His Journey into Crypto Asset Management

Alex Graf Strachwitz is the Head of Sales at Bitcoin Capital and the Founder of Graf Strachwitz Capital Partners, his own boutique firm, with 15 years of experience in asset management, transitioning from traditional to digital assets over the past decade.

He specializes in advising high net worth individuals, entrepreneurs and family offices across the German speaking area of Europe in the area of alternative investments, driving success in emerging sectors like fintech and digital assets.

Digital assets like cryptocurrencies and NFTs are experiencing significant expansion within the Web3 ecosystem, creating opportunities for innovation and evolution and establishing themselves as enduring components of the digital landscape and in the asset management space.

The Early Days of Bitcoin

The concept of Bitcoin emerged in 2009 making waves as a “Peer-to-Peer” system, revolutionizing the way we understand money and paving the way for a more decentralized economy.

The concept of Bitcoin emerged in 2009 making waves as a “Peer-to-Peer” system, revolutionizing the way we understand money and paving the way for a more decentralized economy.

Alex initially met with distrust, he affirms:

“Back in 2011-2013, I already had some friends doing some investments in Bitcoin and sharing the excitement, but to me, it wasn’t something tangible back then, it didn’t catch my attention, working in traditional asset management.”

His engagement with digital assets began in 2017, managing portfolios for a family office and crafting products for crypto asset management despite initial skepticism at the very beginning:

“At the time, I was very far from the Bitcoin Universe myself, also due to the volatility, I wasn’t convinced yet”

By 2021, Alex joined Bitcoin Capital as an advisor, collaborating with experts to refine strategies in crypto management, reflecting back on the progress, he remarks on the evolution of the regulatory framework today in the world of crypto:

“Today we have more safety and regulations, it’s totally different from 2017, but if you have invested back then, you’d be a pioneer. Today it is a pragmatic and data based decision.”

Active Management and Strategic Allocation

The investment expert advocates for an active investment strategy in crypto asset management, emphasizing tailored solutions for individual investors:

“It’s important for our clients to get the expertise of the active management strategy facilitating the process, so we are fully in charge of the buying and selling proposition.”

This approach contrasts with passive strategies, which he believes are less effective for clients navigating the complex and fast-paced world of digital assets.

Transparency is a cornerstone of Alex’s work:

“I encourage transparency when advising my clients, being very clear about the risks and the impact.”

Therefore, he underscores the importance of a diversified portfolio, incorporating crypto as a crucial component, to capture the benefits of this transformative technology.

The Global Perspective: US vs Europe

Globally, the perception of digital assets varies, for instance, in the US, Bitcoin and Ethereum have seen increased adoption, partly influenced by regulatory developments and political events:

“Bitcoin obviously skyrocketed after the elections, and the hype stays on Bitcoin as the leading asset, but unfortunately, other projects are being overlooked.”

In Europe geographically, Switzerland stands out as a hub for crypto innovation, leveraging its strong currency and regulatory clarity where Alex highlights Switzerland’s unique role:

“Switzerland has a unique place in the investment realm due to the safe regulations and due to the strong CHF currency in the market.”

On the other hand, El Salvador made history as the first country to adopt Bitcoin as legal tender, mandating its acceptance by all businesses and showcasing the transformative potential of digital assets to reshape economies.

Alex reflects on its trajectory:

“A great example to highlight is El Salvador which adopted digital assets and Bitcoin early. Now we see many more countries following their example.”

The Role of Regulation and AI in Digital Asset Management

The growing focus on regulation is critical to the trustworthiness of digital assets, and the approval of Bitcoin ETFs in January in the US exemplifies this trend, despite the full explicit approval in Switzerland currently due to the jurisdictions boosting investor confidence:

“The new Bitcoin ETF gives more trustworthiness to the whole crypto industry.”

Additionally, he sees potential in the integration of AI in digital asset management, particularly for data analysis and strategy development:

“AI can be a great tool to analyze data and research…reducing time and costs.”

However, he cautions against over-reliance on automated systems, emphasizing the importance of trust and personalized solutions in managing wealth:

“When you’re dealing with large investors in the business, you need to focus on establishing more trust, and this can’t be accomplished by adopting AI only.”

Moreover, key research from Boston Consulting Group highlights the transformative potential of generative AI (GenAI) in asset management, including its ability to accelerate investment research and enable enhanced knowledge shared across organizations.

Similarly, Linedata’s 2023 survey reveals that 36% of asset management firms are currently utilizing AI technologies, with an additional 37% planning to adopt AI solutions soon.

Predictions and Future Trends

Looking ahead, he anticipates continued growth and innovation in the crypto space, supported by increased institutional investment and regulatory advancements.

Bitcoin Capital and its parent company FiCAS, stand out in this evolving landscape, combining expertise in both traditional and digital asset management, with an experienced team composed of crypto natives, traditional asset managers and bankers with decades of valuable experience.

He proudly affirms:

“We are a privately owned company where decisions are taken much faster compared, for example, to larger companies.”

Therefore with this agility and commitment to transparency, as proudly FiCAS holds FINMA licence, and innovation when it comes to investments, they position themselves as leaders in the European digital asset management industry.

Key Findings from the Report

A recent study conducted by FiCAS, which surveyed more than 45 Swiss asset and wealth manager companies, reveals that the adoption of digital assets is gaining momentum in their portfolios.

These findings align with trends highlighted in reports from PwC, CoinShares, Coinbase Institutional, and other industry leaders.

The research points to significant expansion in the sector, with asset managers gradually increasing their exposure to digital assets.

Approximately 31.8% of the FiCAS research respondents shared that they have already allocated between 1–5% of their portfolios to digital assets, while 40.9% plan to commit a similar allocation over the next 12 months.

This Swiss survey meticulously reflects a rising inclination towards crypto investments fueled by client demand, portfolio diversification opportunities, and the transformative potential of blockchain technology, despite the volatility of the market.

Challenges in the Market

However, the research conducted by FiCAS underscores key challenges as well, and operational barriers, particularly compliance and reporting requirements, which remain a significant concern, cited by 43.2% of respondents.

Additional hurdles include regulatory uncertainty, complexities in taxation, and issues related to custody, all of which must be addressed to sustain the sector’s growth trajectory.

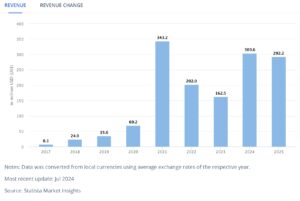

To conclude, the digital asset management space is still promising, expected to increase next year, as according to Statista, the number of cryptocurrency users in Switzerland is expected to gain 4.22m users by 2025.

Carina Schuster is a multilingual tech and science editor for The London Financial & a podcast anchor and producer for SciTech Suisse, covering groundbreaking stories in the matter of disruptive technology developments and interviewing top experts in AI, the Metaverse, Web3, Blockchain and scientific research. Throughout her experience as a journalist in the editorial and digital worlds, she was selected by CNN Money Switzerland in 2020 as a digital producer intern and has demonstrated a collaborative and creative spirit, working alongside talented journalists and delivering impactful stories with the main aim of simplifying the complexity of technology.