By Defne Keser, Economics Student at the Ludwig Maximilian University of Munich

Turkish markets have gone through a very challenging period in the last few years. Since August 2018, high private sector debt, persistent current account deficits, high inflation, and high unemployment have increased macro-financial instability. Following the recent presidential elections, the situation appears unlikely to change anytime soon.

The current situation in the financial markets

Inflation was officially announced at 39.6% in May 2023, but it is felt much higher by the citizens. Monthly inflation is 4% (54% year-on-year), especially in the most consumed items, food, and clothing. Over the past year, these ranges have reached 85%. In 2021, before the implementation of the unorthodox monetary policy aimed at reducing inflation by lowering interest rates, both inflation and interest rates were at 19%. There were signs of an increase in inflation, which could have been prevented by increasing the interest rates by a few points.

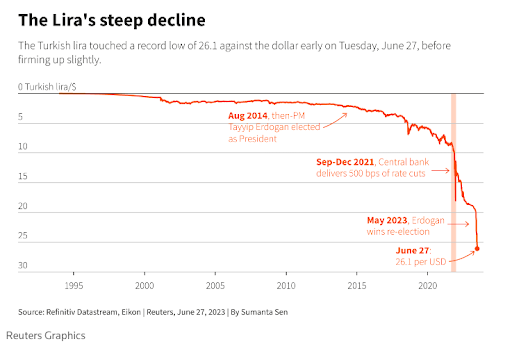

The central bank of Turkey did the exact opposite by starting to decrease interest rates. They continued this policy for nearly two years and brought interest rates down to 8.5 percent. For nearly two years, economic policy has been entirely election-oriented, with no regard for the severe damage to the economy. As a result of this approach, inflation rose to 80 percent. The same jump is also seen with the exchange rate. The current exchange rate for the lira to the dollar is 27. 1 dollar was 20 Turkish liras just before the elections and around 5 Turkish liras a few years ago, and the effects of the extreme changes are felt quite harshly by the average citizen.

According to the Confederation of Turkish Trade Unions (Labor Union), Turkey’s poverty line rose to 33,789 liras in April 2023, nearly four times the minimum wage, which was 8,506 liras until recently. The hunger limit rose to 10,135 lines, meaning that a person earning the minimum wage was below the hunger limit. Turkey has raised the minimum wage by 34% starting July 1, bringing it to a net 11,402 lira (~$400) for the second half of the year, which is still almost one-third of the poverty line.

In addition to the already unstable economic atmosphere, two devastating earthquakes struck on February 6, 2023. Beyond the humanitarian tragedy, physical damage occurred in 11 provinces, accounting for 16.4 percent of Turkey’s population and 9.4 percent of its economy. Direct losses are estimated by the World Bank at $34.2 billion, but reconstruction needs could double. The earthquakes have increased pressure on an increasingly fragile macro-financial situation.

Effects of the current economic climate

The fragile economic situation has created an unreliable economic atmosphere and a high demand for foreign currency. The increased demand for foreign currency due to more and more people losing faith in the Turkish lira has led to the exchange rates increasing rapidly. As the Turkish lira continues to lose value, citizens are looking for alternative options or increasing their consumption to cut their losses.

For the first time in 21 years, the net reserves of the Turkish Central Bank turned negative as of last month. Its net reserves had reached an all-time low of negative $5.70 billion last month. This decline is quite significant, as it represents a decrease of more than $30.5 billion since the end of 2022. For a while, demand was managed by putting pressure on the banks, and foreign exchange buying and selling was controlled. Therefore, people who were unable to meet the demand for foreign currency from official and commercial sources were using the over-the-counter market. Now that the exchange rate is gradually being liberalized, the Turkish lira has started to lose value against the dollar very seriously since the election. While it is still increasing in a controlled manner, the inability to increase interest rates indicates that both inflation and exchange rates will rise much higher.

The government required banks to disclose the differential between buying and selling rates and to purchase low-interest government bonds as a penalty for holding foreign currency deposits or increasing loans. However, when this obligation was imposed, bond interest rates fell due to coercion and lost their meaning as an indicator. The objective was not to increase interest rates, but the government was unable to control them. Despite lowering the Central Bank’s interest rate to 8.5%, deposit interest rates rose to 35%. While exports increased, imports increased even more, resulting in a wider current account deficit. In short, the measures introduced as a new economic model have made it even more challenging to revive the already derailed economy.

Changes in leadership

After the elections, Mehmet Şimşek was appointed as the new Minister of Treasury and Finance, and Gaye Erkan was appointed as the new governor of the Turkish Central Bank. Gaye Erkan is a Princeton-educated former Goldman Sachs banker who was a top executive at First Republic Bank until late 2021. Mehmet Şimşek holds an MPhil in Finance and Investments from the University of Exeter and has already undertaken many roles within the government, including Finance Minister and Deputy Prime Minister between 2009 and 2018. Before entering politics, he worked for Merrill Lynch in London for seven years. He initially worked as an economist and strategist and later became the head of Fixed Income Strategy and macroeconomic research for the emerging EMEA region.

