By Thibault Bastide, Senior Research Analyst at King’s Private Equity Club

Severely touched during the health crisis caused by Covid-19, the tourism industry is living difficult times. However, after the worldwide reduction of sanitary restrictions, the economic and touristic activities are starting again. Hence the perfect occasion for investors to accompany the recovery of a mutating sector. Hospitality investment is attracting more and more private investors as it offers attractive returns on investment and is subject to significant tax exemption.

Overview of the Hospitality Industry

As a diversification asset offered by asset managers, investments made in the hospitality sector are often profitable but are not risk-free. The hospitality industry appears to be an attractive and liquid underlying asset, benefiting from a deep market, especially since capital is now open to the public. Indeed, it is a good diversification asset as it allows private investors to partially invest in a hotel without taking on the management.

Private Equity companies investing in hotels generate profits by restructuring, refurbishing and hence increasing the value of the assets. Leveraged transactions are used to generate capital gains and increase the value of the hotels, achieving net rate of returns of around 8% on average. Investors can invest in different types of funds with different characteristics and can therefore decide the aim of their investment, whether it is tax exemption or capitalisation.

Although hotel assets are very good in terms of diversification, they are not risk-free. Indeed, if the hotel does not function for any reasons the investments made cannot be returned. In fact, the risk generates the returns for investors.

To manage and reduce the potential risk, different safety measures must be taken into consideration; its location (for example airports, city centres), the price of the operating property and finally the operator’s expertise in the market. As the chairman of EXTENDAM (European leader in the hospitality industry) Jean-Marc Palhon says: “Each region or country has an operating company that has a good knowledge of the local market and with whom it is relevant to work”. Therefore, investments can be secured, and risk reduced by diversifying the number of operators and by working with recognised brands such as Hilton.

Hospitality: a mutating sector

Not to mention France’s objective to increase the number of tourists from 90 million per year today to 120 million within six years. This is enough to attract investors, especially given the fact that Airbnb has had the positive effect of forcing hotel managers to be more demanding and to review their strategy. Furthermore, a change in the concept of hotels can be noticed, which increases the value of hotels as they offer more services.

For instance, sports halls, coworking and co-living spaces are becoming more and more common in hotels, increasing the returns for investors but also the occupancy rates. New concepts have shaken up the industry, and the hotel industry as a whole must now integrate the new ways in which people want to travel. Hotels are becoming a place to live, to work, to meet new people and so on, which implies more common and convivial areas.

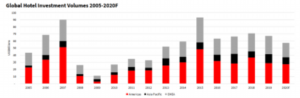

Global Hotel Investment Volumes 2005-2020F. Source: JLL Hotel Investment Outlook 2020

The hospitality industry has recently received a high volume of investments as the graph above illustrates. For instance, more than 90$ billion have been invested in 2015. The situation remains uncertain due to the COVID-19 crisis, but a long-term vision is crucial as the hotel sector behaves according to economic cycles.

Effect of COVID-19 on the Hospitality Industry

Before the start of the pandemic, the growth of tourist activities was extremely important, with a record number of people wishing to travel worldwide observed at the beginning of 2020. The market was at excellent levels with a significant growth in 2018 compared to 2017. In 2019 and 2018, the revenue per available room was increasing driven by the growth in the average daily rate.

The hospitality industry is therefore on solid ground, although the pandemic shattered this enthusiasm. To limit the damage, hotel fund managers decided to implement support policies such as spreading out rents, rediscussing leases etc. The first to rebound is the budget business hotel sector. The “two and even three-star hotels at 50 to 120 euros per night have quickly seen a return of executives and business people who have to go back to work” notes Jean-Marc Palhon. Indeed, this type of hotel is less dependent on international clientele as visitors are mostly domestic.

On the other hand, only 20% of the luxury hotel sector was in operation in June 2020 and only a quarter of the Parisian offer had reopened, against 60% in the regions. The luxury sector is particularly suffering, as foreign clientele cannot completely travel yet. Therefore, the higher up the range you go, the greater the exposure to international customers. Hence the choice of some companies like EXTENDAM to focus exclusively on 2* to 4* hotels to reduce the exposure to international visitors.

The impact of the Covid-19 crisis on the hotel occupancy rates has been important. The sanitary restrictions and the different lockdowns constrained the touristic activities to slow down, impacting the occupancy rates as this graph illustrates.

As an example, the closing of borders has encouraged the French to visit their country, compensating at least partially for the absence of foreign customers. A situation which particularly benefits the mountain and country hotels where the French clientele traditionally predominates and where the sanitary conditions are favourable.

Another effect of COVID-19 is that clients need to be able to work in their hotel. Hence the new concepts that are developing, combining coworking and convivial spaces where they can consume, including in business hotels. “Working differently is a major challenge in the age of Covid-19. We are therefore witnessing the crystallisation of new ways of accommodating people who work. All the levers of value creation are being activated: coworking, co-living, refurbishing, and more broadly an interweaving of business and leisure…”

Apart from these structural changes that began before the pandemic, the tourism market in France will not be radically transformed by the health crisis. “In the hotel market, growth in demand is correlated with economic cycles, so it is important to have a long-term vision. The hotel sector will recover, even if it takes time.

The Importance of Geographical Diversification

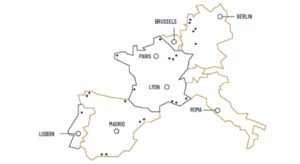

Geographical diversification is especially important in the hospitality sector as many things are different from one territory to another. As an example, Germany has a very domestic market, which is an advantage in the context of Covid-19. On the other hand, Spain or Italy, are highly dependent on international tourism which inevitably makes them more affected. Therefore, being geographically diversified, as EXTENDAM which has more than 200 hotels across Europe and €2 billion in assets under management, allows to minimize risk.

Source : https://extendam.com/en/

Exclusive Offer: Get £100 off your Summer Internship Experience at Amplify Trading by clicking here or using our unique discount code at the checkout: MSAmplifySummer2021. Participants graduate from the course with a Diploma from the London Institute of Banking & Finance. For more information about the course, click here.

References:

https://hospitalityinsights.ehl.edu/private-equity-market

https://www.professioncgp.com/article/etudes/immobilier/pourquoi-linvestissement-hotelier seduit-de-plus-en-plus-de-particuliers.html

https://www.investissementconseils.com/immobilier/actualites/40555-investir-dans-l hotellerie-une-opportunite-de-crise.html

https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our insights/hospitality-and-covid-19-how-long-until-no-vacancy-for-us-hotels# https://www.tendancehotellerie.fr/articles-breves/communique-de-presse/14633-article/etude christie-co-covid-19-quel-impact-sur-l-hotellerie-en-cote-d-azur-a-bordeaux-nantes-lyon-et paris-intra-muros

King's Private Equity Club

King's Private Equity Club is a student society at King's College London, providing a high quality of networking, speakers, workshops and social events to the King's Community. Our goal is to improve our members understanding and employability.

That is a great tip particularly to those new to the blogosphere.

Brief but very precise information… Thank you for sharing this one.

A must read article!