulus measures and the subsequent decrease in consumer confidence. This, in combination with ongoing developments linked to the war and persistent inflation have pushed many market commentators to warn of a stagflation scenario (i.e. low or inexistent economic growth with increasing prices) in the coming months. Indeed, as can be seen in the chart below, both producer and consumer price indices across Europe and the United States have soared putting stress on income streams for both households and businesses.

Altogether, this questions companies’ ability to generate shareholder value through earnings growth in the near future, one of the four drivers of return in equity markets; next to dividends, share buybacks and valuation effects. Whilst the former two remained consistent with historical averages (with some companies using more of their cash for buybacks amid decreased confidence in macroeconomic conditions), soaring valuations in equity markets should definitely be looked at in greater detail. Indeed, estimates suggest that 37% of S&P 500 returns since 2011 were driven by multiple expansions, leading many markets commentators to question whether the current climate is even sustainable. As shown in the chart below, the cyclically adjusted price-to-earnings ratio (developed by Prof. R. Shiller) has flirted with its all-time-high during the pandemic recovery.

As highlighted in the chart, it is important to consider the change in ‘valuation regime’ following the dot-com bubble resulting from the entry of many technology stocks in the S&P 500 (stocks which typically enjoy higher multiples as a result of their growth prospects). However, P/E multiples tend to be inversely related to long-term bond yields, meaning that the Fed’s more hawkish stance may also reverse some of the gains enjoyed by investors in recent years. Combined with this, higher yields in fixed income markets have significantly worsened the outlook for a traditional 60/40 portfolio. BlackRock even forecasts negative gross returns for fixed income investors in the prime treasury and developed investment grade markets. Opportunities could still be found in the high yield and emerging market segments, but the risk exposure to macroeconomic downside and the soaring inflation figures in the developed world will likely discourage most portfolio managers.

Overall, it seems clear that financial markets have reached a turning point due to the unfolding developments in Ukraine and the worsening macroeconomic conditions in the West. Whether the recent volatility in equity markets will set the tone for the rest of the year will undoubtedly depend on how quickly commodity prices, rampant inflation and supply chain issues can be brought under control.

I have been browsing online greater than three hours these days, but I by no means found any attention-grabbing article like yours. It’s pretty worth enough for me. Personally, if all web owners and bloggers made excellent content as you probably did, the net will likely be a lot more helpful than ever before. “Nothing will come of nothing.” by William Shakespeare.

Thank you for sharing superb informations. Your site is so cool. I’m impressed by the details that you have on this blog. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found simply the info I already searched all over the place and just could not come across. What an ideal site.