After he was appointed, Mehmet Şimşek announced: “Turkey has no choice but to return to a rational ground”. With this statement, Şimşek emphasized that the economic practices in the previous period were not rational. With the commitment of the new finance minister to rational monetary policies, a serious change in Turkey’s interest rates was hoped for. The last increase in interest rates was in March 2021. Many predictions from Wall Street included a strong raise. The most aggressive prediction came from Goldman Sachs, which forecasted that the policy rate would considerably jump from its current 8.5% to a whopping 40%. While JP Morgan projected a more modest increase to 25%. On Tuesday, June 22, the central bank raised the interest rates from 8.50 to 15, which was lower than many predictions and gave the impression that there wouldn’t be a change in monetary policy any time soon. Therefore, a rise in interest rates did not affect the markets. Even though they almost doubled the interest rate, it is still 25% below the 40% inflation.

Predictions about the change in the policy of the Turkish Central Bank

Turkey’s current monetary policy favors the pursuit of growth and the stimulation of consumption. The Central Bank of a country sets the interest rate for its economy, which affects the borrowing and lending rates of banks and other financial institutions. To control inflation, the Central Bank normally raises interest rates, which makes borrowing more expensive and reduces the amount of money available for spending. However, raising interest rates may not be enough to bring inflation under control.

To address this issue, the Central Bank may choose to set the interest rate below the inflation rate. This policy is aimed at encouraging borrowing and spending, which can stimulate economic growth and job creation. This approach is often used in countries with high inflation rates, where traditional monetary policy tools may not be effective. This approach encourages inflation to increase. This is because as inflation increases, people’s flight from the Turkish lira accelerates, and consumption expenditures increase, which in turn creates an increase in production and leads to higher growth. When growth is high, firms make good money, and unemployment does not increase, but even decreases. The way to keep this model alive is to set interest rates below inflation and/or to keep consumption possible by increasing wages.

Keeping interest rates below inflation means protecting those who spend by borrowing, not those who save. Because as long as inflation remains high and interest rates remain low, people realize that holding money in their hands and saving is pointless, that it costs them money, and they increase their consumption. On the other hand, in a growing economy, unemployment does not increase, and problems can be pretended not to exist. This policy, which may contribute to winning elections, will in the long run wreck the economy and not lead to real growth.

The road ahead for recovery

As a result of these approaches, the Turkish economy today is in a situation where inflation is well above acceptable levels at around 40% (when the inflation increased to 10% in the EU immediate action was taken), the current account deficit is widening, budgets are depleted in six months, the country risk premium is twice the acceptable level, the Central Bank reserves saw the all-time low of negative $5.70 billion, and expectations look extremely negative.

To remedy the situation, it would be necessary to raise interest rates to reduce inflation, restrict consumption, and endure lower growth and higher unemployment. However, this approach would lose votes. Lowering interest rates caused serious damage, but increasing them can’t solve the problems by itself. An increase in the policy rate can be accepted as an indicator of a return to the right policies and may lead foreign investors to return to Turkey. Foreign direct investment aims to boost employment and prosperity. In the short term, even with a new government, it will not be easy to mend broken ties and restore trust. In addition to improving economic conditions, a predictable governance system and a reformed judiciary are essential for lasting and long-term investment. Creating a plan for long-term development and repairing relations with the EU is essential for Turkey’s real GDP and per capita income to increase and for its citizens to recover from the current economic situation.

A wealthier Turkey would also be more advantageous for the West, as it would also mean more investment opportunities in both directions. Turkey is the European Union’s 6th largest trade partner. In addition, a prosperous Turkey can accommodate and employ the growing refugee population and cope better with crises, making it a more resilient country in its own right and a stronger neighbor and partner for Europe. Changes in policies and reforms continued by the influx of foreign exchange have the power to put Turkey on the long road to development and recovery.

Some of the rational decisions will undoubtedly have negative effects at first. For example, abandoning intervention and leaving the formation of exchange rates to the market will lead to a rise in exchange rates, which will inevitably increase inflation and pull down GDP in dollar terms. The Central Bank will need to invest significant time and effort to re-establish real reserves instead of swaps. However, such changes are necessary to address the problems that the country has been facing rather than merely provide short-term solutions.

Defne Keser

Defne is a student at the Ludwig Maximilian University of Munich, currently pursuing a Bachelor of Economics. She has a particular interest in Emerging Markets and is looking forward to starting a career in Finance. In addition to the university, she is active in various civil society organizations, including Rotary International and the Global Shapers of the World Economic Forum.

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

I love it when folks get together and share thoughts. Great site, continue the good work.

Everything is very open with a really clear clarification of the issues. It was really informative. Your website is very useful. Many thanks for sharing!|